Setting our dive into Palantir’s gross margins aside for another day, Sumo Logic filed to go public this morning. The Redwood City-based, former startup raised around $340 million while private, according to Crunchbase data.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Sumo Logic parses information collected from its customers’ enterprise apps and integrations to help them pinpoint operational and security issues and lets them dashboard additional elements as they wish. The company claims in its S-1 that its code is “continuous intelligence,” which it brands as “a new category of software.”

Our own Ron Miller summarized Sumo Logic as a “cloud data analytics and log analysis company” when it raised a $110 million Series G last May. At the time, it was valued at north of $1 billion, making it a unicorn.

Sumo Logic’s IPO has been in its plans for some time. We can see this in a 2017 TechCrunch headline noting that Sumo had then raised $75 million, and was “on path” to a public offering. So, how healthy is the company, and what have its investors bought with about a third of a billion dollars in capital? Let’s find out.

Sumo Logic’s financial performance

Up top: Sumo Logic operates on a fiscal calendar that ends January 31 of each calendar year. This is super standard for SaaS companies as it allows the firm to not wrap its year during the holiday period. This is good for sales teams and so forth.

So for the years ending January 2018, 2019 and 2020, Sumo Logic reported revenues of $67.8 million, $103.6 million and $155.1 million. As the S-1 notes, those work out to 53% and 50% growth apiece, good numbers for a company now comfortably into the nine-figure annual revenue range.

In the quarter ending April 31, 2020, Sumo Logic posted $47.2 million in revenue, 45% ahead of its year-ago revenue result of $32.5 million. Growth, then, is slowing at the company at a goodly clip, at least in percentage terms.

The company’s revenue had a blended gross margin of 69.4% in its most recent quarter, down slightly from its last fiscal year’s full-year result of just over 71% and down even more from its same-quarter 73% in the year-ago period. That’s not a great trend to have in hand while going public.

Image Credits: Via the Sumo Logic S-1 filing

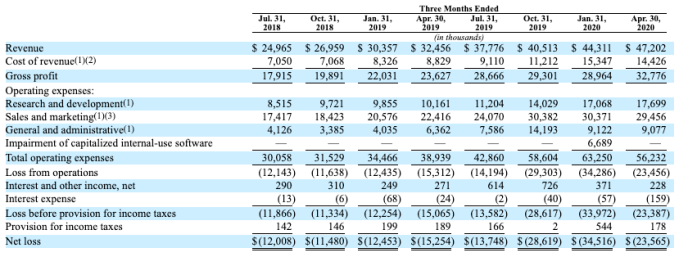

The company’s operating costs also regularly, and greatly, outstrip its gross profit, meaning that Sumo Logic loses lots of money. In its fiscal years ending January 31 2018, 2019 and 2020, Sumo Logic lost $32.4 million, $47.8 million and $92.1 million, respectively. In its most recent quarter, Sumo Logic lost $23.6 million, far worse than its year-ago result of a net loss of $15.3 million.

Indeed, Sumo Logic’s most unprofitable quarters in the company’s history were its last three:

Image Credits: Via the Sumo Logic S-1 filing

Now, let’s get a bit more into the weeds.

Cash burn, net retention

Sumo Logic, in addition to slowing growth, slipping gross margins and rising net losses, has posted greater cash burn over time. In its fiscal years ending January 31, 2018, 2019 and 2020, Sumo Logic burned $6.5 million, $22.1 million and $48.6 million just to support its operations. In its most recent quarter, the period ending April 31, 2020, Sumo Logic’s operations consumed $11.2 million in cash, ahead of its year-ago result of $5.5 million in cash consumed by operations.

But, hell, none of that probably matters in 2020. After all, Sumo Logic is growing more quickly than the average cloud or SaaS company, and it has some neat metrics it can use to excite investors. Like this riff:

Our dollar-based net retention rate has fluctuated between approximately 120% and 135% for each of the past nine quarters, though our dollar-based net retention rate could decline in the short term because of the impact of the COVID-19 pandemic on our business and results of operations

Those are strong net-retention numbers! And with ~70% margins and good trailing growth, Wall Street probably won’t mind the fact that Sumo Logic spent 89.9% of its gross profit in its most recent quarter on sales and marketing costs. What’s wrong with that when the market is rewarding growth!

At today’s SaaS revenue multiples, even inefficient growth can be shockingly lucrative from a valuation perspective. And with more than $100 million in cash in the bank, Sumo Logic is not going public because it has to; it’s diving in because the waters are warm and it’s likely targeting a nice new valuation.

But of what size? The company’s current run rate is around $200 million, and given that most of its revenues appear recurring, its ARR could be a little higher. At a 20x revenue multiple — not at all impossible for its growth rate in today’s market — the company is worth around $4 billion, likely a super good markup from its last private round.

We asked before why more private companies were not taking advantage of the current market conditions. Well, here’s Sumo Logic and soon, we’ll have a public filing for Palantir, or so we think. Regardless, Sumo Logic is going to raise a few hundred million and a likely strong price for its equity. Given the issues we can easily spot in its financial documents, surely more unicorns will follow suit.

Oh, and winners? Greylock owns 22.6% pre-IPO, Sapphire Ventures 7.1%, Accel 6.8%, Institutional Venture Partners 5.6% and DFJ 5.1%, all pre-IPO. Others own less, we presume, but the 5% rule is only so illuminating.

More when it starts to price.