TechCrunch did a synopsis recently on Africa’s 2019 VC stats. Analyses from investment fund Partech and media outlets Disrupt Africa and WeeTracker came up with varied numbers, but there was a common trend: the top two countries for venture capital to startups across all three studies were Nigeria and Kenya.

TechCrunch covered a number of the major investments in those markets in 2019. Here’s a look at the VC numbers and the companies receiving rounds in Africa’s leading startup countries.

How much VC?

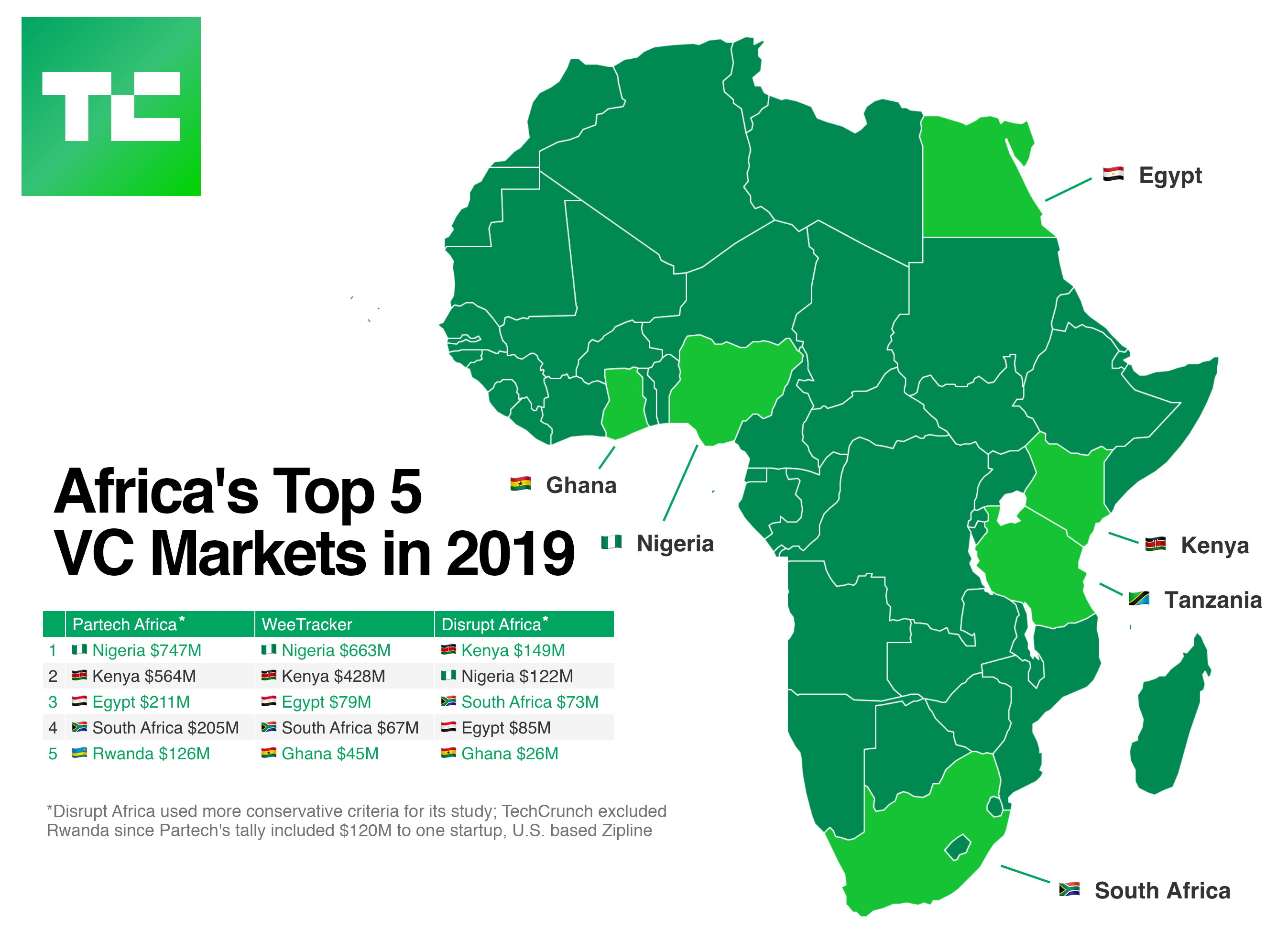

There’s some pretty significant variance in the estimates for annual venture funding in Africa. From high to low, Partech pegged total 2019 VC for African tech companies at $2 billion, compared to WeeTracker’s $1.3 billion estimate and Disrupt Africa’s $496 million.

