When the going gets tough, it’s common for some corporate VCs to head for the hills.

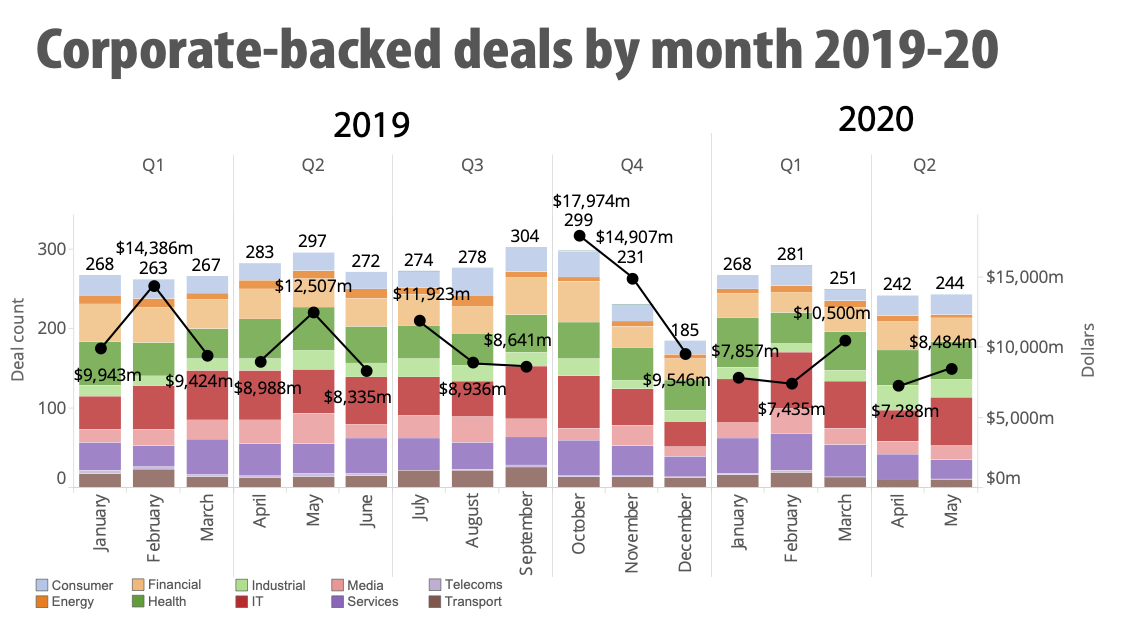

Today, it’s a narrative that’s emerging again amid the COVID-19 crisis. Global corporate venture deals fell from a total of 580 in April/May of 2019 to 486 in the same period this year, according to Global Corporate Venturing.

However, institutional VC deals are also headed for a decline, with PitchBook anticipating a drop in transaction volume over the next several quarters, as well as a downturn in valuations.

Image Credits: Global Corporate Venturing

It remains to be seen how it will play out this time, but I believe corporate venture capital (CVC) will not only stick around, but also be a vital part of the innovation ecosystem going forward.

I know that Merck Global Health Innovation Fund (MGHIF) remains fully committed to “doing” venture. Now, more than ever, health innovation is vital. Second, we understand that many of today’s most successful companies were funded in times of uncertainty. In fact, to put our money where our mouth is, we’ve recently completed two spinouts, three follow-on investments, and two new deals in 2020 — all since COVID hit. We intend to increase that pace going forward in 2020 and beyond.

It hasn’t been easy. It’s hard to do venture when you can’t venture out into the world, meet founders and do diligence the way we did in the past. But it is possible, if you do some innovating of your own and set up a smoothly functioning system to do CVC virtually.

Here’s how we’ve done it.

Finding real benefits in virtual CVC

Are people who work virtually more productive? The question has long been debated and now, as most people are working virtually, we have an answer: Yes. Research shows the majority of remote workers are more productive.

Indeed, here at GHIF, we’ve found that less travel has brought more open calendars and more interaction, not less. In the past, our work entailed a lot of travel. Now that this has been restricted, our calendars have freed up and we’re enjoying greater access to internal Merck business partners. We’re also more available to our portfolio companies and CEOs. I personally had more than a thousand meetings last year and I had to fly to many of them. Since COVID hit, I haven’t flown to any meetings. Now I spend those hours of travel time talking with people. That’s wonderful.

