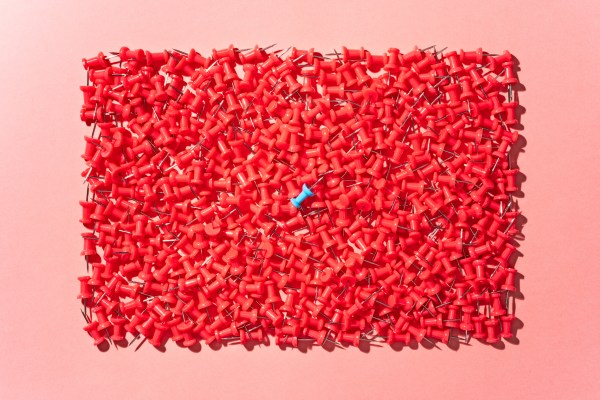

Early-stage startup founders who are embarking on a Series A fundraising round should consider this: their relationship with the members of their board might last longer than the average American marriage.

In other words, who invests in a startup matters as much — or more — than the total capital they’re bringing with them.

It’s important for founders to get to know the people coming onto their board because they’ll likely be a part of the company for a long time, and it’s really hard to fire them, Jake Saper of Emergence Capital noted during TechCrunch’s virtual Early Stage event in July. But forging a connection isn’t as easy as one might think, Saper added.

The fundraising process requires founders to pack in meetings with numerous investors before making a decision in a short period of time. “Neither party really gets to know the other well enough to know if this is a relationship they want to enter into,” Saper said.

“You want to work with people who give you energy,” he added. “And this is why I strongly encourage you to start to get to know potential Series A leads shortly after you close your seed round.”

Here are the best methods to meet, win over and select Series A investors.

Identify industry experts

Saper recommends extending the typically short Series A time frame by identifying a handful of potential leads as soon as a founder has closed their seed round. Founders shouldn’t just pick any one with a big name and impressive fund. Instead, he recommends focusing on investors who are suited to their startup’s business category or industry.

For instance, consumer software startups should seek out those who have done a lot of Series A consumer investing. These investors will likely have pattern recognition and will be able to teach the executive team what they’ve seen in the past. They’re also going to know the right people to help a startup find and hire talent, Saper added.

Lean on your seed investors

Once founders have identified potential leads, they should turn to their seed investors to help vet these contenders. Seed investors play the game over and over again, Saper said, adding that they know what the internal dynamics, expertise and culture is like at Series A VC firms.

Founders should lean on seed investors and specifically seek their advice and candid feedback about what a prospective Series A investment team is like to work with.

After creating a list with a handful of vetted Series A investors, Saper recommends setting up periodic meetings, or better yet, finding a project to work on together.

“As a Series A lead myself, I love doing this with people,” Saper said. “I love for it to not just be a ‘get to know you’ meeting, to know you, but also something substantive.” For instance, it could be working on a pricing strategy or brainstorming about who might be the right kind of account executive to hire, he said.

However, Saper cautioned that this isn’t possible with a long list of investors. That’s why it’s important to pick and vet just a handful, maybe four or five.

He suggests that founders ask themselves once they’ve had a meeting or two and maybe even a brainstorming session: “Does spending time with this person give me energy?” Saper said this is a clarifying phrase that he has used in his life, personally and professionally.

Timing

Timing matters, as Saper said in a previous article centered on how to time a Series A fundraise. Here are just a few of the basics.

There are three basic steps: prep, execution and close. As Saper noted, there’s a science to sequencing the fundraise that begins with understanding how long it takes to work through each step. Founders should budget at least three months for this process.

Prep takes about one month and is the time when founders and their team gather core materials, meet with seed investors and work on demo pitches. Phase two is execution, when founders make their pitches to investors. This lasts between two to six weeks. Founders should also keep in mind that they should allow for two weeks advance notice to schedule VC meetings.

Phase three is the close, a period that follows signing the term sheet. This is when all the legal due diligence occurs. While founders should budget about a month for this process, Saper said it can last up to six weeks.

The three-step fundraise process might take three months, but founders should begin far earlier. Founders will want to start a fundraise at least six months prior to their zero-cash date.

Winning over Series A investors

The fundraising process is a two-way relationship. Investors will be conducting their own due diligence in those early meetings, once the relationship is established and as fundraising begins.

It‘s key to under-promise and over-deliver throughout the entire fundraising process, Saper said. “There are very few things that make a VC more desirous than a founder who is consistently under-promising and over-delivering,” Saper said. “This is something that Eric (Yuan) at Zoom consistently did throughout our time working together, and it’s been really delightful.” (Emergence Capital is an investor in Zoom, which was founded by Eric Yuan.)

Part of that “over-delivery” guideline comes down to timing. Saper recommends signing on a customer or channel partner or reaching a major milestone before closing a fundraising round. Even better, Saper said, is to be able to show some initial data on how that new customer relationship is shaping up.

“Even if it’s limited data, but it is sloping positively — that’s a really powerful thing,” he said.

Another important early indicator that investors pay attention to is the ability of a startup to attract great talent. If a startup is close to hiring a senior-level employee, it might be worth waiting to signing that person on before a fundraise, he said.

“Most Series A companies don’t actually have the executive team fully built out, so it’s fine,” Saper said. “But having one or two is actually a really impressive indicator.”

Whatever milestone a founder does share should not be overblown. If it’s early data, be clear about that.

“What we’re funding is the future,” Saper said. “And if you’ve already built some of the future, and you can show that to us today, that makes me more excited to work with you.”