Every founder’s biggest fear is dilution — investors constantly carving off chunks of their equity in round after round of venture financing. Founders collectively own 100% of their companies in the beginning, but it isn’t uncommon for them to own single digits after years have gone by and millions of VC dollars have flowed into their startup.

So I was a bit surprised to see the numbers today in Lemonade’s S-1 that showed just how well the company has been able to grow its invested capital and valuation while taking relatively little dilution. If you are a founder looking for a role model, Lemonade may just be the best scenario you can have while raising nearly $500 million in preferred equity funding across five rounds.

Alex Wilhelm has written up an overview of Lemonade’s business and margins, but I wanted to to dive into the company’s capital structure.

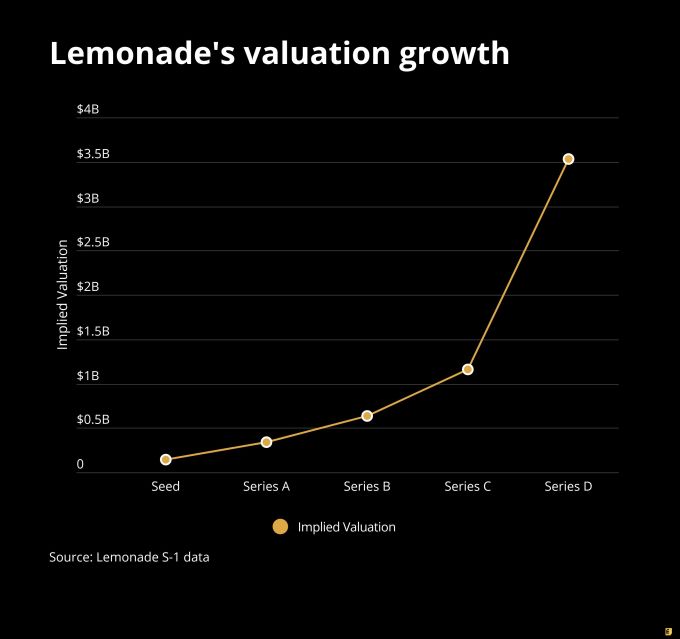

First, let’s look at how the company’s implied valuation has changed over time in a nice graph:

Now, is that not the finest growth curve you have ever seen for valuation? (Certainly it’s got to be one of the best in the SoftBank Vision Fund portfolio, but then again, that’s a cheap shot, so I’ll just place that stray thought in this parenthetical.)

What’s key to keeping dilution at bay is precisely valuation. With such a gorgeous valuation chart and what appears to be reasonable venture capital requirements for growth, Lemonade was able to minimize its dilution over the years to low levels.

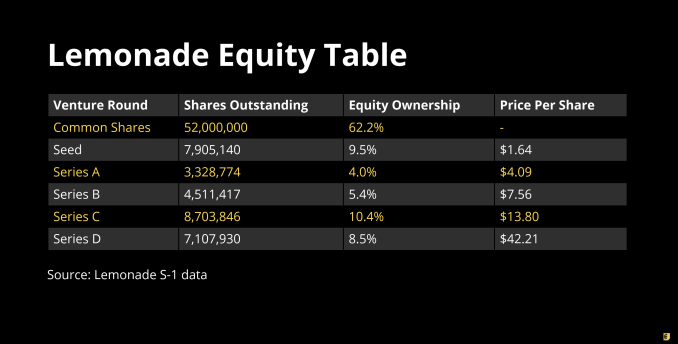

This is the current cap table as rebuilt from the company’s S-1 data:

Some caveats. The common shareholders, outside of the founders and employees, includes money from OurCrowd, a startup crowdfunding platform; Allianz, the insurance giant; and an assortment of individuals and other funds. So it’s not all founder equity for sure in that 62%.

Now that said, it’s amazing to see that the dilution total for each of the preferred rounds is so small, with even the seed investors not getting to 10% final ownership in their round. In fact, the company’s roughly $13 million Series A round only led to a final dilution at IPO of about 4%, with the Series B being roughly similar at 5.4%. SoftBank Vision Fund’s investment in the Series C diluted the company the most at 10.4% by IPO. All the preferred investment rounds together represent 37.8% of the cap table, which is a surprisingly low figure for a company that raised a half billion dollars.

Let’s just say that’s a far cry from the old VC rule of thumb that a venture round will dilute a company by roughly 20%.

Perhaps unsurprisingly, the company doesn’t list all that many funds with a greater than 5% ownership stake, including only SoftBank, Sequoia Israel, Aleph, XL Innovate and General Catalyst.

Given the low dilution, SoftBank and Series B lead General Catalyst apparently re-invested in the company across multiple rounds to shore up their relatively paltry ownership stakes.

It also appears that a few venture firms used secondary transactions to buy more equity.

According to the company’s S-1, the insurer’s executive officers have been conducting a series of secondary transactions with undisclosed venture funds. For instance, according to the SEC doc, “In September 2019, our Chief Executive Officer and Chairman of our board of directors, Daniel Schreiber, sold 118,466 shares of our common stock to a venture capital fund for a total consideration of approximately $5.0 million.”

In total, the company lists four secondary transactions, all roughly priced at the Series D price per share of $42.21, for a grand total of $14.4 million in secondary. That’s still not all that much, considering the company’s total scale of financing.

So what was the magic with Lemonade? One piece of the puzzle is that company founder Daniel Schreiber was a multi-time operator, having previously built Powermat Technologies as the company’s president. The other piece is that Lemonade is built in the insurance market, which can be carefully modeled financially and gives investors a rare repeatable business model to evaluate.

Whether Wall Street agrees with the company’s last valuation (roughly $3.5 billion) or not, as a success story for founders to minimize dilution, it’s a really strong contender outside of pure bootstrapping.