For global venture capitalists still on the fence about entering Africa, a first move could be co-investing with a proven fund that’s already working in the region.

Africa’s startup scene is performance-light — one major IPO and a handful of exits — but there could be greater returns for investors who get in early. For funds from Silicon Valley to Tokyo, building a portfolio and experience on the continent with those who already have expertise could be the best start.

VC in Africa

Africa has one of the fastest-growing tech sectors in the world as ranked by startup origination and year-over-year increases in VC spending. There’s been a mass mobilization of capital toward African startups around a basic continent-wide value proposition for tech.

Significant economic growth and reform in the continent’s major commercial hubs of Nigeria, Kenya, Ghana and Ethiopia is driving the formalization of a number of informal sectors, such as logistics, finance, retail and mobility. Demographically, Africa has one of the world’s fastest-growing youth populations, and continues to register the fastest global growth in smartphone adoption and internet penetration.

Africa is becoming a startup continent with thousands of entrepreneurs and ventures who have descended on every problem and opportunity.

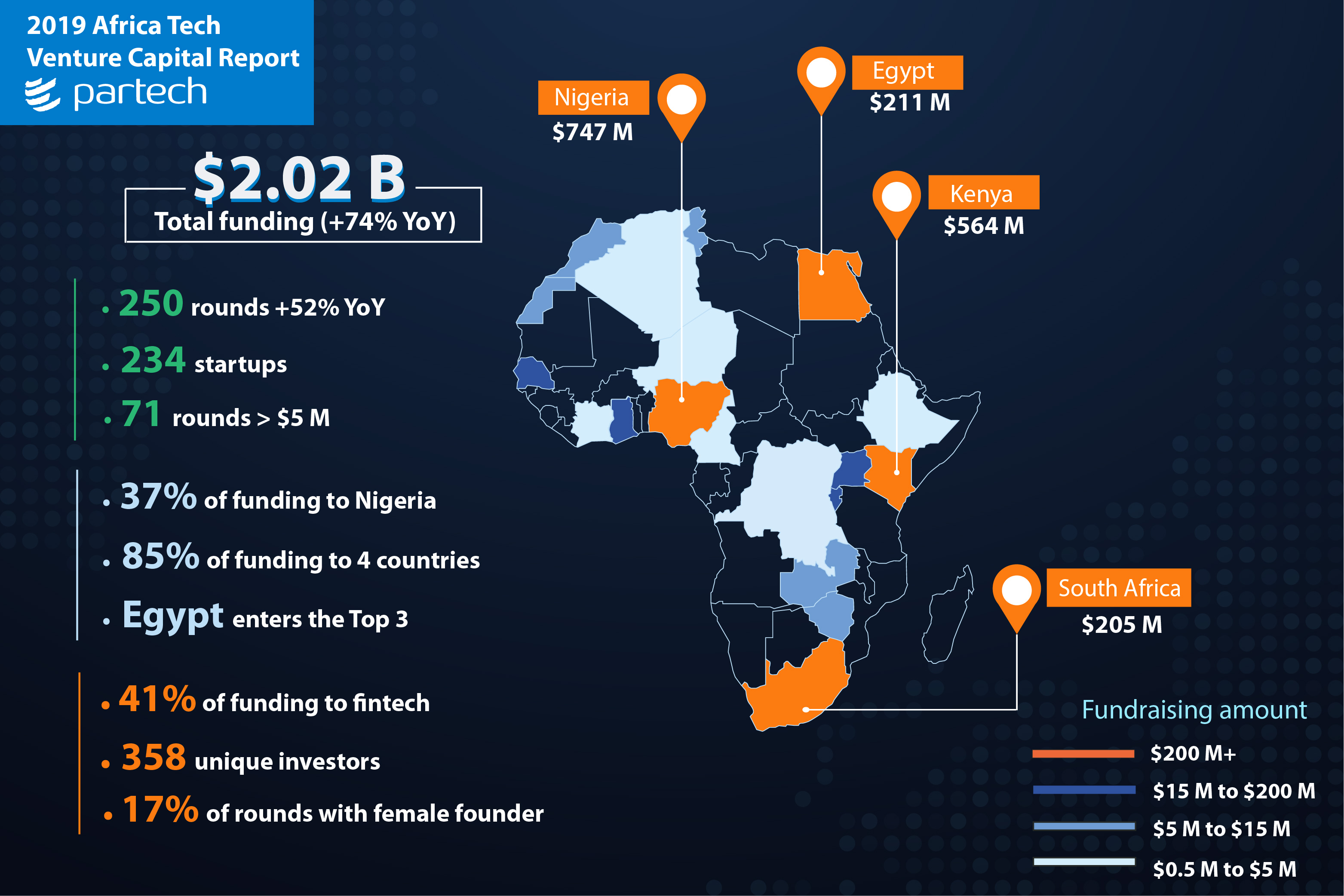

VC is fueling these tech-enabled companies. Accurately measuring venture funding for Africa is a work in progress, but an earlier reliable estimate placed it at just over $400 million in 2014. Recent stats released by Partech indicate that value grew to more than $2 billion in VC funding by 2019.

VC is fueling these tech-enabled companies. Accurately measuring venture funding for Africa is a work in progress, but an earlier reliable estimate placed it at just over $400 million in 2014. Recent stats released by Partech indicate that value grew to more than $2 billion in VC funding by 2019.

Partner-friendly Africa funds

The growth in VC for Africa has moved in tandem with funds investing exclusively in African startups. A TechCrunch and Crunchbase study in 2018 tracked 51 viable Africa specific funds globally, and more of them, such as TLcom Capital, are open to working with co-investors. “As a VC fund, we… are great believers in syndication,” TLcom partner Ido Sum tells TechCrunch.

The firm has offices in London, Lagos and Nairobi, and local expertise in partner Andreata Muforo (from Zimbabwe) and senior partner Omobola Johnson, Nigeria’s former Minister of Communication Technology.

