Ever since Apple opened up subscription monetization to more apps in 2016 — and enticed developers with an 85/15 split on revenue from customers that remain subscribed for more than a year — subscription monetization and retention has felt like the Holy Grail for app developers. So much so that Google quickly followed suit in what appeared to be an example of healthy competition for developers in the mobile OS duopoly.

But how does that split actually work out for most apps? Turns out, the 85/15 split — which Apple is keen to mention anytime developers complain about the App Store rev share — doesn’t have a meaningful impact for most developers. Because churn.

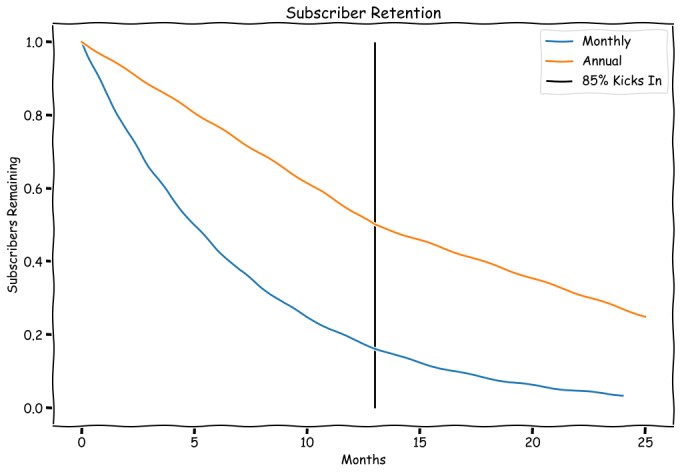

No matter how great an app is, subscribers are going to churn. Sometimes it’s because of a credit card expiring or some other billing issue. And sometimes it’s more of a pause, and the user comes back after a few months. But the majority of churn comes from subscribers who, for whatever reason, decide that the app just isn’t worth paying for anymore. If a subscriber churns before the one-year mark, the developer never sees that 85% split. And even if the user resubscribes, Apple and Google reset the clock if a subscription has lapsed for more than 60 days. Rather convenient… for Apple and Google.

Top mobile apps like Netflix and Spotify report churn rates in the low single digits, but they are the outliers. According to our data, the median churn rate for subscription apps is around 13% for monthly subscriptions and around 50% for annual. Monthly subscription churn is generally a bit higher in the first few months, then it tapers off. But an average churn of 13% leaves just 20% of subscribers crossing that magical 85/15 threshold.

In practice, what this means is that, for all the hype around the 85/15 split, very few developers are going to see a meaningful increase in revenue:

Image Credits: RevenueCat (opens in a new window)

Yes, over the course of many years those loyal subscribers can start to pile up, but it takes exceptional retention rates for the 85/15 split to have any meaningful impact. To frame it another way, Apple could give developers 99% of their app’s revenue, but if it only applied to 1% of their customers, it wouldn’t really matter.

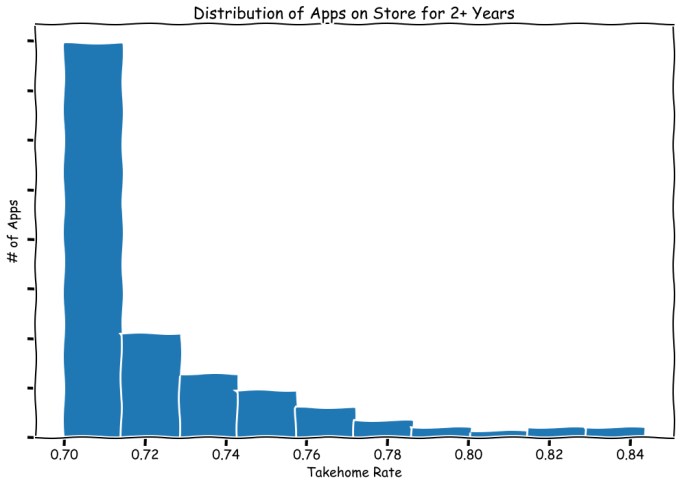

To get a better sense of how the 85/15 split affects the bottom line of subscription apps, it’s best to look at their effective take-home rate — how much are developers really making from their subscription-based revenue every month?

