Despite the economic disruptions associated with the coronavirus pandemic, cloud vendors are holding up well as many client companies and their employees work from home.

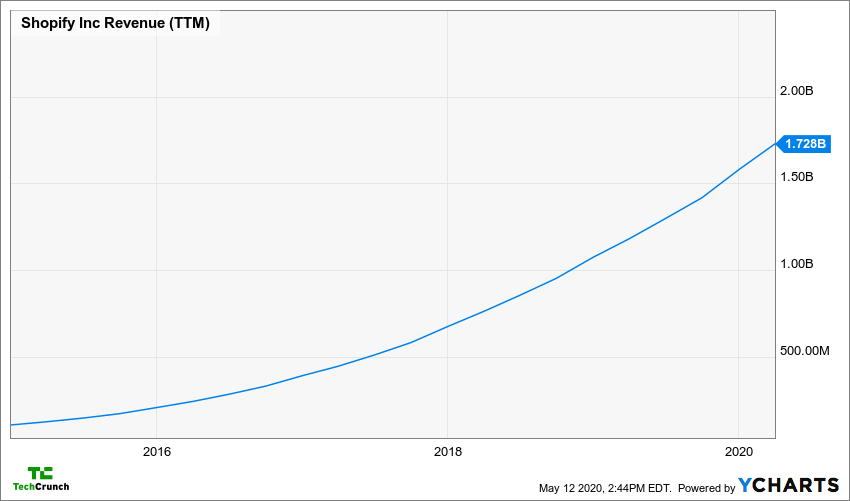

With stores closed, it’s natural that e-commerce would also perform strongly — after all, it’s also cloud-based, and folks working from home are shifting their shopping from brick-and-mortar to digital. (You can look at the pre-COVID-19 trend here; it has since become an even steeper curve.)

If you track Shopify’s stock price over the last six months, the argument appears to hold up; the cloud’s pandemic boom isn’t confined to remote-work tooling like Slack and Zoom.

The Canadian phenom helps businesses large and small build online storefronts, offering a reasonable alternative in the midst of a sinking traditional economy. As more businesses must close their stores, a sturdy online presence could be the difference between surviving and going under.

Going beyond online

The public company doesn’t stop with just digital storefronts; Shopify also offers a point-of-sale system for businesses that lets owners track sales wherever they happen. While having physical stores open on a regular basis might not happen for some time, a unified approach to your business in-store and online could help retailers, no matter what happens.

In fact, Shopify counts larger businesses such as Heineken, Staples, General Mills and D-Link as customers. One other factor could also be helping explain Shopify’s growing success: It serves as an alternative for a growing number of firms and online shoppers who don’t want to give their business to online retail giant Amazon.

Having that level of product and customer could help explain why Shopify’s fortunes have been on the rise in spite of the pandemic’s overall impact on the economy. Let’s dig a bit further.

From product to profit

While Shopify’s recent gains are impressive, the firm’s public market ascent is better understood with a bit of historical context. So let’s back into its present-day rally by going back in time. We can track certain financial events from the company’s past to funding rounds and its IPO, and tie them to various product decisions. Then we’ll track how those product choices have worked out for the company financially over time.

Let’s rewind to December 2013 when Shopify announced it had raised $100 million at what Crunchbase describes as a $1 billion post-money valuation. That round came after Shopify announced a payments product (“Shopify Payments”) with two price tiers.

The two events were critical to the company’s later success. The money helped power the then-startup to its IPO in 2015, and the payments product became a critical part of the Shopify product stack. You can see evidence of that in the company’s most recent earnings report, its Q1 2020 results. In it, Shopify notes that “gross payments volume grew to $7.3 billion [in Q1] which accounted for 42% of GMV processed in the quarter.”

Merchant Solutions, the revenue bucket that includes payments revenue for Shopify, came to $282.3 million in Q1 2020, or 60% of the company’s Q1 revenue.

Between its $100 million round in 2013 and its IPO in 2015, Shopify kept adding features to its toolkit that helped it expand, like the addition of Shopify Plus in 2014. TechCrunch covered the release at the time, noting that the service looked like “a one-stop, white glove e-commerce solution that was designed to be used by large companies and high-volume customers.”

Shopify was going upmarket, a standard move as companies mature.

Going public and gaining market share

And the decision paid off. In its Q1 2020 earnings, Shopify noted that “Shopify Plus contributed $15.3 million, or 28%, of MRR” in the period, “compared with 26% of MRR as of March 31, 2019.” At that rate, Shopify Plus will generate around a third of the company’s recurring revenue in a few years.

Shopify went public in 2015. TechCrunch covered the blockbuster event, noting that the company targeted a price between $12 and $14 per share, a range that rose to $14 to $16 per share before the firm landed at $17 per share. As we wrote that day, the company’s “shares spiked as high as $28.74 per share, before retreating to a more stable range later that day;” Shopify closed at $25.68 per share, up a little over more than 50%.

Today Shopify is worth $750 per share, give or take. Whether it can hold onto its gains is not clear. The firm traded in the mid-$130s at the start of 2019 and around $400 at the start of this year. To hit $750 by mid-May is aggressive.

But as we’ve seen, its fortunes haven’t been made off a single wager or target market: Shopify helps small businesses sell online. And sell on Amazon. And it takes payments, offline and on. And it works with large companies. If you sell something, in other words, Shopify wants to help you and make a dollar along the way.

Most recently, TechCrunch reported that Shopify introduced a new consumer app called Shop. Per our reporting, the application “allows consumers to browse a feed of recommended products, learn more about each brand and make purchases using the one-click Shop Pay checkout process.”

Who knows, perhaps in a few years Shop will be a key driver of growth for the firm. It wouldn’t be the first time Shopify redefined itself to the benefit of its bottom line. (Today Shop the app is ranked third in the app store, according to App Annie, for apps in its category. Not a bad start.)

Looking ahead

Shopify acts as something of a check on Amazon’s rise and should help ensure e-commerce competition remains fierce to the benefit of consumers. And Shopify is sufficiently large that Amazon likely cannot buy it due to regulatory-related issues, even if it wanted to.

This sets up the two firms as rivals, even through they are not pursuing the same market. But as two huge, public companies with plans for the future of e-commerce, they will battle each other all the same.

Five years ago, it would have been easy to presume that Amazon would take over e-commerce outside China with little trouble. Today, with Shopify performing as well as it has, that future is less certain. And for small businesses hoping to survive COVID-19 and thrive after, that might just be a good thing.