COVID-19 has transformed the global business landscape.

So much so that in a matter of weeks after the onset of the pandemic in the United States, Congress provided more than $1.1 trillion in fiscal stimulus directly to businesses and distressed industries — four times more than was distributed during the 2008-09 financial crisis.

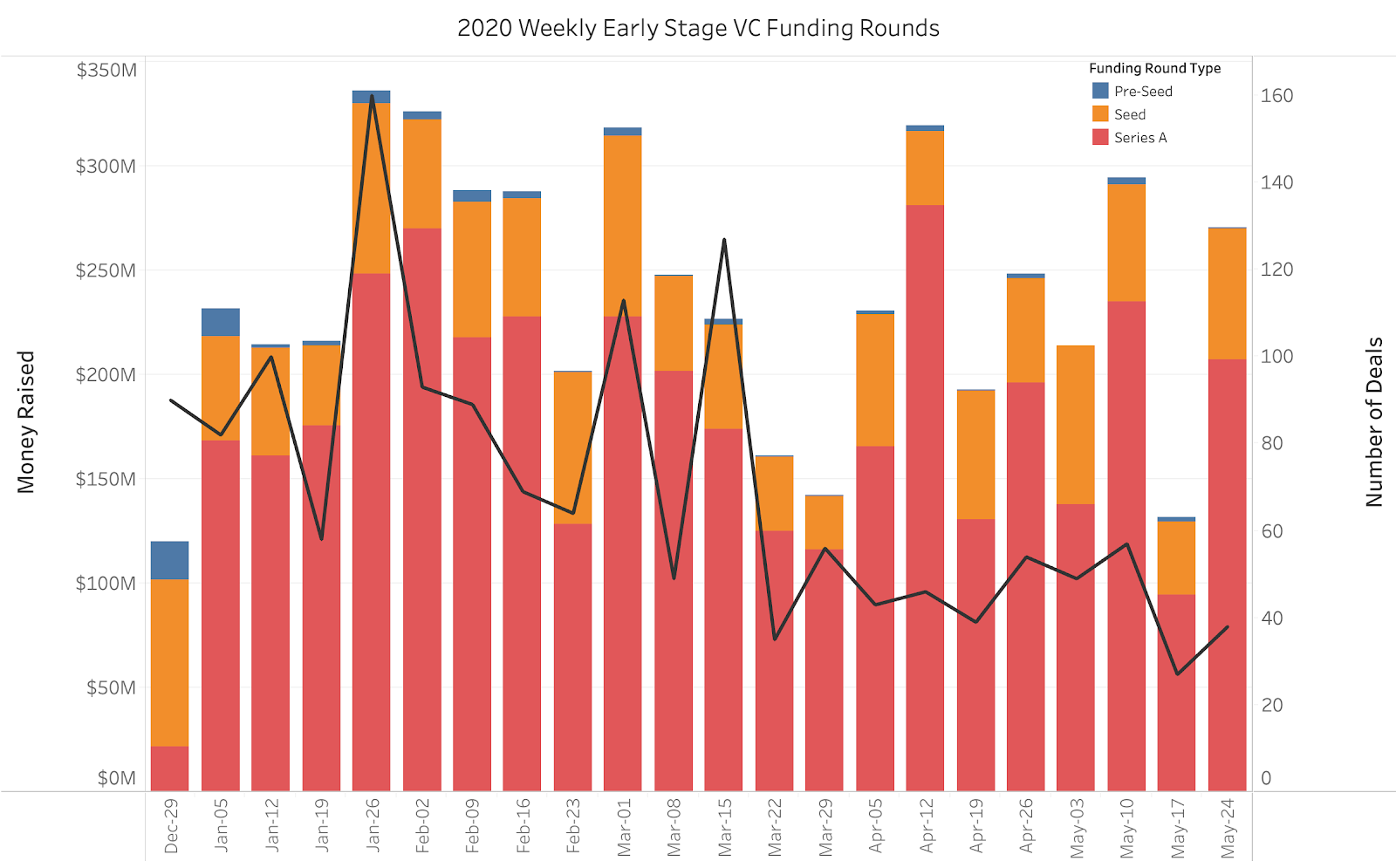

It came as no surprise when, at the start of COVID-19, venture capital investors largely went pencils-down for several weeks and shifted their focus to their existing portfolio companies. Extending company runways, preparing for longer funding cycles and managing operations in a novel business environment became the crux of company resilience. Now, moving into May, we can see this shift reflected in both the decline in number of early-stage companies funded and total capital invested.

As investors begin acclimating to this new normal, they have begun wading into new opportunities in time-proven, healthy industries and new emerging industries that are positioned to succeed during the pandemic. While we are seeing lower valuations, we believe certain B2B technology companies may be uniquely poised to thrive, and are pursuing investment opportunities in this space with a renewed focus.

Image Credits: Crunchbase Data via Tableau Public

*Excluding Biotech & Pharmaceuticals (Source: Crunchbase Data via Tableau Public)

Prior to COVID-19, early-stage B2B investors wanted to see strong growth and healthy unit economics; 3X year-over-year sales growth or 10% monthly growth was the gold standard. An LTV-to-CAC ratio over 3X signified a healthy payback cycle. There was less focus on capital efficiency; for every $1 million invested, investors were happy with $500,000 in generated revenues. Get to these numbers and your next funding round was guaranteed — but no longer.

