At last week’s Early Stage virtual event, founders and investors shared some of their best insights about startup building and what they’re looking for in their next investments. We’ve assembled a compilation of insights covering different elements of entrepreneurship from a handful of founders and VCs:

- Jess Lee, partner at Sequoia Capital on identifying your customer

- Garry Tan, managing partner at Initialized Capital on finding the right problem

- Ann Miura-Ko, co-founding partner at Floodgate on product-market fit

- Ali Partovi, Neo founder and CEO on hiring

Jess Lee, partner, Sequoia Capital: Start with your customers

Jess Lee has a whole framework for describing customers as if they were characters in a film.

“The way to think about it is as a fictional character who represents a particular user type that might use your product or company or your brand in a particular way,” she said. “And many companies have multiple personas.”

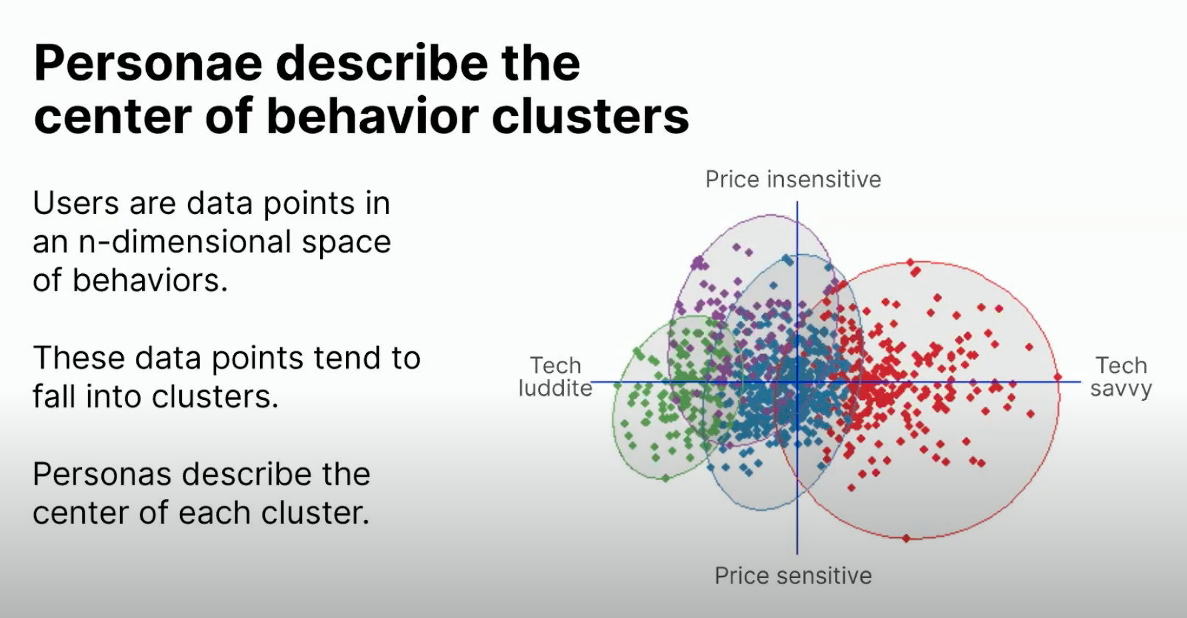

A more scientific way is thinking of your customers as a cluster of data points. The persona that emerges is at the center of that cluster.

Image Credits: TC Early Stage

“So if you map out all of the possible customers, you tend to see these clusters and then you describe who the person is at the center of that cluster,” Lee said.

What makes a good persona is someone who feels useful for product design but also memorable. That means creating a persona that has a clear story with real pain points, she said.

“And that’s the most important thing,” she said. “What do they care about and what problems are you trying to solve?”

Garry Tan, managing partner, Initialized Capital: Find the right problem

A big issue startups face is choosing the wrong problem, Tan said.

“People pick problems they can solve but maybe it doesn’t matter,” he said. “Like, there aren’t enough people who actually have that problem. Or, on the flip side, they’re picking really big problems but then there’s no actual path to get there. There’s not a go-to-market or way for that founder and their team and their resources to actually address it.”

When startups fail, it’s often because they picked the wrong problem, Tan added.

“People don’t really want it or the product isn’t good enough,” he said. “You’re going to pick a problem and the problem probably has a bunch of replacements.”

