It’s raised $5.7 billion from Facebook. It’s taken $1.5 billion from KKR, another $1.5 billion from Vista Equity Partners, $1.5 billion from Saudi Arabia’s Public Investment Fund, $1.35 billion from Silver Lake, $1.2 billion from Mubadala, $870 million from General Atlantic, $750 million from Abu Dhabi Investment Authority, $600 million from TPG, and $250 million from L Catterton.

And it’s done all that in just nine weeks.

India’s Reliance Jio Platforms is the world’s most ambitious tech company. Founder Mukesh Ambani has made it his dream to provide every Indian with access to affordable and comprehensive telecommunications services, and Jio has so far proven successful, attracting nearly 400 million subscribers in just a few years.

The unparalleled growth of Reliance Jio Platforms, a subsidiary of India’s most-valued firm (Reliance Industries), has shocked rivals and spooked foreign tech companies such as Google and Amazon, both of which are now reportedly eyeing a slice of one of the world’s largest telecom markets.

What can we learn from Reliance Jio Platforms’s growth? What does the future hold for Jio and for India’s tech startup ecosystem in general?

Through a series of reports, Extra Crunch is going to investigate those questions. We previously profiled Mukesh Ambani himself, and in today’s installment, we are going to look at how Reliance Jio went from a telco upstart to the dominant tech company in four years.

The birth of a new empire

Months after India’s richest man, Mukesh Ambani, launched his telecom network Reliance Jio, Sunil Mittal of Airtel — his chief rival — was struggling in public to contain his frustration.

That Ambani would try to win over subscribers by offering them free voice calling wasn’t a surprise, Mittal said at the World Economic Forum in January 2017. But making voice calls and the bulk of 4G mobile data completely free for seven months clearly “meant that they have not gotten the attention they wanted,” he said, hopeful the local regulator would soon intervene.

This wasn’t the first time Ambani and Mittal were competing directly against each other: in 2002, Ambani had launched a telecommunications company and sought to win the market by distributing free handsets.

In India, carrier lock-in is not popular as people prefer pay-as-you-go voice and data plans. But luckily for Mittal in their first go around, Ambani’s journey was cut short due to a family feud with his brother — read more about that here.

This time around, Ambani had spent more than six years working out his reentry to the telecom market and he had all the money in the world to fight. Three and a half years later, Reliance Jio Platforms, Ambani’s telecom network, has captured more than just attention.

In the past nine weeks, at the height of a pandemic, Ambani has secured more than $15 billion by selling a nearly 25% stake in his telecom company to, among others, Facebook and private equity firms Silver Lake and General Atlantic.

Jio Platforms, a subsidiary of Ambani’s oil-to-retail giant Reliance Industries (India’s most valued firm), is in advanced stages of talks to sell an additional 8% stake over the course of the next few weeks. Local media reports claim that Microsoft alone could deliver a $2 billion check.

Jio’s frenzy of investments in recent weeks are just as impressive as how quickly it attained the top spot in an industry that has seen more than two dozen firms try their hand in the past 25 years.

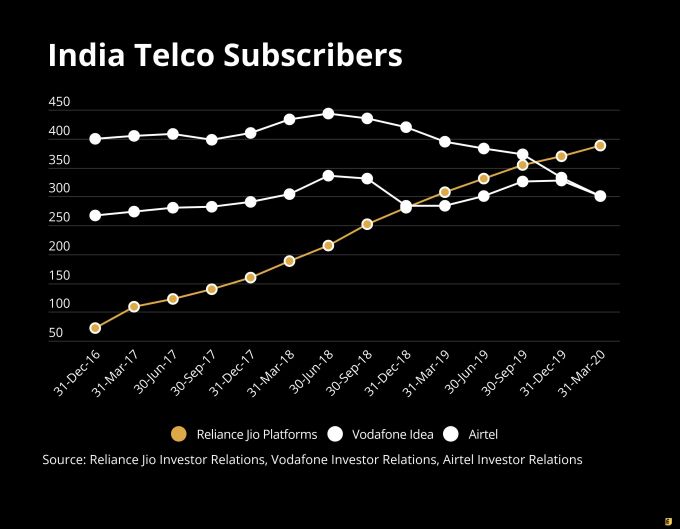

At their peak, Vodafone Idea and Bharti Airtel had established a duopoly and counted more than 650 million users together. But like every other player in the industry, the joint venture between British giant Vodafone and Indian tycoon Kumar Mangalam Birla’s Aditya Birla Group and Mittal’s Airtel has shed tens of millions of users in recent years.

