The Exchange is taking a break from vacation to dig into the new Qualtrics S-1 filing. Then the column and newsletter are back on hold until January 4.

This afternoon, Qualtrics, a software company that helps companies poll their employee base, customers and others, filed to go public. It’s the second time that the Utah-based unicorn has done so, failing the first time to complete its offering after SAP swooped in and bought it for around $8 billion in cash.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

SAP announced in late July of this year that Qualtrics would be spun out via an IPO, bringing the smaller company’s saga full-circle.

The new S-1 filing — you can view the 2018 original here — is a different animal from the first. First, Qualtrics is larger than it was, and older. And its financials are more complex as it extricates itself from its soon-to-be-erstwhile corporate parent.

The new S-1 filing — you can view the 2018 original here — is a different animal from the first. First, Qualtrics is larger than it was, and older. And its financials are more complex as it extricates itself from its soon-to-be-erstwhile corporate parent.

Qualtrics intends to list on the Nasdaq under the ticker symbol “XM.”

Looking back at my chat with Ryan Smith, then Qualtrics CEO and today its chairman, and Bill McDermott, then SAP’s CEO and today the CEO of ServiceNow, it’s hard to believe that the acquisition deal was only two years ago.

Much has changed since late 2018. Let’s see what happened to Qualtrics in the meantime. We’ll dig into the financials, the company’s implied valuation range (spoiler: It has gone up) and whatever else we can shake loose.

The new Qualtrics S-1

A few things up top. First, SAP will be the company’s controlling shareholder after the Qualtrics’ IPO. That’s early in the S-1 filing. And, Smith and Silver Lake are investing in the company as part of its new debut.

Smith bought six million shares (roughly 1% of the stock) at $120 million last week, while the Silver Lake-led investing group will purchase a total of $550 million of the company’s stock in a two-part deal. Silver Lake acquired 15 million shares at $21.64 apiece last week and will purchase another $225 million in stock at the company’s IPO price.

On the subject of price, how do we know that Smith’s six million shares are now worth $120 million or more? Because the company’s IPO filing indicates that Qualtrics may price between $20 and $24 per share. Is it unusual for a company going public to note a possible price range in its initial S-1 filing? Very, but as we’ll see shortly, spinning out of a company is a heavy lift.

In this case, it appears that the company’s possible IPO price range is being provided early due to an offer to employees that will allow them to swap “existing Qualtrics Rights and SAP RSUs” for “awards with underlying shares of our Class A common stock” that will be decided on a fraction comprised of the value of SAP stock and the final price of Qualtrics’ IPO.

Now, let’s talk revenue and growth.

Results

Qualtrics continued to grow after it was acquired. In 2018 the software company recorded $295.5 million in subscription software revenue, along with $106.4 million in services income, for a total of $401.9 million.

The company’s total revenue expanded to $591.2 million in 2019, representing growth of 47%. The company’s software revenues, the majority of its top line, grew 45.5% in 2019, or slightly slower than its aggregate revenue growth.

In 2020, the company’s revenues during the first nine months of the year reached $550 million, up 31.5% from the same period of 2019. Over the same timeframe, Qualtrics’ software revenues expanded by just over 34%, or slightly faster than its total revenues.

In profitability terms, looking at the company through our normal lens — also known as “generally accepted accounting principles,” or GAAP — Qualtrics had a wild 2019. The company lost $1 billion in 2019, compared to a loss of a mere $37.3 million in 2018.

In the first three quarters of 2020, the company’s net loss shrunk to $258 million from $860.4 million during the same period of 2019.

How did Qualtrics go from a near-breakeven company to one so deeply unprofitable? It appears to hinge on how the company’s equity compensation was handled after the SAP acquisition. SAP paid vested equity compensation as cash, not stock. This led to the company’s GAAP results looking different than we might have expected after viewing its 2018 S-1 filing.