Successful apps are at the very least replacing churned customers with new subscribers, and hopefully adding more each month. After the first year of selling subscriptions, developers start to see a blend of new subscribers on the 70/30 split and retained subscribers that are eligible for the 85/15 split. For apps on the RevenueCat platform, we’re able to calculate what the actual take-home rate is and show exactly how much (or, in this case, how little) the 85/15 split contributes to the bottom line for most developers.

Here’s the distribution of effective take-home rates for apps published through our platform. According to our data, just 16% of apps manage to achieve a take-home rate above 75%.

Image Credits: RevenueCat (opens in a new window)

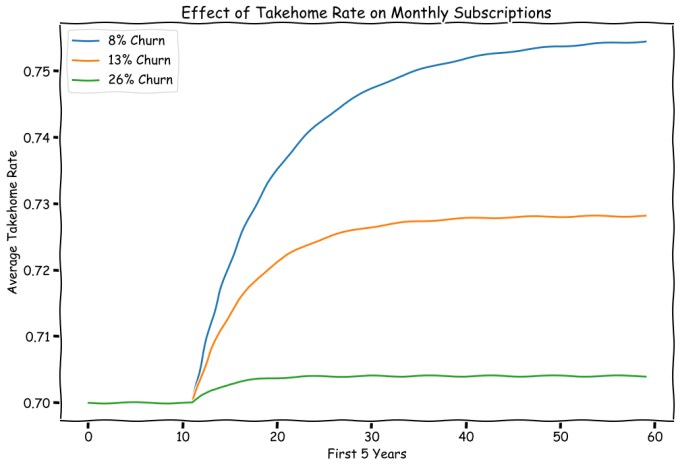

Your churn rate will have a huge effect on how high your take-home rate gets. For an app with a constant user acquisition rate, the take-home rate levels out fairly quickly after the first year. The graph below illustrates how an app with constant acquisition but different churn rates will fare over the first five years.

Image Credits: RevenueCat (opens in a new window)

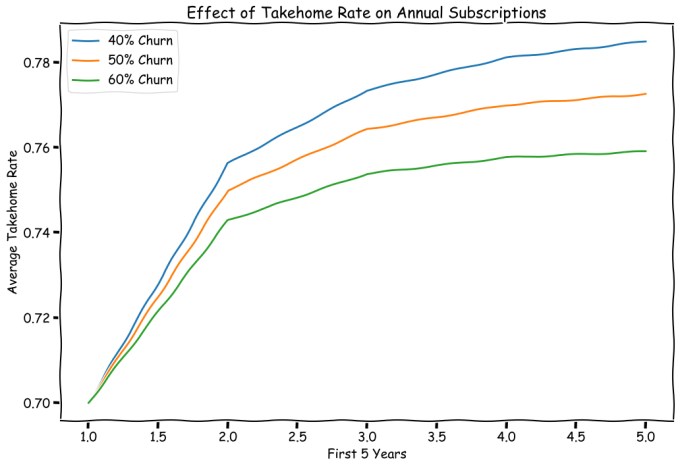

Annual subscriptions tend to churn fewer customers at the one-year renewal mark (where the 85% rate kicks in), leading to larger gains early on. However, most apps rely on a blend of annual plans and other subscription periods, so the effect is often diminished.

Image Credits: RevenueCat (opens in a new window)

As a developer, when you first launch a subscription app (or add subscriptions to an existing app) it feels like if you can just hang on, your Year 2 revenue will soar due to the increased take-home rate on retained subscribers. But in reality, most apps cross that one-year mark and still only take home ~72% of gross revenue. If you’re lucky and work hard to increase retention, maybe you’ll get to take home ~75% of your revenue in a few years. But most subscription apps are still growing quickly, and each new subscriber pushes that take-home rate back down toward 70%.

While the 85/15 split may seem like a generous gesture by Apple and Google, the actual net benefit to developers is drastically lower than they’d have you believe. In fact, both Apple and Google are likely aware of the effects of churn, and that the first year is where most of an app user’s revenue comes from.

Bottom line: It’s great to improve your subscription app’s retention rates, but don’t do it for the 85/15 split. In theory, this deal can be a good way to increase profits from your subscription app. But as our data shows, very few apps are old enough or have high enough retention for the more generous split to have a meaningful impact on their business.