The global recovery in venture capital activity did not miss Europe, new data indicates.

According to a PitchBook report, European venture capital activity rose in Q3 2020, putting the continent on pace to set a new yearly record for aggregate VC activity (as measured in Euros).

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The strong results come in the wake of a cracking quarter for venture capital activity in the United States and a generally bullish period for the global VC market. Venture debt is also seeing something of a rebound from lulls seen earlier in the year.

Inside Europe’s Q3 however, was some less-than-good news: The amount of money that went to first-financings was weak, and much of the strong results from the continent were predicated on capital flowing into already-funded startups. There’s less pie for new companies than the top-line numbers might suggest.

Inside Europe’s Q3 however, was some less-than-good news: The amount of money that went to first-financings was weak, and much of the strong results from the continent were predicated on capital flowing into already-funded startups. There’s less pie for new companies than the top-line numbers might suggest.

Let’s get into the good and bad from Europe’s quarter, contrasting our new data with some prior numbers that we saw when looking into aggregate VC data from Q3.

We’re wrapping up our look at the post-summer venture rebound today, but there’s just a bit more we need to learn before we move on. Let’s get into it.

Europe’s third quarter

Starting with the good news: PitchBook reports that total European venture capital activity came to €10.6 billion in the third quarter of 2020. Per the financial and business data group, it was the third time in history that European venture capital activity crossed the €10 billion mark. (For the sake of comparison, United States-based startups raised around $37 billion, or about €31.5 billion, during the same period.)

Europe’s Q3 number was up its own result of Q2 €9.5 billion, according to the same database.

The same report claims that Europe has recorded €29.5 billion in venture capital activity during 2020’s first three quarters, a result PitchBook says is “on pace to surpass the record €37.2 billion deployed in 2019.”

2020 could be an all-time best year for European venture capital investments, measured in euros. What a turnaround from the fears that gripped the startup world earlier in the year! Though, of course, as COVID-19 makes a staggering return in key markets like Britain, France and Germany, European venture capital activity could yet slow sharply, putting that record out of reach.

A similar risk exists in the United States where the pandemic has reaccelerated to new heights, dragging the pace of hospitalizations and deaths back up along with rising case numbers.

Worries

Through Q3 2020. Image Credits: PitchBook

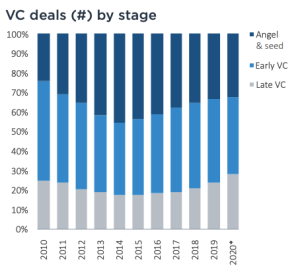

Inside the €10.6 billion result were two worrying trends: First, that venture capital investment deal volume is tilting more and more late stage; and, second, that so-called “first-time” VC deals managed to take in a tiny fraction of invested monies in the quarter.

You can see the the tilt in deal volume toward the later stages in the chart to our right. The dark blue bar (seed and below) shrinks while the light blue and grey bars (all venture after seed) grow as a pair.

That decline in seed and angel dealmaking makes it not too surprising that, per the report, “93.4% of VC through Q3 2020 went to follow-on rounds,” measured in euros, not number of rounds. That leaves not a lot of money for startups just getting off the ground.

Note that a shift in money toward the later stages of venture is a European-exclusive phenomenon. As we wrote regarding the late-stage venture capital in Q3: “54% of all venture capital money invested in the United States in the third quarter was part of rounds that were $100 million or more. That worked out to 88 rounds — a historical record — worth $19.8 billion.”

The Q3 news from Europe is generally good and slightly better than we saw in our global report, which put the continent’s VC result at around $9 billion. But it’s hard to call the quarter a complete win when so much of the capital went to later and larger rounds. Unicorns are grazing so much that the grass is pretty well clipped before the smaller upstarts can get a mouthful.

Q4 will decide if Europe sets a new all-time venture capital record. But all the world’s results in Q3 point to a better-than-expected recovery, something that can be viewed positively, even with our caveats.