Equity compensation and “cash settled stock-based compensation expense” at Qualtrics rose from $4.6 million in 2018 to $876.2 million in 2019. The number is now rapidly falling, from $750.1 million in the first nine months of 2019 to $218 million during the same period of 2020.

The company, apart from stock-based compensation, is effectively breakeven. In the third quarter of 2020, Qualtrics’ net loss of $85.7 million is nearly precisely its share-based comp cost, which was $84.1 million during the same period.

Given the SAP-led quirkiness of cash settled stock-based compensation expenses, Qualtrics’ non-GAAP gross margins and non-GAAP operating margins may take on more significance than adjusted metrics usually do. During the first nine months of 2020, Qualtrics’ non-GAAP gross margin was 75%, off 2% from its result during the same period of 2019.

Looking at its adjusted operating profit, Qualtrics ran a 5% deficit during the first three quarters of 2020, an improvement from its -7% result during the same period of 2019.

That’s a lot of numbers. Take this away from the above: Qualtrics is growing at over 30%, and after enduring some post-acquisition costs that appear at least partially related to how SAP handled equity compensation, is back to a more acceptable level of losses on a GAAP basis and is doing perfectly fine when we observe its adjusted (non-GAAP) results.

SaaS metrics

Past the somewhat irksome nuances of the SAP deal, what can we learn about Qualtrics from a SaaS perspective? Let’s take a look at the company’s net retention and its remaining performance obligations (RPOs). The first metric should tell us how much more Qualtrics customers spend over time, and the latter how much future revenues the company has banked but not yet recognized.

Here’s how Qualtrics calculates its net retention rate:

To calculate our net retention rate, we first calculate the subscription revenue in one quarter from a cohort of customers that were customers at the beginning of the same quarter in the prior fiscal year, or cohort customers. We repeat this calculation for each quarter in the trailing four-quarter period. The numerator for net retention rate is the sum of subscription revenue from cohort customers for the four most recent quarters, or numerator period, and the denominator is the sum of subscription revenue from cohort customers for the four quarters preceding the numerator period.

Qualtrics had net retention of 122% in its most recent quarter, and “120% in each of the last eight quarters.” That’s almost identical to the company’s net retention rate in 2018 when it last filed for IPO.

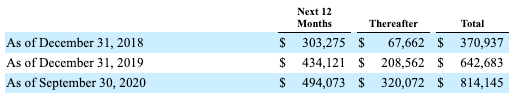

Turning to RPOs, Qualtrics defines the metric as “the amount of contracted future revenue that has not yet been recognized.” Here are the results:

Gross dollar expansion in near-term RPOs slowed from the 2018-2019 pace in the 2019-2020 timeframe. Longer-term RPO value gross dollar expansion in the current year looks stronger, though without Q4, 2020 results were discounting a full three-months’ worth of results. Expect institutional investors to divine future growth rates in part from the above chart.

What’s it worth?

Finally, what is Qualtrics worth? The company’s listing includes 454,416,366 Class A shares that will be owned by SAP, Ryan Smith and Silver Lake. Another 101,829,390 Class A shares are reserved for “future issuance under our equity compensation plans.” More shares will be sold in the IPO, and likely underwriters’ option. So, if we add it all up, the final, fully diluted share count at Qualtrics will likely land around 600 million, and its simple share count perhaps around 500 million.

That means that Qualtrics, using its most parsimonious share count and per-share price, would be worth around $10 billion. And, using our fully diluted share count estimate and higher price could be worth more than $14 billion.

Qualtrics wrapped Q3 2020 with an annualized run rate of $771.4 million. That works out to a roughly 18x multiple at its current maximum estimated valuation. That could be slightly cheap, given current market valuation marks. We’ll see.

More when we get more pricing information.

Update December 29, 2020: Qualtrics includes churn in its net retention rate, in line with industry reporting norms. The original version of this article stated that it excluded churn. The “SaaS Metrics” section has been updated.