The end-of-year IPO wave continues, this time with C3.ai moving closer to its own formal debut by updating its S-1 filing with third-quarter data.

The new data provides the market with a much better look into how the unicorn AI company’s business has progressed during the COVID-19 era, and should help public investors price the company’s equity as it looks to float.

TechCrunch previously explored C3.ai’s performance through the its July 31 quarter. Today we received information about its subsequent fiscal period, the quarter ending October 31.

We noted during our initial dig into C3.ai’s numbers that while the AI startup has had strong historical revenue growth — from $92 million to $157 million in the fiscal years ending April 31, 2019 and 2020 — in more recent quarters, its pace of expansion has slowed.

This brings us to the October 31, 2020, period. Let’s explore what changed for C3.ai and what did not.

C3.ai’s growth story

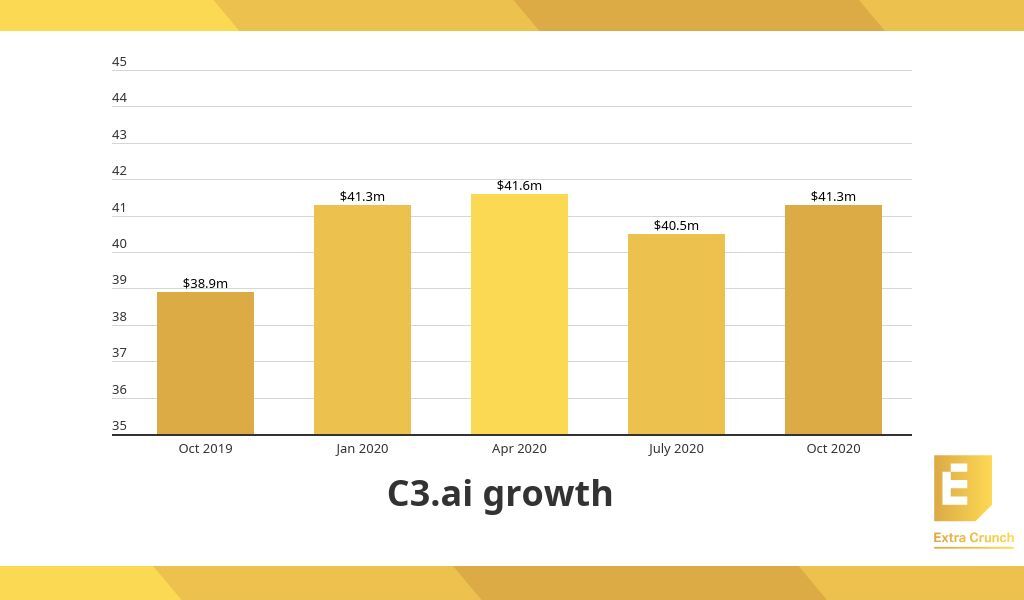

In the October 31, 2019, quarter C3.ai generated $38.9 million in total revenue, counting both its subscription (high gross-margin) and services (low gross-margin) incomes. That figure grew to $41.3 million in the January 31, 2020, quarter.

Then C3.ai stopped growing when measured in sequential terms. For the next three quarters, C3.ai managed to grow compared to its year-ago results. However, since the January 31, 2020 quarter, no subsequent three-month period has shown that the company is able to expand further in raw dollar terms.

Here are those revenue results, including the figures we shared above:

The company’s most recent quarter doesn’t combat the narrative that C3.ai’s revenue growth has stalled.

That said, there are some positive signs to be found in its data. For example, while it appears that in the first two quarters of the company’s current fiscal year — the period ending April 30, 2021 — have posted only modest growth, expansion in non-North American regions is encouraging.

While North American revenue was largely static during the two quarters ending October 31, 2020 compared to the same period of 2019, EMEA revenues expanded from $16.4 million to $22.8 million. And C3.ai’s APAC revenues grew from $286,000 to $2.4 million over the same timeframe.

Perhaps North American growth will return when the pandemic is behind us, but in the meantime there are green shoots to be found on other continents for the company’s investors and boosters.

We can also learn from the company’s remaining performance obligations, or RPOs. What are those? Per the company: “[r]emaining performance obligations are committed and represent non-cancellable contracted revenue that has not yet been recognized and will be recognized as revenue in future periods,” which seems quite a lot like bookings. (OpenView’s definition that bookings can be considered “the value of a contract signed during a certain period,” which makes our point.)

What matters is that we can look at the company’s RPO basis and see if it is accreting revenues for the future or burning through them. The more that the company’s RPOs grow, the more we may see the company expand in the future.

Here’s the company:

Revenue expected to be recognized from remaining performance obligations was approximately $239.7 million and $267.4 million as of April 30, 2020 and October 31, 2020, respectively of which $132.3 million and $133.4 million is expected to be recognized over the next 12 months and the remainder thereafter, respectively.

So, there’s some growth added to future quarters, but nothing that screams acceleration change in those numbers.

Deferred revenue is a bit better, with C3.ai counting $82 million at the end of the October 31, 2020 quarter, up from $60.3 million at the end of the April 30, 2020 quarter. That feels a bit more bullish.

Regardless, I had expected C3.ai to have had a big October quarter. Why? Because its preceding quarters appeared flat., so, it stood to reason that when the company updated its S-1, it would do so with more impressive numbers — the results that it knew were coming, and that it centered its IPO timing around.

Instead, we saw a flat quarter, compared to those preceding.

Why is the company going public, then? C3.ai has around $290 million in cash, cash equivalents, and short-term investments, so it has lots of liquidity, especially having turned operating cash flow positive in the last few quarters. The IPO, then, looks like a timing play around strong market conditions, instead of the company going public when its growth story might carry the most weight.

Let’s see how it prices.