But what about conferences, meeting people and networking in person? This is a valuable part of our business, and some of these key interactions may inevitably be lost. However, many conferences like Global Corporate Venturing are now taking place virtually, so we’re still able to develop relationships and source deals. We are also finding that virtual conferences are more productive, since we’re not spending half the time on planes just to get to them. But, we won’t be able to connect serendipitously, and after thinking more strategically about it, serendipity isn’t a highly effective strategy for making and developing relationships. So, we are developing a more targeted and curated approach to this networking need.

We have established a centralized, coordinated way to manage face-to-face meetings, workshops and collaborations to maintain our innovation efforts. We have discovered that this approach increases our “return on time,” brings the right stakeholders to every meeting and expedites a process that is often delayed by real-world obstacles.

Another immediate concern when COVID-19 first hit was board meetings and how we conduct them going forward. Sure, they’re not the same these days, but they do still work virtually. Especially in cases where there are established relationships and the situation is relatively stable, board meetings can be conducted effectively via the app of your choice.

Challenges to virtual corporate venture

All that said, we do realize virtual corporate venture presents difficulties. Perhaps the worst is the absence of personal interaction in the diligence process. But what I have found is hardest to do without face-to-face contact, is research on a new investment. To do diligence properly, it’s very important to read the room — see body language, observe interpersonal exchanges, have spontaneous conversations and talk to administrators. This sort of investigation can still be done, but you have to figure out a way around the challenges. That’s why for us, references have become even more important than they were before COVID-19. We take the time to gain very deep insights into the people or companies we are vetting.

Internal connections at your firm could weaken. If your firm is like ours, you once did a lot of management by walking around the office to take the pulse of the organization, stopping for an impromptu conversation or to meet a new task force member, say hello and tee up a future meeting. It’s important to keep in mind that these interactions are vital — and you should find ways to continue them virtually.

Another challenge is the generational divide. It’s not an overgeneralization to say that VCs tend to be older people who are most comfortable working more face-to-face and founders tend to be younger people who are more comfortable with virtual work of all types. Founders today often are known for their use of social media and virtual communication, rather than physical gatherings, to broadcast ideas, establish viewpoints and take action.

No matter what, to get the most out of all your meetings, you’ll have to invest in virtual creative tools. Yes, white boarding and collaborative-design efforts are limited on virtual platforms, but they do exist. They’re what you have to work with right now.

A final point here: Remember that work-life balance will be further tilted when everyone works virtually. Your team, like ours, is no doubt accustomed to a 24/7 business environment. See to it that your team takes regular breaks and ensure that all the people you interact with aren’t suffering from isolation or overwork.

Getting the best returns

Even if you follow all these steps, you will still face challenges amid the new normal. Implement the following strategies to ensure the best returns for your firm:

- Kill deals early and often. Decide quickly on what not to pursue so that you can devote more time to your most promising deals.

- Triage your portfolio. Among your existing companies, spend more time on the potential winners.

- Move quickly. Remember, there is still a need for speed. A lot of corporate processes have slowed down amid the pandemic. But don’t let that mindset creep into your own work. We’d rarely get a deal done if we moved at corporate speed.

- Avoid analysis paralysis. Perfect information is an illusion. Know the unknowns, address the risks and adjust from there as better information becomes available.

- Deploy a situational approach. Trusted relationships and stable situations require less effort and can be handled virtually. But new relationships and unstable situations will still require face-to-face interaction, even today.

Preparing for the future

When will corporate venture go back to “normal?” We don’t know. Nobody does. In the meantime, we’re taking measures to make sure that we’ll continue to be successful under any circumstances.

We’re normalizing remote work. Our team is comfortable working remotely and they don’t expect to come into the office other than for management updates or key meetings. We’ve found that we don’t need offices at all, just hotel space for those occasions when we need to be together.

We’re virtualizing more operations. Most of our board meetings, diligence efforts and pipeline development will be different in the future. We think portfolio company board meetings will be done virtually from now on. As for diligence, we’ll cut our face-to-face diligence meetings from three or four to one or two.

We’ll do face-to-face when necessary. As the world reopens and travel restarts, some situations will of course call for face-to-face interactions to drive deeper relationships, address creative processes and solve critical issues. In those cases, we’ll be traveling.

The coronavirus pandemic has taught a lot of lessons to everyone in our partnership. It has reinforced the absolutely vital nature of our work — driving innovation in health care technology. And it has taught us that this work can and will continue successfully, whatever challenges the world brings our way.