The deviations come largely from the different methodologies used to define startups and venture funding.

Even with the differences, the common thread in the studies was Nigeria and Kenya surging ahead as the African countries with the most venture capital dollars. West and East African nations have overtaken South Africa, which served as the continent’s lead on venture investment for years.

Startup snapshot

By many accounts, including one of my own, Nigeria is now Africa’s unofficial tech capital. Yes, the West African nation is commonly associated with negative cliches around corruption and terrorism (which persist as serious problems).

Regardless, Nigeria’s dual distinctions as Africa’s largest economy and its most populous nation (200 million) have made it a magnet for venture capital and a hotbed for startup formation. By WeeTracker’s assessment, the country received 49% of VC in Africa in 2019 through 97 deals. Partech’s methods had Nigeria gaining 37%, or $747 million, of venture capital last year.

TechCrunch covered a number of the recipient companies of tech funding in Nigeria in 2019:

- Interswitch: Founded in 2002 by Mitchell Elegbe, the fintech firm pioneered much of infrastructure to digitize Nigeria’s banking system. Interswitch now offers financial and payment services in 23 African countries and became a unicorn in 2019 when a $200 million investment by Visa gave the company a $1 billion valuation. Interswitch is likely to go public in 2020 in an IPO on a major global exchange (probably the LSE).

- OPay: The payments startup raised a $120 million round in November backed primarily by Chinese investors. OPay is part of Chinese/Norwegian consumer internet company Opera’s push into Africa via Nigeria. The payment utility is used for a suite of Opera-developed, internet-based commercial products in Africa. These include ride-hail apps ORide and OBus and food delivery service OFood.

- Andela: Founded by Americans and Nigerians, the tech talent accelerator raised $100 million in 2019, bringing its total funds raised to $181 million. Andela trains and connects African software developers with global companies for a fee. That the startup is Nigerian is debatable, but its largest Africa office is in Lagos. Andela has more than 1,000 engineers, offices in five African countries and confirmed $50 million revenue in 2019.

- Kobo360: In September, the Nigerian freight logistics startup raised a $20 million Series A led by Goldman Sachs. Kobo360 has an Uber-like app that connects truckers and companies to delivery services in Nigeria, Togo, Ghana and Kenya. The firm claims a fleet with more than 10,000 drivers and trucks operating on its app. Top clients include Unilever and DHL. Kobo360 plans to expand to 10 more countries in 2020.

- Max.ng: The Lagos-based startup runs an app-based platform to coordinate motorcycle taxi and delivery services for individuals and businesses. Competition in Africa’s two-wheel ride-hail market is accelerating, which led Max.ng to raise a $7 million funding round in June with participation from Japanese motorcycle manufacturer Yamaha.

In addition to city expansion, the company is using the funding to pilot e-motorcycles in Africa powered by renewable energy, CFO Guy-Bertrand Njoya told TechCrunch.

In East Africa, Kenya is the region’s startup hub and second to Nigeria in 2019 on VC. The country of 53 million people received $564 million in funding to tech ventures through 52 deals, according to Partech. WeeTracker had Kenyan startups raising $429 million through 72 deals in top sectors of fintech, healthcare and logistics.

TechCrunch covered a number of those ventures, including these three:

- Twiga: The B2B food distribution company raised $30 million in October from lenders and investors led by Goldman Sachs. Founded in 2014, Twiga built its platform around improving agricultural pricing mechanisms and optimizing supply chain between farmers and marketplaces. The startup is now moving toward offering B2B services for Kenya and East Africa’s FMCG markets.

- Lori Systems: The 2017 Startup Battlefield Africa winner offers on-demand trucking logistics and raised $30 million in 2019. Lori Systems has operations in Kenya and Uganda and expanded to Nigeria in 2019, where it competes with Kobo360.

- Sendy: The delivery logistics startup raised $6.3 million in 2019 and a $20 million Series B backed by Toyota in January 2020. Sendy offers e-commerce and enterprise services and on-demand freight delivery in Kenya, Tanzania and Uganda for a client list that includes DHL and African online retailer Jumia. Sendy’s latest financing includes an R&D arrangement with Toyota to optimize delivery trucks for African markets, CEO Mesh Alloys told TechCrunch in January.

The following year will see more funding to startups in Nigeria, Kenya and the broader continent as more specialized investors raise and deploy VC. In January, Africa focused venture fund TLcom Capital announced it had closed a $71 million fund with plans to back at least 12 startups into 2021.