Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Yesterday we explored what the SaaS world thinks about churn. A cohort of SaaS executives surveyed by Gainsight are expecting medium-bad churn (our take on their reported forecasts); select software companies will see booming demand; and the impact of churn won’t be felt evenly around the world, leaving some markets stronger than others, offering SaaS startups and their public brethren a chance to grow.

What mattered (read the piece if you have time) is that there is a general expectation that churn will rise as the world’s economy slips in the face of a historic pandemic and its constituent city- and country-wide shutterings. In time, we should see the impact of rising churn in public earnings reports, lower startup valuations, slower growth curves, and changing go-to-market motions.

But, something that we can see today is a falling growth rate among SaaS companies focused on both other businesses and consumers. This is thanks to new data from ProfitWell, a Boston-based software company that helps other firms track their subscription businesses and work to reduce churn. A set of charts provided to TechCrunch detail how the growth rate of SaaS companies, in both B2B and B2C, are falling. Add in a rising churn expectation for the modern software industry, and the market could be in for SaaS’s first patch of hard times in recent memory.

Growth

According to ProfitWell CEO and co-founder Patrick Campbell, the following data is predicated on “just under 20,000 subscription [and] SaaS companies” that range “from small startups to Fortune 50 companies.”

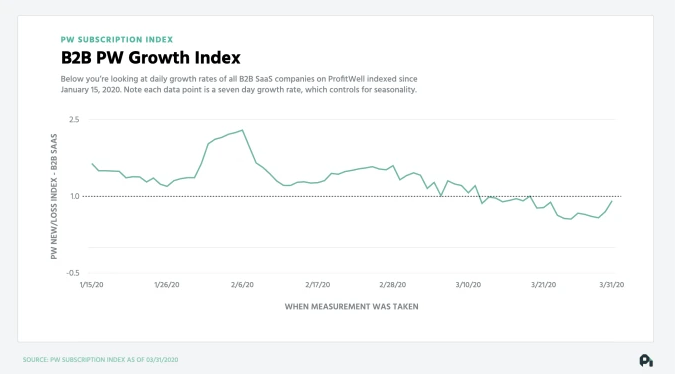

Given that we tend to focus a bit more on the B2B world, we’ll start there. The following chart tracks growth amongst business-focused SaaS startups that ProfitWell has data on. Try to spot where the trendlines change, and then check the data associated with the turn:

What the chart shows is a decline in growth starting at the end of February. As March begins, the growth rate continues to fall. By late March, growth has fallen from a little under 2% to a figure under 1%. What matters more than the raw number is the magnitude of its decline; this chart shows a steep decline in B2B SaaS growth.

There is a hopeful spike there at the end, something that we’ll watch in coming weeks. If B2B SaaS can regain some growth momentum, it would be welcome news for a huge number of startups and their investor backers. But that small bump still leaves the index sharply down from recent levels, let alone year-highs. (It is notable to see how strong SaaS growth as tracked by ProfitWell looked at the start of the year—how different 2020 could have been.)

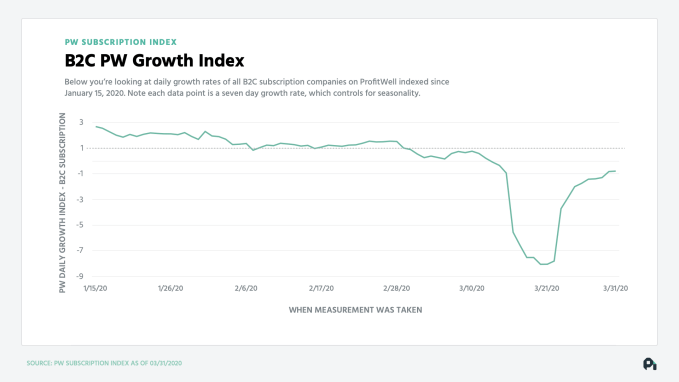

Now let’s turn to the B2C SaaS world. Campbell told TechCrunch this morning that the following chart includes things like “consumer education apps, fitness” and the like, but it excludes ecommerce and media, which his company tracks separately. Here’s the data:

The B2C chart’s declines begin around the same time as the B2B’s own, namely the end of February. But the B2C world saw a far sharper change in its fortunes as March reached its second week. Consumers appear far more reactive to economic changes than businesses, something that we could have guessed; the scale of the differential, however, is a shock.

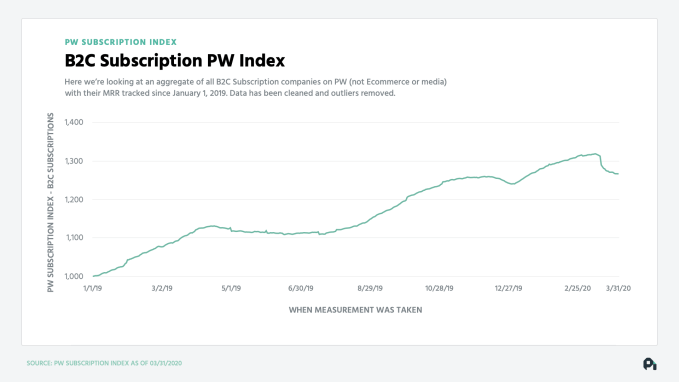

That u-shaped dive there is so deep that it eliminated a chunk of B2C SaaS’s historical growth, again leaning on ProfitWell’s own cohorts as a lens:

Eyeballing that chart some, it appears that B2C SaaS gave up all its 2020 growth in the last few weeks. That’s a lot of lost income.

SaaS revenues are supposed to be durable, predictable and always growing at least some. Those assumptions are going to be tested in 2020. We’ll be on this topic regularly until we understand it, so get ready for more.