Omobola Johnson

TLcom has backed companies like Nigerian trucking logistics venture Kobo360 and Kenya’s Twiga Foods, a B2B food distribution company. Both companies have gone on to expand in Africa and receive subsequent investment by U.S. investment bank Goldman Sachs.

TLcom Capital closed its Tide Africa Fund at $71 million this month and has plans to make up to 12 startup investments over the next 18 months.

On investment partnerships, “we like to start syndicating from early (usually Series A onward) and are very happy to bring to the table co-investors with relevant experience…to keep supporting the company in future rounds,” Sum says. “We are currently looking at…co-investment opportunities with…co-investors [who] bring more than just capital to the table and can support the company in its growth and scaling journey.”

Based in Cape Town, South Africa’s Knife Capital is another African VC firm seeking partners. Founded in 2010, Knife recently opened its second fund to new investors.

“We want to be the local lead investor, then co-invest with international investors that can help [startups] with access to networks…[follow-on] money and other geographies,” Knife Capital co-managing partner Andrea Bohmert tells TechCrunch. Backing ventures with pan-African and global potential is a priority.

Knife Capital’s Keet van Zyl, Eben van Heerden, Bob Skinstad and Andrea Bohmert

“We want to help South African and African companies internationalize,” says Bohmert, explaining that larger round values with co-investors will provide more support for that expansion. A growing list of startups, such as Nigeria’s Paga and South Africa’s FlexClub, have developed business models in Africa before entering new markets abroad.

Bohmert pointed to Knife Capital’s track record as a reason co-investors in places such as Silicon Valley would join them. The company has several notable exits, including mobile fintech startup Fundamo’s acquisition by Visa and orderTalk’s sale to UberEats in 2018. Bohmert says she encourages interested partners to reach out to her on LinkedIn.

Knife Capital and TLcom Capital aren’t the only Africa-focused funds welcome to global partners.

Dakar Network Angels, a seed-fund for startups in French-speaking Africa, is open to co-investors, according to co-founder Marième Diop. So, too, is CRE Venture Capital, managed by Pule Taukobong and Pardon Makumbe, whose current portfolio includes Andela and FlexClub.