Last week, Lightspeed Venture Partners announced that it had closed on $4.2 billion in new capital across three distinct funds — an $890 million early-stage venture fund, a $1.83 billion later-stage fund and a $1.5 billion “opportunity fund.”

With offices in the U.S., China, India, South East Asia, U.K. and Israel, the firm certainly has wide access to courting new deals in the midst of a crisis. The question is how easy it will be to source those deals.

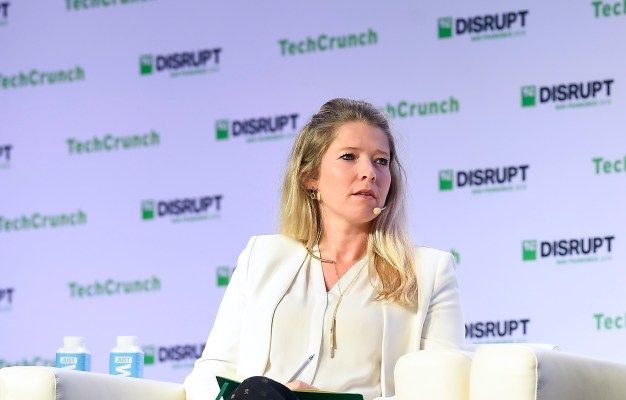

Lightspeed partner Nicole Quinn joined the company in 2016 to help build out its consumer investment portfolio. Quinn’s investments include direct-to-consumer fashion company Rothy’s, celebrity shout-out platform Cameo and meditation app Calm.

I talked with Quinn last week about how her schedule is changing, who she’s talking to and where she is looking to invest next.

This conversation has been edited for length and clarity.

TechCrunch: What’s your schedule looking like these days? How much have things changed?

Nicole Quinn: My schedule has certainly changed; I’m spending much more time with portfolio companies. It’s thinking through uncharted waters and we’re thinking through all of these aspects because we’re encouraging them to make sure that they are in the strongest position they can be in. After that is making sure they have two years of runway, because who knows how long this is going to last — it’s pretty hard to model out a global pandemic.

Supporting our companies, not just in the good times, but in all times, is paramount to who we are. So, yeah, the lion’s share of my time is definitely being spent with portfolio companies. I haven’t made any new investments over the last few weeks, but I am currently working on a couple of reinvestments into a couple of our portfolio companies.

Do you think you’re taking fewer meetings with founders with whom you don’t have a previous relationship?

There’s this interesting trend — people are either doing less in this market and slowing down or there are the people who are workaholics, that aren’t knowing any difference between work and home life now and are just working more.

I am in that latter category, so I’m taking a lot of meetings, all over Zoom — maybe even the same amount of new meetings — just adding more contact with portfolio companies now too.

How has it been moving away from in-person meetings?

I’m an extrovert, so I definitely get energy from meeting people in-person. I’m also eight months pregnant, so all of that is [laughs] definitely adding complexity. While it’s nice to not be hopping on flights all the time, I have a new portfolio company in LA that I want to be seeing them in-person, and I can’t in this environment, so that’s a big change.

Several of our partners have made new investments over the last few weeks, and it’s great to see them go right from very first meeting, all through diligence to the partner meeting, to closing, all through Zoom. It’s really great to see.

Any concerns that it’s going to be harder to deploy any of these new funds in this climate? Where are you focused?

I will say, the velocity will certainly slow down and we want to be sure that we’re focused on the companies that will be durable and will come out of it stronger, and yes, the velocity will likely slow down from the paper investing that we’ve been doing over the past couple of years.

Of the investments that I’m pretty excited about right now, one is early-stage and one is a B round so I’m definitely split in terms of my time between early-stage and growth at the moment.

Any specific verticals that you’re excited about looking into?

Habits build up quite quickly and so we view behaviors that we have during these times as things that could become habits that I think will last far longer than this pandemic.

I often think about the fact that we’re between platforms and we don’t know what the next one will be, maybe it’ll be voice, maybe it’ll be AR. So we’re really investing in true brands, marketplaces and e-commerce companies that are also between and could transcend different platforms.

Then other interesting things are people working out from home and really leaning into action fitness. People are enjoying Zoom and Zoom is doing well, but there are so many kinds of things that are tangential to that.

How worried are you about overcompensating for things that can succeed mid-quarantine but might not become part of user habits?

That’s a key question.

At Lightspeed, we have so many different folks around the table. We started with enterprise and infrastructure, then added on consumer, now we’ve added on healthcare. So it’s great to have all these people who have experience and perspective, so that we do ask all of those questions and we’re very deliberate about every decision.