Pale Blue Dot, a new “climate only” venture capital firm located in Malmö, Sweden, is officially de-cloaking today, with a first close of €53 million.

Primarily targeting startups in Europe at pre-seed and seed, the VC plans to back companies that are using technology to help solve climate problems. The aim is to invest in up to 40 companies out of this first fund, with investment tickets ranging from €200,000 to €2 million.

The fund is described as sector agnostic and will consider software and technology investments with a strong positive climate impact. Current focus areas include food/agriculture, industry, fashion/apparel, energy, and transportation.

“The startups we look for are ones that scalably contribute to climate, which most of the time means that they are powered by the same forces as many internet companies are: software, data, and network effects,” Pale Blue Dot founding partner Joel Larsson tells TechCrunch. “We see more and more of these companies digitalizing and hope that we, and many other venture funds, are able to invest in them to accelerate the change to a greener world”.

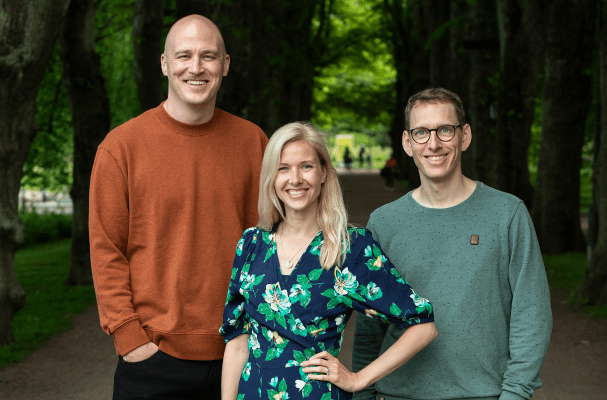

Pale Blue Dot’s three founding partners, Hampus Jakobsson, Heidi Lindvall and Larsson, are all relatively well-known within the Nordics’ tech ecosystem and beyond.

Jakobsson co-founded TAT (The Astonishing Tribe), which was sold to Blackberry in 2012, and is a prominent angel investor in the region and most recently a venture partner at BlueYard Capital.

Lindvall is the former head of accelerator and investment team at Fast Track Malmö, with a background in human rights and media.

And Larsson is the former Managing Director at Fast Track Malmö, with a technical background and prior fund management experience.

Notably, Pale Blue Dot is one of a number of new European VCs that have chosen to specialise, perhaps more evidence of the maturing ecosystem in the region. With that said, numerous more general VCs are arguably making climate tech bets too, to varying degrees.

“We think all funds should be ‘planet positive’ and working for a better world, but it will take time until it is a [major] focus,” says Lindvall, on the need for a “climate only” VC. “Still, most funds look at a potential positive impact late in their assessment and will not decline the deal if the startups wouldn’t be significantly pulling the world in a good direction”.

“We were very lucky to get an amazing set of LPs, especially as many of them never got to meet us in flesh and blood due to the fundraising happening during COVID-19,” adds Jakobsson. “Less than 50% of the money comes from Sweden, and a big LP is the Swedish VC Saminvest, and then we have an amazing list of entrepreneurs and investors”.

I understand they include the family offices of founders/former employees from unicorns such as Supercell, Zendesk, Navision, and Unity, to investors like Albert Wenger (USV), Staffan Helgesson (Creandum), and the VC fund Atomico, amongst others.

Meanwhile, Pale Blue Dot has already made three investments. They are Phytoform, a London headquartered company creating new crops using computational biology and synbio; Patch, a San Francisco-based carbon-offsetting platform that finances both traditional and frontier “carbon sequestration” methods; and 20tree.ai, an Amsterdam-based startup, using machine learning and satellite data to understand trees to lower the risk of forest fires and power outages.