While Jio Platforms has yet to hit 400 million, today it is the clear leader with 388 million subscribers, ahead of Vodafone Idea and Airtel, both of which have about 300 million customers each.

Nothing sells like free

“In India, telecom operators make most of their money through voice calls. Jio was launched with free voice calls and bulk of 4G data at no cost for a protracted period that immediately made it the favorite,” said Jayanth Kolla, an analyst at research firm Convergence Catalyst, regarding Ambani’s strategy.

The free period, which began in early September 2016, was supposed to last until the end of that year, but Ambani later extended it to April 2017. It only took him 170 days to gain 100 million subscribers — the fastest any company globally had reached this milestone for mobile service accounts.

Airtel, Vodafone Idea and state-run operator BSNL completely missed the boat — despite knowing that India’s richest man was preparing to launch a competing service, said Mahesh Uppal, director of communications consultancy firm Com First:

Existing players in other markets expect the newcomer to compete aggressively on price. So they often lower their prices — sometimes steeply — to reduce the latter’s attractiveness. Newcomers often complain to the regulators about anti-competitive practices of incumbents. In India, the opposite happened. It was the existing players who ran to regulators with complaints.

Despite Jio’s ferociously quick gain, official data from companies — and corroborated by the local regulator — shows that Airtel and Vodafone Idea did not start to lose subscribers until September 2018.

In India, the vast majority of smartphones ship with the ability to simultaneously handle two phone numbers (through multiple SIM cards). Reliance Jio (technically Reliance Jio Infocomm, which is the subsidiary of Reliance Jio Platforms) quickly became the second phone number for millions of Indians — the one they used for data and voice calls.

Leveraging telco into digital services

One of the most remarkable things Jio has been able to pull off in its journey is retaining customers when the free days were finally over. Until late last year, when the entire industry collectively raised mobile tariffs, Reliance Jio kept its data plans cheap. Its cheapest plan cost less than $2 and delivered unlimited voice calls and a gigabyte of data each day.

Before Reliance Jio entered the market, Airtel and Vodafone charged users about $2 for 1GB of 3G data alone. Jio’s aggressive growth, which from day one has only supported 4G, forced them to eventually slash their mobile charges by as much as 80%.

Convergence Catalyst’s Kolla said Jio was able to retain customers in part because of its digital offerings. Jio operates a suite of apps, including JioTV, which streams more than 500 channels, JioSaavn, an ad-supported music streaming service, and on-demand movies and TV streaming service JioCinema. All of these offerings are available to Jio subscribers at no additional charge.

Some of these services have already amassed tens of millions of users. JioSaavn had 23 million weekly active users last month, according to one of the top mobile insights firms — whose data was shared by an industry executive. MyJio, an app that bundles many of these services, has 80 million weekly active users.

“Ambani used his telecom network to make inroads in the digital ecosystem — something, which until then was dominated by Silicon Valley firms. Jio’s competitors did not invest much in creating their own digital services because it did not make much financial sense for them,” said Kolla.

This strategy is also evident in the way Ambani is leveraging his telecom network to boost his other businesses. Last year, he announced JioMart, a joint venture between Reliance Jio Platforms and Reliance Retail, the largest retail chain in the country with presence in more than 700 cities.

Facebook chief executive Mark Zuckerberg said as part of his company’s $5.7 billion investment in Jio Platforms, the company will collaborate with JioMart to empower tens of millions of neighborhood stores and merchants in India. A week later, JioMart began testing WhatsApp to let users quickly place orders and track their shipment on the messaging service. In the weeks since, JioMart has expanded to more than 200 cities and towns in India.

But while its competitors were fighting on pricing, Jio had moved on to its next act. A year since its launch, the company had inked deals with more than 20 smartphone vendors that included all the big brands such as Apple, Samsung and Xiaomi to bundle its SIM card with their smartphones.

Soon afterward, Jio launched its “smart feature phone” called JioPhone that supported 4G. JioPhone, which was available to customers for $2.40 a month, immediately gained a foothold in small towns and villages where the penetration of smartphones and internet is low.

The company claims that it has sold more than 30 million JioPhone units to date. “Getting millions of people access to the internet was always their strategy. JioPhone enabled them to reach users who could not otherwise afford a smartphone and access its digital suite of services,” said Kolla.

As for Jio Platforms’ subscribers, analysts at Bernstein expect the firm would reach 500 million customers by 2023, and half of the market by 2025.