The fortunes of startups that leverage artificial intelligence have soared dramatically in recent years.

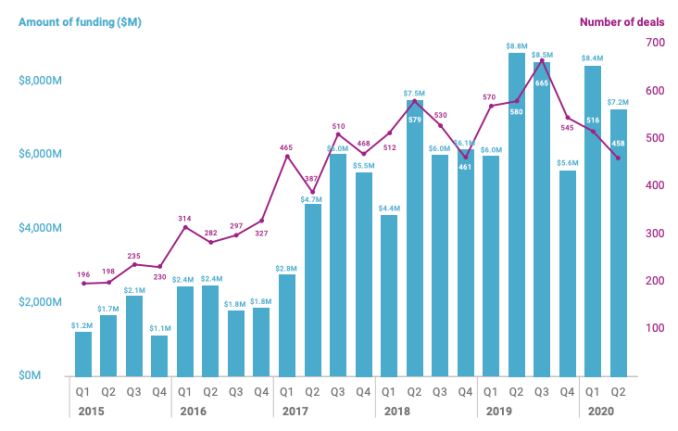

These AI-powered startups have seen quarterly investment totals rise from a few hundred rounds and a few billion dollars each quarter to 1,245 rounds and $17.3 billion in the second and third quarters of 2019, according to data from CB Insights. The rise in dollars chasing AI startups has been huge, demonstrating strong venture capital interest in the cohort.

But in recent quarters, the trend has slowed as VC deals for AI-powered startups fell off.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

A new report from the business-data company looking at the second quarter of venture capital results for global AI startups shows historically strong but declining investing rates for the upstart firms. During a pandemic and widespread recession, this is not a complete surprise; other areas of VC investment have also fallen in recent quarters. This is The Exchange’s second look at quarterly data in the startup category, something partially spurred by our interest in the economics of the startups that make up the group.

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

The scale of decline is notable, however, as is the national breakdown of VC investment into AI. (The United States is doing better than you probably guessed, if you have only listened to politicians lately.)

Let’s unpack the latest results, determine how investing patterns have changed by stage and examine how different countries compare when it comes to deal and dollar volume for AI-powered startups.

Global declines, US dominance

In the second quarter of 2020, global investment into AI startups fell to 458 deals worth $7.2 billion. According to the CB Insights dataset, the deal volume is the lowest for 12 quarters, or since Q2 2017 when 387 investments into AI startups were worth $4.7 billion.

In dollar terms, Q2 2020 wasn’t as bad. The quarter’s $7.2 billion in globally invested dollars was the fifth best result of all time and bested the Q4 2019 result of $5.6 billion. Here’s the chart:

Image Credits: CB Insights, shared with permission.

Whenever deal volume falls more quickly than dollar volume when we consider venture capital trends, we tend to see average round sizes go up. The same set of results can also indicate that more mature startups are raising capital — precisely what we can see in Q2 AI data. Indeed, seed and angel deal volume for AI-powered and focused startups as a percentage of sector deal volume fell to an all-time low since at least the start of 2015, while Series A and D volume grew.

The declines in investment do not mean that the United States is falling behind China, however. A few years back it seemed likely that China-based startups were set to challenge the United States’ own, as VC totals in the country tied and perhaps surpassed what was seen in the US.

Times have changed, which is evident across a number of metrics, including Q2 2020 AI-powered startup funding data. Here’s the three leading entries in the geographic breakdown of AI deal volume from the report:

- United States’ share of AI startup deals, Q2 2020: 39.5%.

- “Other” countries’ share of AI startup deals, Q2 2020: 31.6%.

- China’s share of AI startup deals, Q2 2020: 15.5%.

The Chinese number is still impressive. The fourth place entry in that dataset was Japan, with 5.2% of deal volume. So, China is second when it comes to individual countries’ share of AI deals, though it remains a distant second.

Let’s close on the data on the VCs themselves. Which VC firms cut the most checks into AI startups in Q2?

Andreessen Horowitz had seven deals in Q2, and 8VC and GGV Capital tied at five. Accel, Bessemer and Founders Circle came next. On the corporate venture capital side, Intel Capital led with 10 deals in Q2, while Google Ventures and M12 (Microsoft’s CVC) managed six and five, respectively. Salesforce came in fourth amongst the corporate realm, with China Merchants Venture and Tencent Holdings coming next.

Q2 has not been an impressive period for venture capital data, even if deal and dollar totals are above historical averages. Q3 will be more illustrative — are we rebounding today, or slipping further behind prior results? Are the halcyon days of the unicorn era behind us?