Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

So far, 2020 has proven to be a year of surprises and disappointments. Over the past month, we’ve seen companies like Toast go from raising huge new rounds this year at heightened valuations to layoffs in mere months. TripActions is another example. Indeed, BounceX went from a rebrand and an announcement that it had reached $100 million ARR earlier this year to layoffs as well.

TechCrunch has been talking to VCs, founders and all sorts of folks to figure out what they are seeing in the market as we race to learn more about venture and startups in the COVID-19 era. To further that goal, this morning we’re going to run a survey of surveys, looking at sentiment and performance data collected by valuation shop Preferred Return, NFX, a venture firm, and 500 Startups, a startup accelerator and investing group.

As a bit of a spoiler, there aren’t too many smiles ahead. But march forward we must.

Rewinding the clock

Let’s start with Preferred Return’s report, published two weeks ago, on “VC community reaction to COVID-19,” which asked 35 venture capitalists a good number of questions. Why look at the dated information? Because we might be able to see changes in sentiment since the first survey was taken, providing grounding for our more recent data. What we care about is the following set of data, summarized from the report’s digest:

Among the VCs who responded, a little more than half thought they would write fewer and smaller checks, although almost half predicted no change. We translate this input to a ~25% overall reduction, reasonably, in the number of checks issued.

Adding on to that relatively stark set of data was the number of VCs from the survey who felt that valuations were going to drop. Nearly every VC surveyed agreed with that sentiment, with a handful saying that they might stay the same and a few more saying that they weren’t sure. None expected valuations to go up.

So, as March moved towards its final week, give or take, about half of VCs were expecting to cut fewer checks, half (perhaps the same half, mind) were expecting to cut smaller checks, and nearly every investor questioned expected prices to drop.

More recently

Since March 23, the economy has worsened. Unemployment is up significantly, and COVID-19 has continued to spread around the world, especially here in the United States.

In early April, 500 Startups released a set of data it culled from a group of investors that showed up to its recent demo day. Note that the following data points are taken from a group of VCs who not only took the time to show up to a virtual demo day during an economic meltdown, but also stuck around to answer some questions. You might think that they would be a positive, sunny bunch. But that doesn’t appear to be the case.

- 84% of investors surveyed expected a negative “impact on early-stage investment activity in 2020,” with 36% saying it would only be “somewhat negative.” Another 16% said it would be “very negative.”

- 83% of investors surveyed responded “yes” to the question: “Is the COVID-19 health crisis having an impact on your investment activities or plans?”

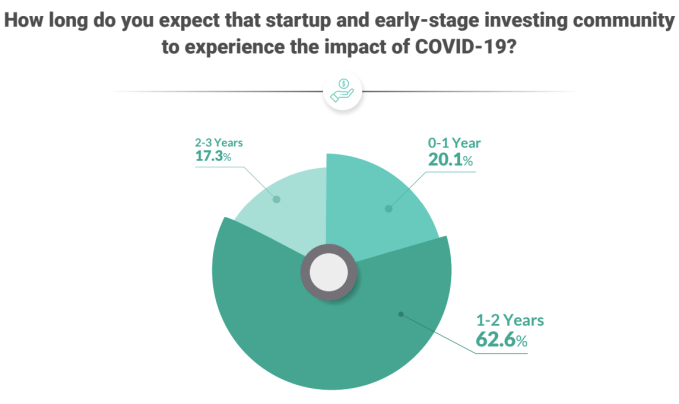

- The following chart, shared with permission:

These questions are tilted towards the early-stage market as 500 Startups works with younger firms, but they offer an incredibly interesting lens to investor sentiment. A year, in startup terms, is a decade. To see nearly two thirds of early-stage investors surveyed expecting at least that long a winter is a big deal.

But we have more work to do, so let’s now turn to NFX’s founder and VC survey. Also dated April 3, the data adds entrepreneur responses to the mix, allowing us to compare and contrast some between the capital haves and have nots.

- Over 90% of founders surveyed said that they were at least slightly worried when asked how they were feeling; 77% were at least moderately worried; and over half were either “very” worried or “extremely” worried.

- On a more positive note, 36% of founders expected the U.S. will be back to normal before September. However, only 16% of VCs surveyed share that belief. Indeed, half of VCs did not expect domestic normalcy until April 2021 or beyond. Two-thirds of founders expected normalcy in the US before April of 2021. The two groups cannot both be correct.

- Only 11.5% of founders said that VC response times were unchanged; none said it had gotten better; nearly three-quarters of founders said that VCs had slowed their responses while an additional 15.5% said that VCs had stopped responding altogether.

That was a lot of data, but what the three surveys show is that as March progressed investors were changing their behaviors, and that by the start of April early- and late-stage investors alike expected long-term damage to the economy. Founders were a bit more optimistic, but aside from about a third of entrepreneurs expecting the U.S. economy to snap back quickly, there wasn’t a huge amount of positive anticipation to be found. And with investors slowing their calls with founders, their negative sentiment may erode even that sliver of entrepreneur optimism.

The world has changed quickly. Startups that weren’t able to hire quickly enough went to hiring freezes and layoffs. Megarounds that we couldn’t count before are now notable. The Vision Fund’s boom to today’s market selloffs and delayed IPOs. So much has changed in the last year, and especially the last few months, that it’s a little hard to recall what it was like during the boom.