So much for a year-end IPO slowdown.

On the heels of news that Expensify could direct list next year and Coinbase’s announcement that it has filed to go public (albeit privately), Poshmark dropped a public S-1 last night.

We’ll have more on the bloc of IPO news in coming posts, but as Poshmark has provided hard numbers and a fascinating business 2020 story, we’ll start here.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We’re going to range a little wider than usual in this IPO dig, including more notes on investor ownership and what the company does. That’s in case you, like myself, had forgotten.

So, we’ll start with product and talk finances before noodling over the surprising venture capital results that Poshmark is prepped to produce. Let’s get into the filing!

So, we’ll start with product and talk finances before noodling over the surprising venture capital results that Poshmark is prepped to produce. Let’s get into the filing!

Poshmark

Poshmark is an e-commerce marketplace that allows users to sell new and used fashion-related goods to one another. It sits atop secular trends towards e-commerce over traditional retail, mobile commerce over static and what I would call a cultural rethinking of used goods in recent years.

And of course, Poshmark has braved the economic waves that COVID-19 brought to the global market.

The company’s model is simple: It holds no inventory, instead providing a marketplace where buyers and sellers connect, juiced with an algorithmically built feed of items and an emphasis on digital social interactions. At the end of 2019, the company’s audience was 83% female and 80% of its members were part of the Gen Z and millennial generations.

It’s not hard to understand how Poshmark makes money, with the company charging 20% of a sale price for goods over $15, or a capped rate for cheaper goods.

In theory, the company has a workable flywheel for growth. Attracting new users via marketing helps it build a deeper user base. Those users generate more social activity and purchases, which, in turn, could bring in more sellers.

That would help keep Poshmark’s goods selection fresh. Which, could attract even more buyers. More goods and more sales means more revenues for Poshmark… which can then spend some of the resulting margin back into marketing, kickstarting the process all over again.

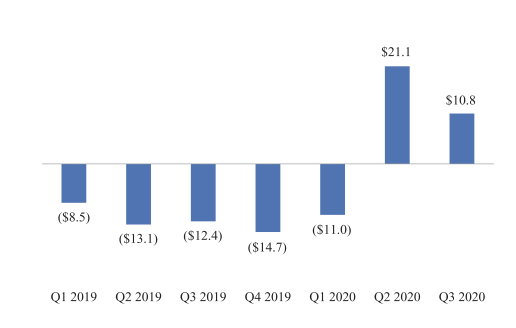

But despite that winsome circular updraft, the company has posted regular losses, which means Poshmark has had to outspend its business model to keep its growth up. Until 2020, that is. This year, things turned around in profit-terms for the e-commerce marketplace, ending with the company turning in consecutive profitable quarters.

Poshmark’s cash generation also improved in 2020, putting it on strong footing heading into its public offering. As with other companies that wound up enjoying a strong 2020 based at least in part on COVID-19 and its resulting economic impacts, investors will have to math out what happens to the company in 2021.

Let’s talk about the company’s historical growth and how it wound up generating net income this year.

Results

From the first nine months of 2019 to the same period of 2020, Poshmark grew its revenues 28%, from $150.5 million to $192.8 million. Its profitability, however, swung sharply from a net loss of $33.9 million in the first three quarters of 2019 to net income of $8.1 million during the same period of 2020.

From 2018 to 2019, Poshmark grew 38.4%, so its profitability comes with slowing growth compared to historical results.

In addition to GAAP net income, during the first nine months of 2020, Poshmark also generated operating profit of $21.8 million and $68.2 million in positive operating cash flow.

What changed from 2019 to 2020 to allow the company to move from regular losses to success quarters of profit? Revenue growth coupled to cost declines, the magic formula.

This year, Poshmark slashed its sales and marketing costs, cutting other spend as well in the second quarter of 2020. The result of rising revenues in the year and falling costs was a dramatic shift to profitability.

Here’s what that looks like in chart form, from the filing itself:

Quarterly Poshmark net income, via public filing.

For such an extreme swing, the input numbers must have changed radically themselves, yeah? They did.

In Q1 2020, Poshmark spent $34.6 million on marketing. That fell to $11.7 million in Q2 2020 and remained depressed at $19.2 million in Q3 2020. Down went the marketing spend, up went the profits. (We are not arguing that marketing is bad, or a waste. But when folks get jammed at home with nothing to do, you might be able to get away with historically acceptable revenue growth while slimming marketing spend, Poshmark shows.)

Poshmark agrees with our read, stating in its IPO filing that its “increase in net income and Adjusted EBITDA was primarily due to an increase in revenue and a decrease in marketing spend in response to the COVID-19 pandemic.”

Looking ahead, what can we parse out when it comes to Poshmark’s future growth? The company is cash-rich, with $216.6 million in cash and equivalents before its IPO. The company will pad that figure by the time it floats.

And it does have places to spend funds. Poshmark’s international business is a pipsqueak thus far, but a rapidly growing one. As its S-1 reports, Poshmark “began operations in Canada,” its first international expansion, “in May 2019.” Its early efforts to get outside of its domestic borders generated a modest $6.4 million in gross merchandise volume in 2019, a figure that rose to $32.6 million in the first three quarters of 2020.

Perhaps with even more cash, Poshmark can unlock international growth that will allow it to re-accelerate revenue growth, or at least defend a growth rate of around 30%.

As a profitable and growing company, Poshmark is valuable. How valuable the market will decide. But who will it enrich with its final pricing decision? Let’s find out.

Ownership

In 2017, Poshmark raised $87.5 million in a Series D. According to Crunchbase data, that round valued the company at $600 million, post-money. Given what we learned above, it’s safe to say that Poshmark will become a unicorn in its IPO.

Regardless, that Series D included 10,450,374 shares at a price of $8.3729 apiece. Anderson Investments dropped about $50 million of the round, while Mayfield kicked in $12.85 million, Inventus Capital $7.5 million and Menlo Ventures $3.0 million, along with $2.5 million from GGV.

I bring up that transaction as it frames the company’s later, approved secondary sales:

- In March 2018, Inventus Capital bought $150,000 of Poshmark shares for $7.53561 apiece; the approved shares were worth $2.2 million in total.

- In February 2019, Menlo Ventures bought $5.0 million of Poshmark shares for $17.00 apiece, around double its 2017 price; the approved shares sold were worth $18.5 million.

- In August of 2020, more shares were allowed to sell at a price of $22.50 apiece.

Poshmark appreciated since its last formal pricing. Indeed, at its final, approved secondary price it is worth more than $1 billion.

So, its major shareholders who bought equity in 2017 and before have done well. Here are the leading venture groups with material Poshmark holdings heading into its IPO, along with its founder and CEO:

- Mayfield: 17,253,647 shares (26.5% of Series B stock)

- GGV Capital: 5,126,167 shares (7.9% of Series B stock)

- Menlo Ventures: 10,319,197 shares (15.8% of Series B stock)

- Inventus Capital : 6,779,118 shares (10.4% of Series B stock)

- Anderson Investments: 5,971,646 shares (9.2% of Series B stock)

- Manish Chandra (founder and CEO): 6,022,002 shares (9.2% of Series B stock)

You can see how venture returns work in the company’s early share price. Poshmark sold stock at $0.37 per share in its Series A. Those 9,441,596 shares, worth just $3.5 million (Poshmark’s 2011 Series A really was from a different era), are worth $212.4 million at its most recent secondary-market valuation of $22.50 per share.

Next up for Poshmark is a road show of sorts, and pricing. If those are coming this year or next is not clear from where I sit today. But we’ll know soon enough. More when we have it.