During COVID, and likely beyond, company expectations and goalposts have been adjusted; 2X year-over-year growth may be the new 3X. While growth and unit economics are important, there are now new health indicators that will determine if a B2B company will thrive in a post-COVID world. With that in mind, we have put together a COVID resilience test that startups can use as a north star to grow their business in this new world.

This COVID-19 test is meant to be a gated checklist that will indicate where efforts should be focused, whether it be sales, product or finance. Before we leave you to your own devices, we wanted to walk through a couple of these new post-COVID questions that you should try to answer (and why they are relevant).

Do you understand the health of your target customer?

Healthy customers lead to healthy businesses, and it is important to think about the customer profiles that you are selling to in a post-COVID world. Ask yourself: Are you selling to industries that will be impacted as discretionary travel and consumer spending dips, do you have a high concentration of SMB or startup customers that have limited financial runway?

While we are not suggesting a 180-degree pivot of your business model, it might be a good time to consider diversifying your customer base or expanding your offering to service more use cases. Here are some resources that might help you assess the health of your underlying customer base.

- COVID-19 industry exposure

- Corporate COVID-19 response tracker

- Industries most and least impacted by COVID-19

Are you providing a mission-critical service?

It is not surprising that wallets are tightening for companies of all sizes and software purchases that are not deemed mission-critical or that do not directly impact a company’s bottom line are being deferred. Madhavan Ramanujam sums it up well in his book “Monetizing Innovation” by reminding us that we need to develop crystal-clear benefit statements, not just feature descriptions for our customers.

On a practical level, you should start to track activation rates, and subsequently engagement levels, which are typically good proxies for how essential a product is. The gap between contracted MRR and live or onboarded MRR is another leading indicator that reflects the relative importance. Finally, it might be a good exercise to sit down with 3-5 potential or current customers and draw a spend map to understand how much they are spending on tools in your segment, as this will help you gauge your share of their wallet, and provide better predictability around future ACVs.

Are you able to promote/sell your product remotely?

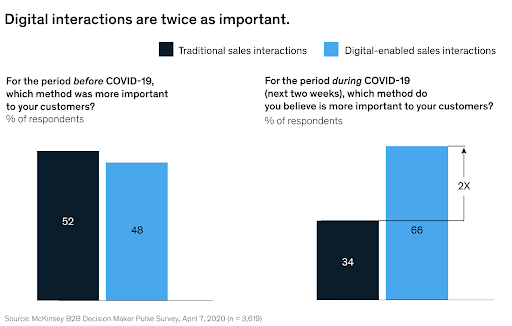

I’m sure that you remember that enigmatic enterprise sales leader that is able to work the room at every post-Dreamforce happy hour, but the truth is that method of marketing and selling is going away, at least in the near term. According to a McKinsey & Company study in April 2020, online interactions are now twice as important for B2B sales.

McKinsey B2B Decision Maker Pulse Survey, 4/7/2020 (n=3,619)

This means you need to:

- analyze your current sales and marketing toolkit;

- determine whether you are able to get mindshare through digital channels;

- convince your customers to jump on a call with you; and

- effectively communicate your value proposition.

Two good questions to ask are: What percentage of sales or marketing leads come through online channels and how does your online CAC compare to your offline CAC?

Do you have out-of-the-box readiness and collaboration functionality?

Adaptive Insights is a great financial planning software used by several of my portfolio companies, but an Adaptive implementation usually requires onboarding consultants, and can take up 50-100 hours of a team’s time. This was already a huge ask in a pre-COVID world, and it was much easier when finance teams and technology consultants were in the same room. With a larger proportion of teams going remote, it is important to streamline the onboarding process and have out-of-the-box functionality so that it is almost plug and play for teams. Measure customer time to value to inform your onboarding process and ensure your product is providing value as soon as possible after implementation. B2B companies should also think about cost-effective ways to provide remote support, and consider chat bots versus call centers and interactive tutorials to facilitate customer onboarding and ongoing usage.

In the absence of in-person interactions, employees yearn for other ways to stay connected with their team. Collaboration tools between internal or external teams will become even more important. Consider building integrations with collaboration platforms like Slack or Google Docs early on in your software development life cycle.

Is your business capital-efficient?

While the LTV/CAC ratio remains an important metric, short-term capital efficiency is becoming increasingly important. Payback periods are now a bigger focus as attention shifts to working capital cycles, and LTV calculations that bake in assumptions for multi-year renewals or upsells should be revisited. An imperfect but quick litmus test for startups is to examine current ARR run rate relative to total capital spent since the venture was launched. A ratio above 1 is generally perceived to be healthy in this environment.

Slack, Cloudera, Square, Twilio, Stripe and Asana were all founded during the financial crisis. Time and time again, economic downturns have provided the right set of circumstances and advantages for transformational companies to develop. We are extremely bullish about the current environment. Many great B2B companies will emerge in the post-COVID world as more and more companies turn to technology to drive efficiencies in their own businesses. We do expect consolidation in the B2B software market, but the best companies will build sticky long-term customer relationships and advance their share of wallets.

We hope that our COVID resilience test can help you reflect on your current situation and ultimately improve your chances of being one of the companies that survives and thrives through this pandemic and beyond. This tool is still in development and will be updated regularly as information and market conditions evolve. We welcome any comments or questions, which can be sent to tx@fika.vc or colton@fika.vc.