Before the coronavirus made edtech more relevant, companies in the sector were historically likely to see slow, low exits. Despite successful IPOs by 2U, Chegg and Instructure in the United States, public markets are not crowded with edtech companies.

Some of the largest exits in the space include LinkedIn’s scoop of Lynda for a $1.5 billion in cash and stock and TPG’s purchase of Ellucian for $3.5 billion.

But both of those deals happened in 2015. Five years later, edtech is cooler and surging — but is it seeing exits? Are Lynda and Ellucian one-off success stories?

2U’s co-founder and CEO, Chip Paucek, said he is optimistic.

“We are a rare edtech IPO,” he told TechCrunch last week. “For a long time in edtech it was either ‘sell to Pearson or not.’”

Despite the sector’s slow past, Paucek said now is a good time to start an edtech company because the sector “is finally starting to hit its stride” with more back-end infrastructure and demand for online education.

This morning, let’s use some data to paint a picture of the landscape of edtech exits and bring some balance to this stodgy stereotype.

Boot the growth

Boot the growth

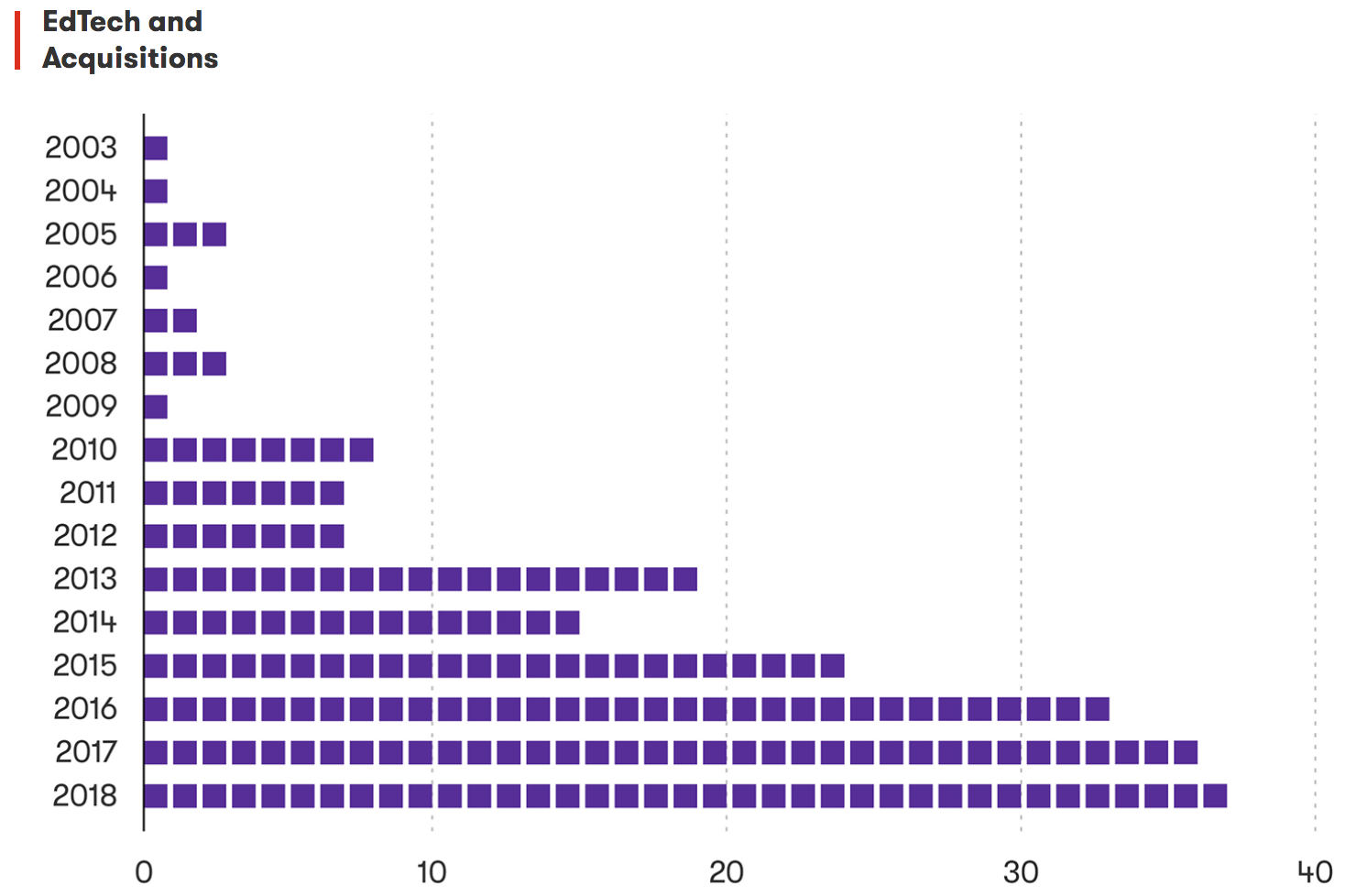

There have been approximately 225 acquisitions in edtech between 2003 and 2018, according to Crunchbase data. RS Components sent me a graph in March to contextualize this timeframe a bit more:

Edtech deals over time. Graph credit: RS Components.

From this, we can glean that acquisitions have steadily been on the rise, even before the pandemic. It’s impressive that despite regulation hurdles, edtech has managed to have exits, although I wish we were able to see dollar volume, too.

But, the graph does do its job: it tells me that Lynda and Ellucian are not outliers; edtech exits occur more often than the stereotype suggests, and as the sector grows and companies bring in more revenue, I imagine we’ll see even more consolidation.

While growing, edtech is still a small slice of startup-land. According to Crunchbase, the fintech sector saw 193 acquisitions in 2018 alone. As noted above, there were 225 edtech acquisitions in the preceding 15 years.

Another data point I’ll share, this time from Career Karma’s State of Industry report, gives a look at how well one edtech sub-sector is performing: bootcamps.

Career Karma analyzed 105 companies and found at least one bootcamp acquisition in the space every year since 2014. I’ll admit, I was shocked. Sure, bootcamps are an alternative form of education and are largely more accessible than a four-year degree, but with so many entrants, competition and need for human capital to scale, I wasn’t sure if the business was healthy enough to be an enticing purchase.

It made more sense when I learned that these deals, although common, were relatively small in dollar size, with most falling under $100 million in transaction volume, according to the report. Career Karma chalked it up to the increasing cost of customer acquisition and bootcamps being one way to bring in new customers.

Combining this data point with the earlier graph, my conclusion is that edtech exits are growing in size, although at a modest pace. Lynda and Ellucian were blockbuster hits, but that doesn’t mean the market isn’t destined for a different looking green shoot.

As the market gets frothier, more competitive and better-funded, we might see the ability to be bought (and buy) change, too.

Thanks for letting me guest on this installment of The Exchange while Alex is out! Read more of my work here or follow me on Twitter.