Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

This morning we’re looking at what venture capitalists got up to in the first quarter of the year and how they are really responding to the current global crisis.

It’s easy to find mixed signals on Twitter, with some VCs noting that they have slowed their investing cadence or tightened criteria as the markets shed value. Others claim to be as active as before. Founders are reporting new, higher standards that private capital deals now appear to require. TechCrunch compiled a number of reports from entrepreneurs which described an either slowed, more conservative or utterly frozen venture capital scene.

It seems very likely, then, that the United States’ venture capital results for Q1 will be somewhat weak. The full impact of the COVID-19 pandemic, however, may show up more acutely in Q2 2020. Why? Because venture data is famously — and annoyingly — laggy. Rounds are announced weeks or months after they are completed, and the timing of their announcements is impacted by news cycles.

So what we see in Q1 2020 venture data will contain deals that took place in the latter days of 2019; Q2 2020 data, in contrast, will feature mostly 2020 deals and will include a reporting period in which a lot of later Q1 deals would have been completed. This does not mean that there’s no use in looking at Q1 results — we’re looking for early signals, not complete answers in the data.

So let’s dig up what information we can on our own, mix in some data from other reports and see what the tea leaves are saying about Q1 venture results so far.

Down and to the right?

We’ll start today with a few looks at monthly, reported, equity-only venture capital data from the U.S. We’ll proceed on a monthly basis, comparing this year’s known results with last year’s more complete results; venture rounds are added to private company databases over time, so as time passes, those repositories become more complete. But a big enough gap could indicate a slowdown, if we do find one.

Via Crunchbase, here’s a look at the year so far:

- U.S. equity-only private rounds in January 2020: 712, $13.7 billion (1,103 rounds and $17.7 billion in 2019)

- U.S. equity-only private rounds in February 2020: 519, $11.7 billion (811 rounds, $13.1 billion in 2019)

- U.S. equity-only private rounds in March 2020: 472, $11.2 billion (997, $9.9 billion in 2019)

We can see clear declines in reported private deal volume in the U.S., with a general downturn in invested dollars, at least according to Crunchbase data as of today. The falling round volume appears steep enough to discount reporting lag as the only reason for the decline; deal volume has fallen in the United States in 2020 not only compared to 2019, but also on a sequential-monthly basis.

This matches what we expected, but it is nice to have data back up our gut.

U.S. vs The World

What’s going on in the United States appears to mirror what we’re seeing around the world.

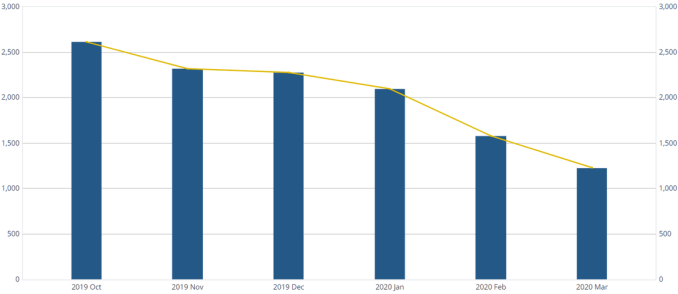

Indeed, the U.S. data’s direction matches Pitchbook data that Axios’s Dan Primack published earlier in the month, showing a decline in global venture capital rounds:

What’s stunning about this chart is that the timeframe Primack selected shows roughly 50% decline from October to March. This chart is from March 26th, mind, so the final month is short about a week, but it seems unlikely that the final few days of the month will close the gap to even February’s totals.

Adding to our chorus of downward arrows, a March 25th piece in the WSJ reported that, per CB Insights, seed-stage capital has “has declined by about 22% globally since January” and that “total private-market funding for startups at $67 billion in the first quarter,” off $10 billion from its year-ago totals. Once again the data paints a negative picture of the current venture market.

So what?

The Q1 data is not great. And it’s hard to imagine that Q2’s results are going to look much better, unless the U.S. economy posts a shocking recovery in the period. Given that domestic states and cities are adding time to their lockdowns this week, in a bid to prevent further infections of COVID-19, the economy is likely to continue to descend in the quarter. Rebuilding is looking like a Q3 task.

It is not clear that VC totals will snap back as the economy begins to mend; it could be quarters until private investors are once again as bullish as they were in the unicorn era (if we match prior heights at all in the next decade).

This is a correction, a downturn, a retrenchment. It may not feel like it yet, but the same crisis that we can see in global economic data is being matched in private investment, and it’s going to cause a lot of pain.