Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

As the economy has worsened, the market for many goods and services has slowed. Some SaaS products have found themselves immune, or even boosted by recently changes in consumer and business consumption patterns and travel habits. Software that aids in remote work, for example, have seen demand for their products rise sharply.

But on balance, private-market investors had told TechCrunch that they expect SaaS customer loss (churn) to rise and growth to slow. SaaS revenue, often sold on year-long contracts, is generally expected to hold up reasonably well in the current downturn; you can see this in the rapid rebound in the value of public SaaS stocks, for example. But what can data tell us?

Today we’re turning once again to statistics from ProfitWell, a Boston-based software startup that helps other companies track their subscription businesses and reduce churn. The company has provided TechCrunch with updated performance charts detailing how SaaS in the B2B world is performing.

Let’s examine what the data says, and we’ll close with a hint of how consumer SaaS is itself holding up.

A recovery, a plateau

Every SaaS company has churn. Some of its customers leave each year, for example. But it’s not all bad news, as others customers will spend more over time. And new customers are constantly acquired as well. Added together, churn, upsells, and new customer adds work out to an aggregate growth rate, positive or negative.

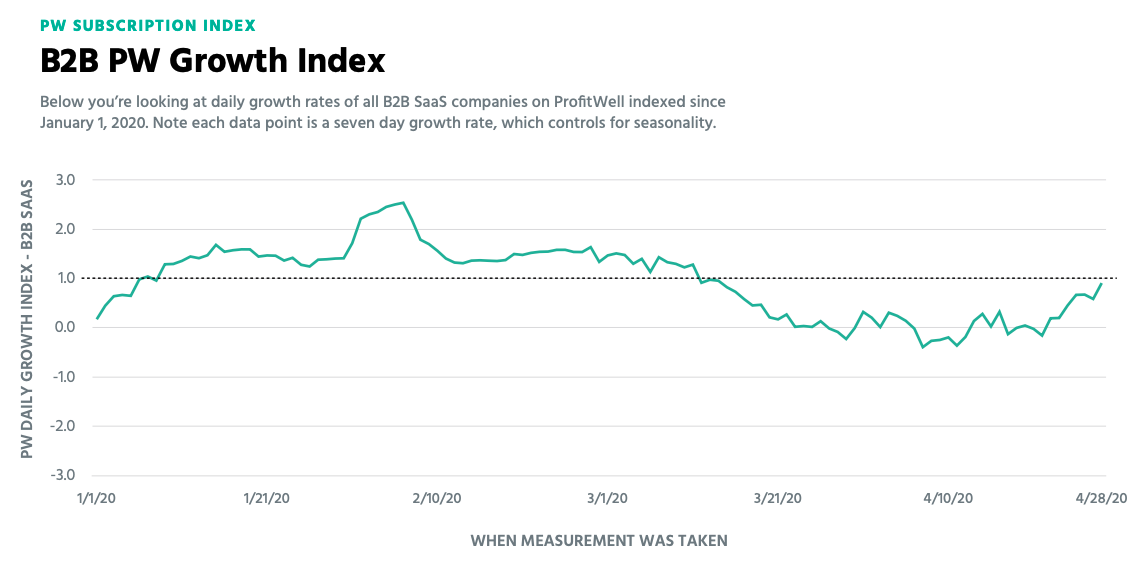

The fewer customers a SaaS startup can churn, the more its existing customers buy over time, and the greater number of new customers it can get in the door, the faster the upstart will grow. The opposite is also true. But while SaaS companies as a cohort tend to grow over time, there was a notable decline in the B2B growth rates according to ProfitWell data, leading to a short period of negative growth in late March.

Observe the chart, with data roughly through the end of April, the first month of Q2 2020:

The early-year gains are notable; B2B SaaS was cruising in early 2020, before March began to see a slip in growth. That downward motion continued until B2B growth rates actually went negative in late March and early-April.

There is a return to growth towards the end of April, you’ll notice. The first thing that growth accomplishes after contraction is to replace what was lost, however, so how much B2S SaaS companies have managed to grow since the start of March should be our next target.

