Since Minneapolis police officers killed George Floyd in May and kicked off months of nationwide protests, the corporate world — including venture capitalists — have attempted to respond to the Black Lives Matter movement.

Indeed, many quickly took to social media to voice their support, broadcast their new diversity-focused networking groups and pledge to do better, particularly when it comes to finding and funding more Black founders and other underrepresented entrepreneurs.

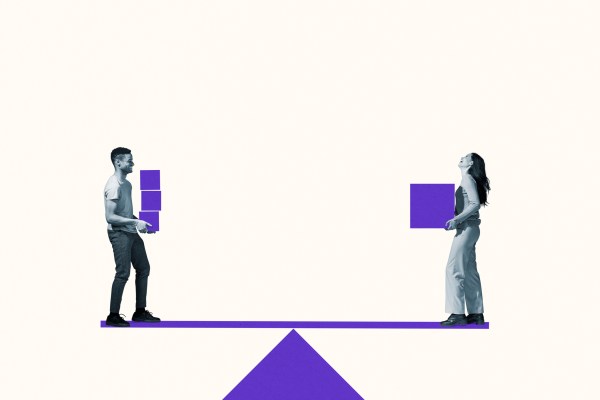

As of 2018, 81% of venture firms still lacked a single Black investor.

It was tempting to dismiss it as so much hot air, given that VCs have talked about diversity for eons without doing much about it.

As of February 2020, according to a report by All Raise, an organization that promotes female founders, 65% of VC firms still had no female partners. As of 2018, 81% of venture firms still lacked a single Black investor, per an analysis by Equal Ventures partner Richard Kerby.

Those numbers are comparatively rosy when considering the percentage of women and Black investors in senior decision-making roles. According to recent PitchBook data, at the start of this year, just 12.4% of decision-makers at U.S. venture firms were women (up slightly from the 9.65% at the start of 2019). As for for the number of Black investors in senior positions, it has long hovered around just 2%.

But here’s the good news: While it remains an ongoing challenge to get these numbers in sync with other industries, there were two developments specifically in 2020 that may beget more action in 2021.

We’d first point to the decision this fall by Yale’s endowment to require its asset managers to do better when it comes to diversity. Specifically, the school’s $32 billion endowment — led since 1985 by investor David Swensen — told its 70 U.S. money managers that from here on out, they will be measured annually on their progress in increasing the diversity of their investment staff, from hiring to training to mentoring to their retention of women and minorities.

Though Swensen hasn’t gone public with any targets, it’s hard to overstate the importance of this edict, considering his influence in the world of institutional investment. The vast majority of dollars raised by venture firms comes from educational institutions like Yale, along with pension funds, hospital systems, insurance companies and families’ offices; if more of these outfits leverage their power to hold venture firms accountable for hiring more diverse managers and investing in more diverse teams, it could prove game-changing.

Some already see it as inevitable, including Lo Toney, founder of Plexo Capital, an Alphabet-backed diversity-focused investment firm that both writes checks to venture funds and invests direct in startups investments. As Toney, a Black man, told us this summer, pension funds like the California Public Employees’ Retirement System manage the assets of 1.6 million employees, many of whom “look like me.” Imagine, he asked, what might happen if they started asking more questions about who is managing their money.

The second-most impactful development of the year came, unexpectedly, from SoftBank, which in June announced a $100 million Opportunity Growth Fund that is being used entirely to fund startups whose founders are either Black, Latinx or Native American.

Though $100 million is modest by current venture fund standards — the fund was also immediately met with skepticism, given that SoftBank’s $100 billion Vision Fund backed exactly one company with a sole founder who is Black — it remains the biggest commitment to date by an investment firm.

At WebSummit earlier this month, we had the chance to talk with SoftBank COO Marcelo Claure about the effort, along with two members of the fund’s investment committee: Stacy Brown-Philpot, former CEO of TaskRabbit, and serial entrepreneur Paul Judge, who has co-founded Luma and Pindrop Security, among other companies.

As part of that discussion, Claure said SoftBank has always been focused on diversity, founded as it was by Masayoshi Son, a native Korean who became successful in Japan, and helped along by Claure, “a Bolivian who has done okay in the U.S.”

“We have always talked about how much harder minorities have to fight to achieve our objectives,” said Claure, adding that the Opportunity Growth Fund has already received more than 700 business plans and has since backed 20 startups, 80% of them from first-time founders.

As for whether that’s enough to move the needle, Claure said other traditional venture players tend to copy SoftBank’s efforts. It certainly didn’t take long for other firms to bulk up after SoftBank debuted its massive Vision Fund. Claure meanwhile pointed to SoftBank’s $5 billion Latin America-focused venture fund, which the Japanese conglomerate launched in the first quarter of 2019. While at the time, that amount of capital was “more than all the all the [regional funds] put together,” he said, “now, I find myself competing with Sequoia; Dragoneer is there.”

Given the strength of the founders that SoftBank is discovering, Claure said it won’t be too long before firms copy SoftBank in forming their own, sizable diversity-focused funds, too. He also predicted that they’ll be writing follow-on checks to the startups it’s backing right now. “Everyone is looking for a great company,” Claure said. “Where SoftBank goes, people follow.”

If you’re interested in learning more about SoftBank’s initiative specifically, please watch or listen to our interview with Claure, Judge and Brown-Philpot below.