The economic effects of COVID-19 could delay Africa’s next big IPO — that of Nigerian fintech unicorn Interswitch.

If so, it wouldn’t be the first time the Lagos-based payments company’s plans for going public were postponed; the tech world has been anticipating Interswitch’s stock market debut since 2016.

For the continent’s innovation ecosystem, there’s a lot riding on the digital finance company’s IPO. After e-commerce venture Jumia, it would become only the second listing of a VC-backed African tech company on a major exchange. And Interswitch’s stock market debut — when it occurs — could bring more investor attention and less controversy to the region’s startup scene.

What is Interswitch?

TechCrunch reached out to Interswitch on the window for listing, but the company declined to comment. The tech firm’s path from startup to IPO aspirant traces back to the vision of founder Mitchell Elegbe, a Nigerian electrical engineering graduate whose entire career has pretty much been Interswitch.

Africa’s tech scene is still fairly young, but it does have a timeline with several definitive points. An early one would be the success of mobile money in East Africa, with the launch of Safaricom’s M-Pesa in 2007. Another is the notable wave of VC-backed startups and founders that launched around 2010.

Interswitch CEO Mitchell Elegbe (Photo Credits: Interswitch)

With Interswtich, Elegbe pre-dated both by a number of years, founding his fintech company back in 2002 to connect Nigeria’s largely disconnected banking system. The firm became a pioneer of the infrastructure to digitize Nigeria’s economy.

Interswitch created the first electronic switch whereby Nigerian financial institutions could communicate and thereby operate ATMs and point of sales operations. The company now provides much of the rails for Nigeria’s online banking system.

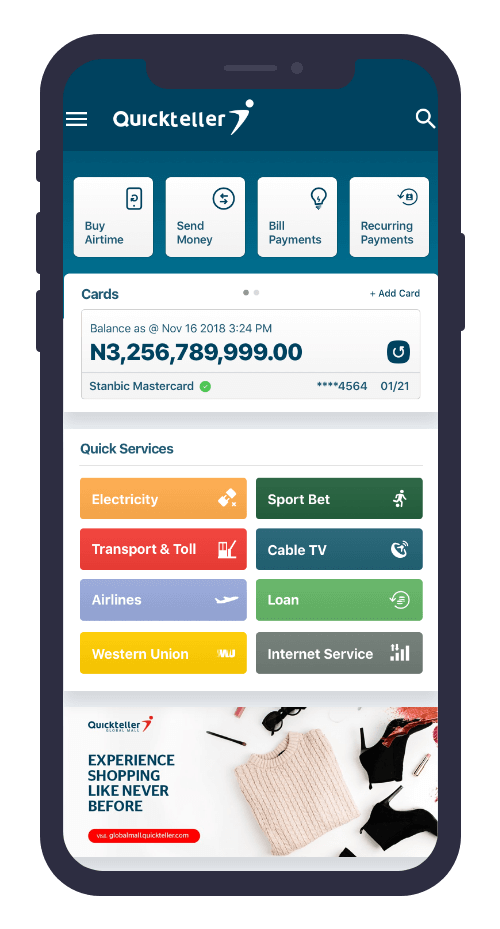

Interswitch has since moved into high-volume personal and business finance, with its Verve payment cards and Quickteller payment app. The fintech firm (which is now well beyond startup phase) has also shaped a pan-African and global reach with a physical presence in Uganda, Gambia and Kenya, selling its products in 23 African countries. In August 2019, Interswitch launched a partnership that allows its Verve cardholders to make payments on Discover’s global network.

Image Credits: Interswitch

Interswitch launched a venture arm in 2015 called its global ePayment Growth Fund that made two investments, but then went largely quiet. Another milestone came in November 2019 when Interswitch achieved a $1 billion unicorn valuation after Visa took a reported $200 million minority stake in the company. Other Interswitch backers include IFC and Helios Investment Partners.

Heading into 2020, the momentum was there and the pieces were falling in place for the Nigerian tech firm to mark that next big achievement — an IPO.

Why this IPO Matters

As TechCrunch reported, Interswitch was poised to go public in 2016. CEO and founder Mitchell Elegbe confirmed “a dual-listing on the London and Lagos stock exchange is an option on the table,” when I spoke to him in January of that year.

In 2017, after it didn’t happen, TechCrunch queried Interswitch on why; the company declined to comment. In other public interviews, Elegbe and Divisional Chief Executive Officer Akeem Lawal named Nigeria’s recession — which created an exchange rate crisis with the Nigerian Naira — as a reason for the delay. Both execs reaffirmed a likely dual London-Lagos listing by the end of 2019.

In November 2019, a source with knowledge of the situation told TechCrunch on background, “an IPO is still very much in the cards; likely sometime in the first half of 2020.” When Interswitch does go public, it will have implications for the broader African tech ecosystem, starting in its home country.

The company’s Nigerian origins and operations have become more significant as Nigeria is now Africa’s most populous nation and largest economy. The West African country has also become the continent’s unofficial tech hub and fintech capital.

Nigerian startups now raise the majority of Africa’s annual VC haul, estimated by Partech to have topped $2 billion in 2019.

There’s also a conventional wisdom settling in that any financial company — be it a startup or a global player — needs a foothold in Nigeria to scale fintech in Africa. In Visa’s 2020 Investor Day call, the country was mentioned six times related to business and strategic partnerships.

There’s also a conventional wisdom settling in that any financial company — be it a startup or a global player — needs a foothold in Nigeria to scale fintech in Africa. In Visa’s 2020 Investor Day call, the country was mentioned six times related to business and strategic partnerships.

All that said, if Interswitch goes public on a major exchange and create exits for its investors, it will attract to Nigeria and broader Africa more VC from major funds. A windfall of IPO capital and growing competition from other fintech startups could also spur Interswitch to fire up its venture fund, the net effect of which could be more capital and exits in African fintech.

And finally, an Interswitch dual IPO on the London and Lagos stock exchanges could provide another benchmark that lets global investors gauge Africa’s tech sector beyond Jumia. The outcome of the e-commerce venture’s IPO is still uncertain, with Jumia’s share price plummeting more than 50% since listing.

Recession in Nigeria would forestall an IPO

The most likely indicator that COVID-19 (and its ripple effects) could delay Interswitch’s IPO connect to Nigeria’s economy. By all accounts, Nigeria is either already in or headed for another recession as the novel coronavirus creates internal and external economic pressures.

Internally, the spread of COVID-19 in the country has brought lockdowns and a near halt to economic activity. As a major oil producer, Nigeria faces an additional economic blow due to the drop in demand the pandemic has dealt to petroleum markets.

The scenario is shaping a déjà vu situation for Interswitch on the reasons it (reportedly) delayed its IPO in 2017. With an HQ and primary revenue base in Nigeria, this makes a dual listing at home and abroad more complicated. For Interswitch — or any company — listing during a recession and currency volatility is obviously less advantageous for everyone involved, including core investors.

Of course, there are still two more economic quarters in 2020, and anything could happen. Whether it’s this year or next, when Interswitch does finally make good on an IPO it will definitely become an entry on the timeline for major events in African tech.