No one wants to prepare for their fundraising round to fail. Many founders spend months (or even years) getting their businesses to a point where they’re ready to pitch investors. But there are times when, no matter how hard you try, you’re just not going to be able to close a deal.

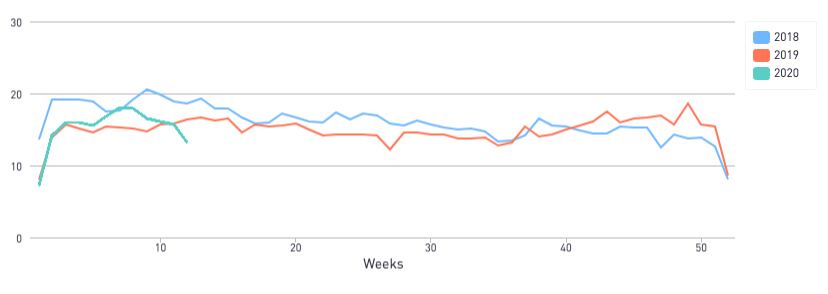

With the current COVID-19 pandemic, the entire VC community is in a state of uncertainty, and there is no clear answer when it comes to the question, “can I still raise funds for my company?” However, there’s hope for early-stage startups. We used the 2020 DocSend Startup Index to track Pitch Deck Interest among investors and found that last week, despite seismic changes across the country, pitch deck interest has only been 11.6% lower than the same week in 2019 so far.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you’re an early-stage startup and you were planning to raise, there is still opportunity to come away with a term sheet. But if things don’t go as planned, how do you know if it’s time to give up or if you just need to push through?

According to recent DocSend data, you’ll know pretty quickly if it’s time to call it quits. While the average founder who was successful in fundraising contacted 63 investors during their process, startups that weren’t able to raise funds stopped at 27. Why stop? Because the founder listened to the feedback they were getting. If you hear the same concern or piece of feedback twice you should take it to heart, but if you hear it three times you probably need to stop and rethink things.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

According to our study on the fundraising process of pre-seed startups, founders who were unsuccessful in raising had just nine meetings. That should give you enough feedback to know if you have a deal breaker in your deck.

But negative feedback doesn’t mean all is lost. In fact, of startups studied in the 2020 DocSend Startup Index, 86% reported that they were going to try to fundraise again after addressing the feedback they’d received.

When should you try again?

Determining how long to wait before you begin fundraising again depends on the type of change you need to make. It’s usually a good idea to wait a minimum of several weeks before you re-approach investors. It demonstrates that you have taken their feedback seriously and have course-corrected accordingly. Otherwise, you’re likely to get the same response you did the first time.

According to our data, only 10% of companies were planning on waiting a month before they tried fundraising again. In fact, most companies (51%) were planning on waiting 12 to 24 weeks before they approached investors again. And there was a small group (5%) that were planning on waiting an entire year before they attempted to raise their pre-seed round again. With the coronavirus likely to disrupt the next two quarters of fundraising, waiting at least 12-24 weeks seems like the right idea.

Revenue and traction are a big deal

We’ve seen a recent shift to companies, and their investors, prioritizing revenue over other high-growth metrics. Pre-seed companies are even seeing that shift while fundraising now. According to our data, 38% of companies were taking a fundraising break to address their revenue and traction numbers.

Including financials is still rare for pre-seed companies, with only 35% of successful decks including any financial slides. And even when they did, they averaged only 1.4 slide(s). On the other hand, 60% of successful decks included traction metrics, which clocked in at 1.7 slides on average.

If your deck doesn’t currently include traction, or you don’t have any early strong wins, you may want to spend some more time on your business before you fundraise. Because VCs are going to be more selective with pitches in the current environment, these traction points can go a long way.

Find other funding sources

If you’ve been turned down by several VCs, you don’t need to wait to retool. In fact, according to our data, 30% of companies were going to actively seek alternate funding. Of that group, 27% were going to cut costs so they could bootstrap their business or try to raise funds from friends and family. Another 18% were applying to incubators both for the funding and to get concentrated help for their businesses. Another 18% were going to focus on angel investors.

It’s worth noting that depending on how much money you’re attempting to raise, an angel round can take significantly more time than your raise from institutional investors. That’s because with angels you’re getting much smaller checks, so you’re going to have to contact more angels and have more meetings than you would with a typical VC round. Angels are also much less likely to offer funding during an economic downturn, as they most likely won’t pull capital out of other investments. During the current global pandemic, angels are probably not an area where you want to spend a lot of time.

Addressing your product

As the 2020 DocSend Startup Index has shown, an MVPP (Minimum Viable PowerPoint) won’t cut it anymore in pre-seed rounds. In fact, 92% of companies with successful pitch decks had either an alpha, beta or shipping product, but only 68% of companies with unsuccessful pitch decks presented the same type of product readiness.

We found that 22% of unsuccessful founders were working on or launching their product before they tried fundraising again. Of those, another 22% were making a full pivot. Because we’re in a time of uncertainty, taking a step back to strengthen your product offering or show how your product can be of value in the new order of things could land you in a better place to get funding down the line.

Maybe it’s just your deck

You don’t always need to make material changes to your business. There are multiple factors that can cause investors to give you poor feedback. It’s possible the narrative in your deck isn’t telling a clear story. Or perhaps your value propositions weren’t clear. Or maybe the business model you presented won’t work. These things don’t necessarily mean you need to change your business at all, just the way you present it.

According to our data, 8% of companies were simply reworking their deck before they went back to pitching.

It’s up to you to decide how much of the feedback you need to take to heart. And once you have a clear plan about what needs to be addressed, you can plan your next fundraise.

Need some advice on your deck? DocSend has channeled our analysis into a new tool for startups, The Startup Pitch Deck Analyzer, where you can submit a pitch deck and receive insights within 48 hours on what your deck does well and ways to improve it.

While fundraising is clearly a major responsibility for any founder, it shouldn’t take you away from running your business for months on end.