Pale Blue Dot, a newly outed European venture capital firm focused on climate tech, announced this week the first closing of its debut fund at €53 million.

Targeting pre-seed and seed stage startups, the firm says it will consider software and technology investments with a strong positive climate impact. Current areas of focus include food/agriculture, industry, fashion/apparel, energy and transportation, with plans to back up to 40 companies out of fund one.

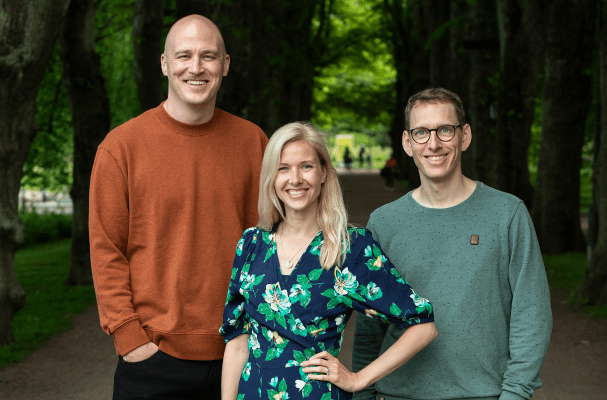

Founding partners Hampus Jakobsson, Heidi Lindvall and Joel Larsson are stalwarts of the Nordic tech ecosystem and beyond: Jakobsson co-founded TAT (The Astonishing Tribe), which was sold to Blackberry in 2012, and is a prominent angel investor in Europe, most recently a venture partner at BlueYard Capital. Lindvall is the former head of accelerator and investment team at Fast Track Malmö, with a background in human rights and media. Larsson was previously managing director at Fast Track Malmö, with a technical background and prior fund management experience.

I put questions to all three, delving deeper into Pale Blue Dot’s remit and the firm’s investment thesis. We also discussed the macro trends that warrant a fund specializing in climate tech and why Europe is poised to become a leader in the space.

Pale Blue Dot is a new VC fund specializing in climate tech, but in a sense — and to varying degrees — isn’t every venture capital fund a climate tech fund these days?

Heidi Lindvall: We think all funds should be “planet-positive” and working for a better world, but it will take time until it is a focus. Still, most funds look at a potential positive impact late in their assessment and will not decline the deal if the startups wouldn’t be significantly pulling the world in a good direction.

Hampus Jakobsson: Focus has both upsides and downsides.

The negative part with being niche is that we won’t do investments in amazing people or startups that we don’t think are “climate-contributing enough” or that the founders aren’t doing it in a genuine way (as the risk of them to paying attention to the impact might lead them to become a noncontributing company).

The positive part with a strong focus is of course that we can assess the companies easier as we know the areas better than if we were broader, but also that the community that is built in the portfolio and around the fund has a strong value alignment.

Pale Blue Dot’s first fund plans to invest in 40 companies at pre-seed or seed level with investment tickets ranging from €200,000-€2 million, but can you be more specific with regards to geography and the types of founders and startups you look for?

Joel Larsson: We invest all over Europe, but can also do the U.S., even if we think a majority of the investments will be done here. The reason is that we see how Europe is very progressive on climate; in terms of consumer demand, in policy and corporate interest.

The startups we look for are ones that scalably contribute to climate — which most of the time means that they are powered by the same forces as many internet companies are; software, data and network effects. We see more and more of these companies digitalizing and hope that we and many other venture funds, are able to invest in them to accelerate the change to a greener world.

We look for a diverse group of founders who have a deep understanding of the problems that we are facing and have the skills and the knowledge of how to solve these and build scalable global businesses.

Picking up on the theme of “reduce, reverse and prepare for a new world,” can you share an example of a company (real or fictional) that falls into each category?

Heidi Lindvall: For “reduce,” there are many companies that just make products of today in a better way; with less materials, waste, animal products or energy. Some of these are solved by actually using less material in production or material or processes that impact the world less, or by reusing or sharing the product. A good example from tech is Phytoform, which we invested in, that create new crops, where some of them handle transportation or storage better, which drastically reduces waste.

Hampus Jakobsson: Within “reverse,” the company needs to do something that sequesters greenhouse gases (in layperson terms, “sucks down carbon dioxide or methane from the atmosphere”). Luckily there are many things that do. For example, biomass such as trees, peat or algae, as well as some novel industrial methods that need carbon dioxide to create materials that we use already (cement, steel, plastic to name a few). One way is to funnel more money into these projects like Patch, which we invested in, which allows for a spread of offsetting methods, directing more money to biosequestration, and allowing more innovative projects to be funded. Another way is to make products that use the sequestering materials in a way that they are not burned; for example, algae in food or cross-laminated timber in construction.