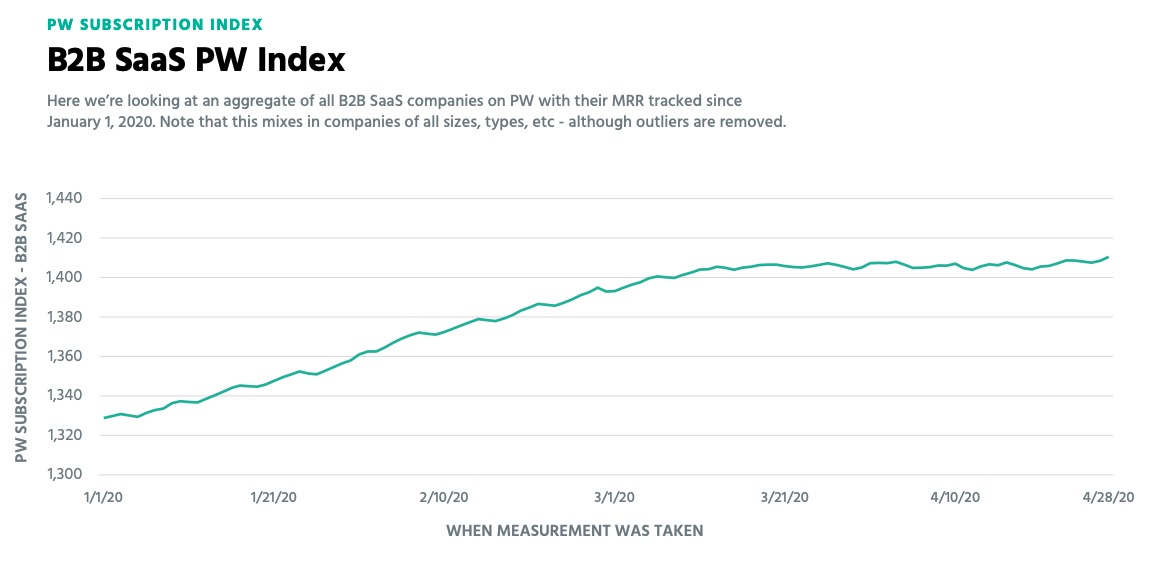

Let’s figure it out. Now that we know how growth rates have changed for B2B SaaS companies that ProfitWell has data on, what did the decline into, and out of, negative growth do to recurring revenue for the cohort, measured on a monthly basis (MRR)? Or more simply, what impact did the shifting growth rates that we’ve examined have on total B2B SaaS revenue?

Here’s the chart:

This dataset is less dramatic, but perhaps more interesting. The result of the swinging growth rate in B2B SaaS companies — which, let’s be honest, matches what we expected — is that MRR has effectively flatlined in the cohort since March, with a small uplift at the end of April. So, growth is back, even if it has a long way to go to make up for March and April’s B2B SaaS growth plateau.

Indeed, even if B2B SaaS continues to grow as it did in late April, the cohort of companies will still be growing less briskly than it was before. This extends the impact of COVID-19 and its constituent economic disruptions long into the future, as SaaS revenue tends to compounds over time; the base from which SaaS companies will grow in the future is being curtailed, dinging later opportunities for net dollar retention (when upsells are greater than churn).

Taken as a whole, the return to growth for B2B SaaS companies is good news, and implies that the short period of time when churn was perhaps beating out upsells and new customer adds is behind the market — at least for now. We’ll ask ProfitWell for May data in early June and see how far growth can re-accelerate, if at all.

One more thing

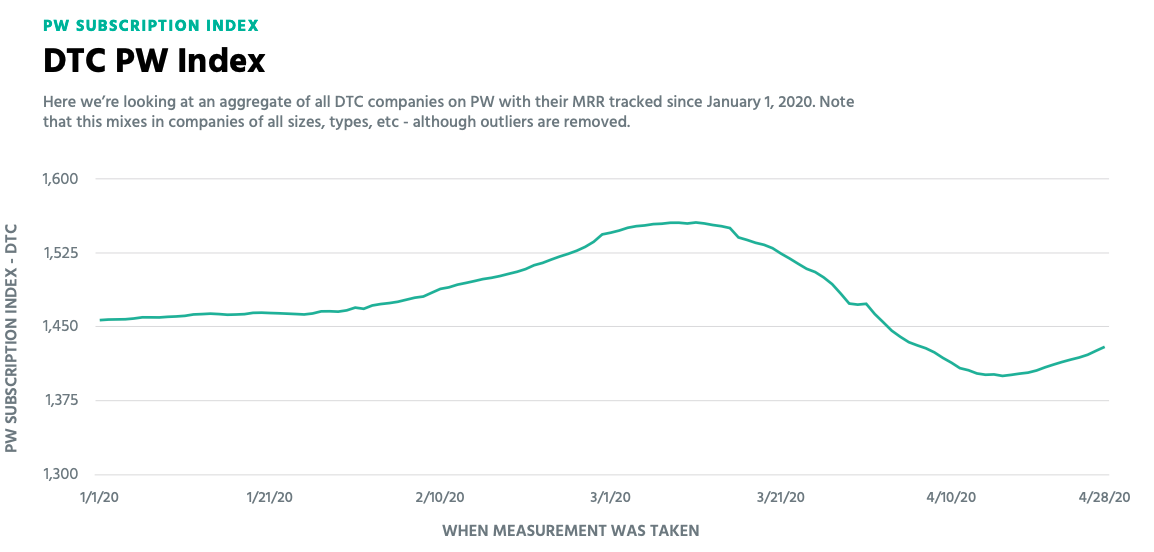

I promised a look at the world of consumer SaaS business. I have some questions about this chart, namely which types of consumer SaaS fit inside the DTC index that ProfitWell runs. But regardless of that query, what the chart shows is sufficiently clear as to still be useful:

The only way I can read that data is that consumer spend on recurring-revenue products was strong in early 2020 and then fell incredibly sharply. (Email me if your startup is in this cohort and you want to share what’s been going on.) More steeply than I would have imagined, though a mid-April bottom has been founded and, so far at least, the growth corner has been rounded. It will take this SaaS cohort a few months to recover to just flat.

It’s been tricky to figure out what’s going on today in the world of SaaS, but our picture is sharpening up a bit. Perhaps a correct next question would be what portion of B2B SaaS companies really are growing, and which are falling, and which group is larger; are the outlier SaaS winners making the data look better than it really is for most business-focused modern software companies?

Update: ProfitWell’s founder and CEO Patrick Campbell weighed in on the data via email, saying that Recurring revenue seems to be recovering on all fronts, including the B2B and consumer markets, but we should still be careful since most downturns have multiple aftershocks. The Founder in me is optimistic, the CEO in me is still planning for the long haul.” It seems he shares our generally optimistic take on the data.