Using Instacart as an example, Tan said the company needed to prove customers would choose it over all the alternatives that existed. That’s part of the hardest problem for a startup, Tan said. “How do you pick a problem that is small enough that you can totally dominate that market? At YC, we would always call that the thin edge of the wedge.”

Turning to Airbnb, Tan pointed to how the company didn’t come out the gate saying it would totally upend the hotel industry. Instead, Airbnb literally used to be called “Air Bed and Breakfast.”

“That was the thin edge of the wedge and then at some point, it became clear that this is actually for all spaces and then that’s sort of the ideal Series A scenario. We have the world’s market for air beds and breakfast totally cornered but then hey these are our initial tests in these other spaces, like we’re listing whole apartments, we’re listing whole houses and that’s actually a 10 times or 100 times, 1000 times larger market. That’s what I deal with Series A.”

Ann Miura-Ko, Floodgate: Find product-market fit

Product-market fit, according to Ann Miura-Ko, is a minimum viable company. And what makes a minimum viable company is the combination of good product value, strong business model and an understanding of how it fits into the overall ecosystem. When raising a seed round, however, Floodgate won’t expect your startup to already have product-market fit.

“What I would expect to see if you’re raising seed is that you have hypotheses around all of these areas, and you might even have run some pretty significant tests in them,” Miura-Ko said. “The idea is not to actually have significant traction and to be investing into that traction. The big caveat here is, what is your insight? And how unique is your insight? Oftentimes, we will see companies come in that have an insight that is not terribly a great secret, right? In that case, you are entirely evaluated upon your traction, because that is the only thing that you have going for you. And so, depending on what the investor believes is the secret that you have, and how well kept it is, do you have an advantage?”

If what you have is the cure to cancer, it doesn’t matter whether you have traction if you have the intellectual property for it, she said. Investors won’t need to see it in the market to understand you’d be able to make a lot of money doing it.

“So we’ve seen companies that have incredible tech secrets,” she said. “If we believe that there’s great applicability, and we believe that that’s something that can happen, then obviously, we would take that risk. But on the other hand, I’ve seen a lot of businesses these days that, as an example, they are building on top of Zoom and they are going to enable some sort of consumer experience on video chat. You have to tell me why that is something that most people wouldn’t agree with, in order for traction not to be an important piece of making that seed investment.”

Ali Partovi, Neo founder and CEO: Hiring is your top priority

Hiring great people is the most important thing you can do as a founder, according to Partovi.

“The way I like to think of it is to try to hire people smarter than yourself, and that’s difficult for any of us to do because, you know, whether it’s identifying them, evaluating them, and ultimately closing them, you know, hiring is really difficult. But if you get that right, it makes everything else much easier,” Partovi said.

The easiest place to start is hiring people you’ve worked with before that you already trust. But it’s also important to think about diversity, Partovi said. And that’s diversity in every sense — not just gender and race.

You also “want people who are not from the companies you’ve worked at before, not from the schools you attended and not your own age … as long as you have one or two people who are different, that’s enough to make your company feel welcoming to others,” he said. “If you have five or 10 people who are all similar, it becomes really difficult to add diversity later because any new person who doesn’t fit in will feel like, ‘Oh, wow, these people are all part of the same group and I don’t belong here,’ and it just becomes harder and harder.”

Lastly, if you’re not a technical founder, it may be hard to evaluate your first batch of engineers. While online coding tests like Code Signal and Byteboard can be useful, Partovi said it’s important to not solely rely on a coding test to evaluate potential candidates.

“If you relied only on a coding test, it would kind of be like if you were trying to draft for an NBA team based on a dunking contest. It’s a proxy. It’s a hint that this person is probably good but it’s not the only thing they’ll be doing all day long. In fact, very often, the types of problems in coding tests are pretty divorced from the types of day-to-day work someone will do in reality. It’s just one form of screening.”

On top of coding tests, it may be worth asking candidates to walk you through some code they’ve written for previous projects. That may help you to determine how well they understand the subject and if they explain complex ideas to someone, Partovi said.

“Whatever it is that they’re an expert in, ask them questions and try to see how well they can teach you about it.

One general tactic is to ask them to elaborate on a specific point. If they really know their craft, they will be able to thoughtfully and simply talk about it, rather than use jargon just to try to intimidate you, Partovi said.