E-commerce is taking off faster than ever. In the last couple of weeks, my Twitter timeline has been filled with operators gushing about how the weekends seem like Black Friday, even for non-essential commodities. Change is already here.

Looking at the above graph in this Tweet from Shopify CTO Jean-Michel Lemieux — and the passing, contextless mention of “Offline2Online” — we got curious.

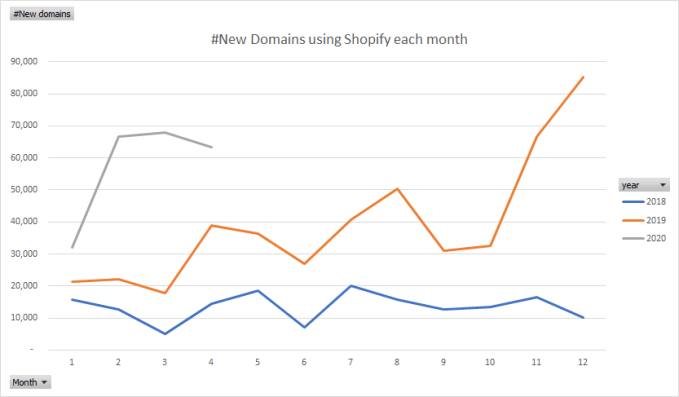

Beyond just the anecdotal evidence, we looked for signs that tell us e-commerce is being adopted at a faster pace. One way to ascertain that is to look at the historical data of how Shopify has been onboarding merchants for the last two years on a monthly basis, and compare that with what happened this year in Q1.

All of these data points come from PipeCandy’s own data platform that tracks close to 750K+ Shopify merchants with historical data for each:

New domains using Shopify each month

While 2020 started on a faster clip than 2018 and 2019, February and March have seen nothing short of jaw-dropping growth in merchant numbers for Shopify. In those two months alone, Shopify seems to have onboarded more merchants than in the whole of 2018.

The softening you see in April is a result of the lag in the way our systems validate and confirm the data and not a slowdown in Shopify per se. The e-commerce embrace is real.

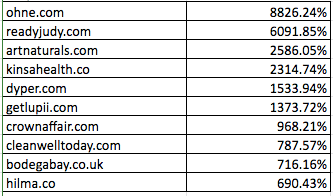

Here’s another sneak preview into an analysis we are doing with 1,000 D2C brands and their growth in traffic numbers. The top 10 D2C brands that grew the most in April 2020 over their peak traffic in 2019 are below. The growth rates are insane. I will share a more D2C-specific view once that analysis is done.

Image Credits: PipeCandy

How permanent is this change and how exactly will this play out for consumers? I have not studied all the nuts and bolts in this puzzle, but there are a couple of very powerful inferences I could make drawing parallels from other markets that went through such era-defining forcing functions.

Contactless payments everywhere

Whenever I am in NYC, I always prefer to walk or take an Uber simply because the idea of punching the numbers on subway ticketing machines or touching the screens made me feel so vulnerable. It didn’t help that my visits always coincided with the flu season.

America has had the burden of legacy impede progress for payment innovations. Modern, digital-first payment systems like UPI have not found their way into the U.S. yet. QR code-based payments, as a result, have not taken off either. Due to health concerns, contactless payments will finally become mainstream. Do you want to touch a PIN pad or hold an iPad Pencil to sign a digital receipt? Or would you rather just scan and go?

With contactless physical world payments or QR code-based scanning, every surface becomes an e-commerce interface. Imagine a Dunkin ad on a sidewalk with the QR code. Without downloading an app, a customer could order a box of donuts delivered to their home. Contactless payments make e-commerce more accessible for the “physical-native” segment.

Previously, this cohort didn’t have a compelling need to force payment innovations or adopt one. Now they will do it to save their lives. Payments were a big blocker to the adoption of e-commerce. That’s changing.

Convenience narrative to safety narrative

E-commerce was cool. It was an embodiment of how human society progressed to make life a lot simpler for almost every economic class. When India demonetized its currency notes a couple of years ago with a few hours’ notice, the older generation had two choices: queue for hours at an ATM for currency with no guarantee of getting the money, or install mobile payment wallets. My mom did the latter and never looked back. Today, she books train tickets with her wallet, buys goods on Amazon and prescriptions through another app. (She lives in a village at the edge of civilization.)

COVID-19 has made e-commerce a safer choice than visiting a hotspot. Would you rather stand in the Walgreens queue for your pills, or subscribe and get them delivered to your home? The answer is already playing out. Walgreens recently announced a tie-up with Postmates to deliver medicines to customers.

The last time we had a safety narrative, in response to 9/11, it lead to the boom of the surveillance industry. Now, that boom is happening in e-commerce: “go online to live a little longer” is a very compelling narrative. Nearly 35% of America’s spending population is older than 55. Historically, this demographic has been the slowest to adopt e-commerce, but now they will.

‘Safety to convenience’ flywheel

Some changes are set in motion because there is a forcing function. But once change unfolds, there is no way to say there will be a preordained endpoint, or that it will or won’t touch some parts of the physical transactions economy. As a customer who’s new to online shopping becomes accustomed to Postmates’ UI over time, each new category added becomes an “e-commerce-first” for that user.

Consumer behavior changes are hard but when they happen they start a flywheel effect; new behavior will be introduced by one transaction for one category but will set the flywheel in motion for other categories. As soon as delivery apps understand the cohort of new users and their behaviors, the app adapts to them and introduces them to the powers their iPhone magic wands possess. There will be no looking back. Everything convenient to order online will be ordered online!

Fear and flight to safety are great motivators. Fear of getting a transaction wrong and losing money slowed down payment innovations. Safety was never in the ‘e-commerce equation’ before. Two powerful motivators are propelling e-commerce forward now.

If there is one J-curve that won’t be depressing to watch in the near future, it will be e-commerce revenues.