As the IPO market heats up, one offering slipped beneath our radar. This morning, then, we’ll catch up on Accolade’s initial public offering and what its proposed pricing may tell us about the state of the IPO market.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

Catching everyone back up, Accolade sells its service to employers who in turn offer it to their employees; the company’s tech provides a portal for individuals to “better understand, navigate and utilize the health care system and their workplace benefits,” Accolade states in its S-1 filings.

The firm goes on to point out that the U.S. health care system is complex, which puts “significant strain on consumers.” Correct. Its solution? To help “consumers make better, data-driven health care and benefits-related decisions” through its service by selling a “platform to support and influence consumer decision-making that is built on a foundation of mission-driven people and purpose-built technology.”

The firm goes on to point out that the U.S. health care system is complex, which puts “significant strain on consumers.” Correct. Its solution? To help “consumers make better, data-driven health care and benefits-related decisions” through its service by selling a “platform to support and influence consumer decision-making that is built on a foundation of mission-driven people and purpose-built technology.”

Yeah.

Regardless of that verbiage, Accolade’s business has proven sufficiently attractive to allow the firm to file to go public in late February, around when Procore filed. Both companies delayed their offerings, but Procore raised more private capital, a $150 million round that values it at around $5 billion. Accolade, to our knowledge, did not raise more funds. So, its IPO is back on and today we have its pricing interval.

Let’s unpack its pricing range, write some notes on its recent financial results and try to figure out how ambitious Accolade is being in terms of its expected valuation as it counts down to trading publicly.

Accolade’s S-1/A

According to Accolade’s June 24th S-1/A, the company expects a $19 to $21 per-share IPO price range. The company intends to sell 8.75 million shares in its debut, not counting a 1,312,500 share greenshoe option offered to its underwriters. Discounting the extra shares, Accolade would raise between $166.3 million to $183.8 million in its debut; inclusive of greenshoe shares, the total fundraise grows to a range of $191.2 million to $211.3 million.

The IPO price range allows us to value all of Accolade. According to its listed share count, the former startup would be worth $886.4 million to $979.7 million at $19 to $21 per share, not including the greenshoe option. Both numbers compare favorably to the firm’s reported last private valuation of a little over $600 million.

If you include the greenshoe shares, at $21 per share Accolade is worth $1.007 billion, just over the unicorn mark.

So, for investors like Accretive, Andreessen Horowitz, Carrick Capital and Comcast Ventures, the IPO looks set to be an affair worth celebrating. Especially if they got in early to the company’s fundraising history; as a private company Accolade raised nearly a quarter-billion dollars.

Does that pricing and valuation feel aggressive? Let’s explore its results to find out.

Accolade’s revenue grew from $29.7 million in the quarter ending November 30, 2019, to $44.4 million in the three-month period ending February 29, 2020. Those two periods generated net losses of $18.3 million and $2.1 million, respectively. So, heading into its most recent quarter, Accolade was making real progress in terms of revenue growth — its February quarters, notably, have historically featured seasonally high revenues and diminished losses. What did the company manage in its quarter ending May 31, 2020?

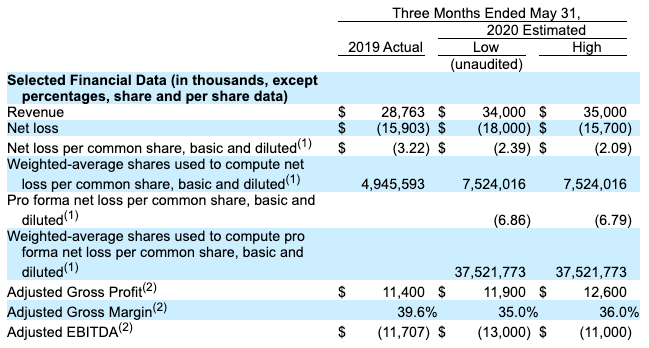

In the year-ago period ending in May 2019, Accolade managed $28.8 million in revenue and a net loss of $15.9 million. More recently, here’s what Accolade is expecting for its May 31, 2020 quarter:

Image Credits: Accolade via S-1 filing

So the company will manage, at best, to lose about as much on an adjusted basis as it did in the year-ago period, albeit from a higher revenue base. That’s ok, but not spectacular. The company’s expected year-over-year growth rates of 18.2% to 21.7% are also not heart-stopping.

There are still things to like. In its fiscal year ending February 29, 2020, for example, Accolade posted gross margins of 44%, up from 36% in its preceding fiscal year. That’s material! But, we can also see the reason why the company appears set to trade at a single-digit revenue multiple. Namely, that its gross margins are far below where SaaS companies tend to reside.

This is, we presume, because the firm has health care workers on staff that it has to pay, and people are more expensive than bits and bytes. But Accolade has something that other companies may not have: A digital solution to an industry that just got shunted deeper into a long-needed digital transformation. Health care was inching toward more digital solutions and telehealth broadly before 2020; COVID-19 greatly accelerated momentum for the creaking, massive industry.

Perhaps Accolade will enjoy long-term tailwinds due to secular changes in healthcare spend. Perhaps.

But today, the company is targeting a modest multiple. Taking the upper end of its most recent quarter’s revenue projections, we can put the company on a run rate of around $140 million. At its $21 per-share valuation, the firm would be worth around 7.0x revenues. Pretty good, if not great.

I would not be shocked, however, if Accolade managed a higher interval before setting a final price on its shares. But, regardless, here we have another unicorn-ish company going public without having barnstormer numbers. That shows, yet again, how comfortably open the IPO window is today.