Heidi Lindvall: Regarding “prepare for a new world,” we are facing enormous challenges due to climate change such as harsher weather and heat and regardless of whether we manage to stay within an inhabitable temperature, we will need to prepare for a new reality. This includes thinking about the future of food and agriculture, how to prepare for mass migration due to weather changes and to build more sustainable future cities.

How do you approach due diligence within climate tech, not just for moonshot, climate change reversal-type technologies but also ensuring that a new technology or product/service doesn’t have unintended consequences that negatively impact climate change, especially as they scale?

Heidi Lindvall: We do an assessment for every company during the investment process. There are many factors to look out for: direct climate impact, replacement effects, side effects, longevity of the impact, if it requires a behavioural change or will be driven by cost, how the effect changes as the company scales and so on. We cannot, of course, handle all details and be “future safe,” especially in the stage we operate but try to find any red flags and weed out concepts that only at first glance seem climate positive.

Who are the LPs in this fund? And are any of them strategic or hands-on?

Heidi Lindvall: We were very lucky to get this amazing set of LPs, especially as many of them never got to meet us in flesh and blood due to the fundraising happening during COVID-19. Less than 50% of the money comes from Sweden, and a big LP is the Swedish VC Saminvest, and then we have an amazing list of entrepreneurs and investors. We have all from family offices from amazing unicorns such as Supercell, Zendesk, Navision and Unity, to investors like Albert Wenger (USV), Staffan Helgesson (Creandum) and the VC fund Atomico, to family offices from startup-superstars such as Kevin Ryan or Jeff Dean.

We don’t expect any of our LPs to have to be hands-on. They are “limited partners” for a reason, but we love the fact that they are very engaged in the question and already helping out.

Your pitch to LPs cited macro trends that arguably make it a good time to launch a VC fund dedicated to climate tech: changing consumer behaviour, new regulation, shareholder and employee advocacy and the number of new startups focused on this area. Perhaps you can share a bit more of your thinking here and how these macro trends tie into your investment thesis.

Heidi Lindvall: Climate is a macrotrend in general. The world has woken up the last ten years to the effects of climate change and how we can live a good life without depleting the planet and emitting greenhouse gasses. This has led to an explosion in demand in nonanimal food and products with a smaller climate footprint. The same people are employees, shareholders and voters, so we see the effects in corporations who need to attract talent (Amazon, for example, announced that they would meet the Paris accord ten years in advance) and get pressure from their shareholders (Maersk announced their fleet to be carbon neutral in 2040 and H&M’s new CEO was the previous Head of Sustainability). Europe also has the highest taxes for carbon emissions, the strongest policies toward emission reduction, and EIB announced their massive funding of the new green economy.

You also cite Europe as having a lot of potential to build leading climate tech companies. What are Europe’s strengths and weaknesses in this area?

Joel Larsson: Europe is very strong on the macrotrend of climate; all from consumer awareness, demand and interest, to corporate behavior, to policy and taxes. Also, Europe has a lot of impressive research centers for the more deep tech startups to pull from or collaborate with.

Europe is still lagging behind on fundraising, even if the number of VC funds in Europe are growing quickly, the mentality is still not as far as in some other parts of the world. Also, Europe is many nations, laws and languages which, of course, also makes it slower to scale within Europe.

Finally, how does Pale Blue Dot think about diversity and inclusion, both in terms of the investment team you have assembled but also what you expect from founders within your future portfolio and the teams they are building out?

Heidi Lindvall: The climate crisis impacts all of us. However, it disproportionately impacts people from varying geographies and socioeconomic backgrounds. We believe that diverse teams are vital in tackling the problems we are facing in order to ensure that the solutions that we back are benefitting all.

Joel Larsson: We generally believe that similar people find similar problems and solutions, and that a more diverse founding team, leadership and early hires contribute to a better understanding and execution. As part of our due diligence process, we consider the diversity within the team and whether they are value-aligned. Secondly, that they have the ambition to build a diverse team and whether they have a diversity and inclusion policy in place or are happy to set one up.

Hampus Jakobsson: Currently, all three GPs will be on the investment team but after our second close we will look at diversifying our team further.