Reading headlines here and there, one might assume that venture capital interest in fintech startups is setting records every quarter.

After all: Didn’t Robinhood raise $280 million and $320 million more this year? Stripe raised $600 million just a few minutes ago, and wasn’t it Monzo that raised £60 million a few weeks back? Oh, and Hippo raised $150 million the other day.

And what about that huge Plaid exit earlier in the year and Chime’s jillion dollars that came right before 2019 ended?

That’s how it has felt to me, at least. And with good reason: New data from CB Insights indicates that fintech startups raised a record number of so-called “megarounds,” financings worth $100 million and more, in the second quarter of 2020.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

So the vibe in fintech that huge rounds have been landing quite often is correct. But underneath the big deals, there was early-stage weakness in the market that makes for a surprising contrast.

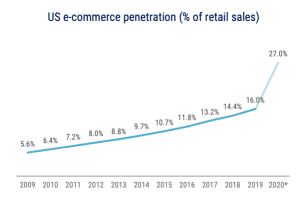

The same CB Insights report details a key “tailwind” factor for many fintech startups, namely that e-commerce is booming in the COVID-19 era, rising from about 16% of total U.S. commerce to around 27% through Q2 of this year.

The same CB Insights report details a key “tailwind” factor for many fintech startups, namely that e-commerce is booming in the COVID-19 era, rising from about 16% of total U.S. commerce to around 27% through Q2 of this year.

So, let’s start by taking a quick look at Square’s earnings that leaked yesterday, and some notes from Shopify’s recent results to decipher just how fast the economy is heading online before examining what happened in Q2 VC for fintech startups as a cohort.

We’ll keep this as numbers-light as we can, and fun as we can — I promise. Let’s go!

Digital commerce is growing like a weed

You might think that Square, a company most famous for its IRL payment terminals and ability to turn any person into a microcompany would suffer while COVID-19 slowed in-person business. But, despite slowing gross payment volume (GPV), as expected, Square’s revenue exploded in Q2, growing from $1.17 billion in Q2 2019 to $1.92 billion in the most recent period.

Two numbers stand out: First, Square’s fintech service Cash App “delivered strong growth, with gross profit up 167% year-over-year to $281 million.” Those results were built on the back of 30 million monthly users and 7 million users of the related Cash Card.

Second, Square saw its online channels grow as a percentage of its total GPV from 14% in Q2 2019 to more than 25% in the second quarter of this year. That gain was led by more than 50% more online GPV through Square’s services.

Image Credits: CB Insights

The bits of Square that we’d easily bucket as “fintech” are scaling rapidly. So are other fintech-enabled companies, like Shopify.

Picking one data point from its earnings: “Gross Payments Volume grew to $13.4 billion, which accounted for 45% of GMV processed in the quarter, versus $5.8 billion, or 42%, for the second quarter of 2019.” Gross payments volume tracks “the amount of GMV processed through Shopify Payments.” Damn.

Both companies have seen their public valuations skyrocket in recent months, making the lesson from them all the more explicit: Fintech products and services are scaling and public investors are paying attention.

Perhaps that’s why it isn’t a surprise that Q2 2020 megarounds doubled compared to Q1 2020, shooting from 14 to 28 in the most recent period. A previous high of 26 $100 million or larger fintech financing events took place in Q2 2019, making the recent tally is a record.

Fintech’s epic funding run started back in 2017, when in its second quarter, fintech startups landed 11 megarounds, never dipping into the single digits for any quarter since.

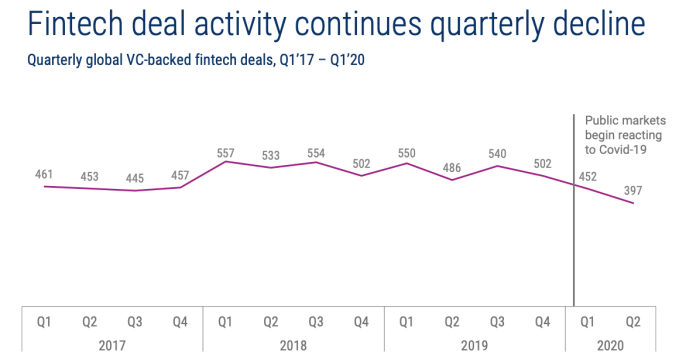

Sadly, all the good news doesn’t trickle down: According to the same CB Insights data set, fintech startups raised 397 funding rounds in Q2 2020, down from 452 in Q1 2020 and 502 in Q4 2019 and 540 in the quarter before.

Indeed in 2018 and 2019 there were, on average, more than 500 fintech rounds around the world each quarter.

Image Credits: CB Insights

So far 2020 is seeing 424.5 per quarter and falling.

On one hand, then, late-stage fintech companies are able to surf strong public market results to great effect. On the other, early-stage fintech companies are seeing fewer funding events.

Wrapping on a happier note, June was the best month in Q2 2020 for fintech rounds (141) and dollar volume. It was the second best of the whole year. If July and the rest of Q3 can build on that momentum, the fintech VC market could skate to thicker ice, perhaps boosting early-stage fintech startups.

The global economy is changing rapidly to a more digital, more online version of itself. Fintech startups will be there to help, profiting while helping the economy’s evolution. That should mean strong venture results, and more IPOs. We can hope, at least.