Read the first part of this article, Latin America takes the global lead in VC directed to female co-founders, on Extra Crunch.

Latin America lags when it comes to female investors

Interestingly, these positive numbers for Latin America come in spite of a lack of female investing partners in Latin America.

New data shows that only 7% of VCs with check-writing ability in Latin America are women. This is just over half the current U.S. average of 12%.

This is a critical finding, given that studies indicate that investments in female founded or co-founded teams increase when more women sit across the table as investors.1 Specifically, 2019 research shows that women invest in female entrepreneurs at nearly three times the rate of male investors.2

This means that Latin America could be on the early side of a positive cycle. In other words, more female investors in Latin America would lead to more female co-founders, and faster exits at higher valuations.

Other parts of the world have seen the effects of this positive cycle. Sophia Bendz, a partner at leading European VC Atomico, has watched this happen: “I’ve seen first-hand the impact having female investment partners can have on increasing the amount of investment into female-led companies.”

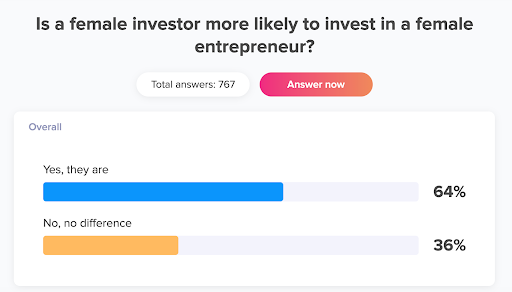

The public agrees. I ran a public opinion study with TruePublic, where I am an advisor and angel investor. When asked if a female investor was more likely to invest in a female entrepreneur, 64% responded affirmatively (67% percent of these individuals were women and 58% percent were men).3

So does Jomayra Herrera, an investor at Silicon-Valley based Cowboy Ventures and a volunteer with AllRaise: “As the venture industry continues to diversify, especially as it relates to gender and race/ethnicity, I am optimistic that we will see more female-led and people of color-led unicorns over the next decade.”

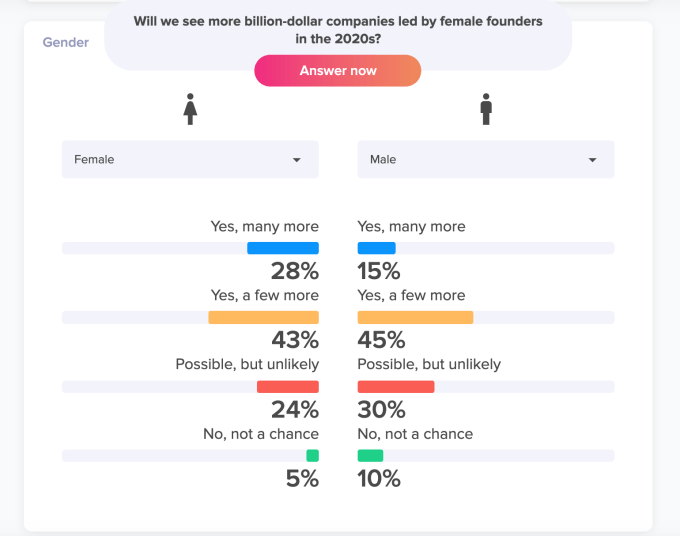

Our TruePublic study showed similar sentiment. When asked if people believed we would see more female-led unicorns in the 2020s, 77% percent of respondents said we would see more, with 28% of women responding “many more” (as opposed to only 14% of men). Only 5% of women and 10% of men responded “no, not a chance.”4

Looking at the current Latin America numbers, one can only be hopeful that more investment into female co-founders will promote further growth in the region.

Female founders seeking female investors are one way this can happen. Flavia Deutsch said she felt this lack of female investors and decided to do something about it. When she was fundraising for Theia, her parenting application, she felt so passionately about ensuring a gender-balanced cap table (and avoiding the “The Gap Table”) that she encouraged women to start angel investing in the first place. As Deutsch says, “we had to say ‘no’ to male investors to stick to our commitment.”

By the numbers, there were a lot to say “no” to. In the end, two of the angel checks that she and her pregnant co-founder Paula Crespi accepted for Theia were the very first angel investments two of their female investors had ever made.

Why female investors are key to creating more Latin American unicorns

Ultimately, the data suggests that an important key to Latin America’s continuing startup growth will be to bring more female investors to the table. Although the data is still emerging, there are a number of potential reasons that women may invest more in women and why this leads to faster exits and greater profits.

Diverse teams lead to better decision-making

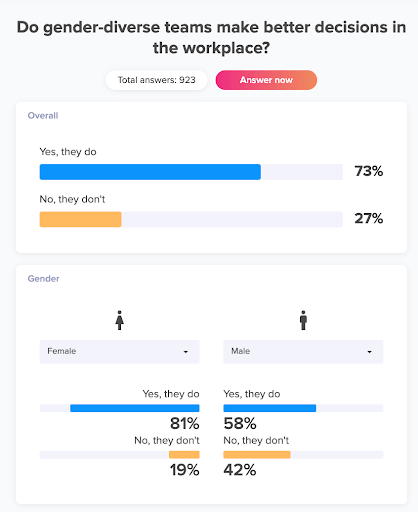

There are now many studies that show that diverse teams lead to better decisions. Public opinion agrees. On TruePublic, I asked the question, “do gender-diverse teams make better decisions in the workplace?”5 Seventy-three percent of people said they do. When broken down by gender, 82% of women and 59% of men responded in the affirmative. “At a greater than 450-person response rate, we can consider the data significant for research and consumption,” said CEO Kaben Clauson.

Experts echo this sentiment.

Susana Robles Garcia, one of the key champions for female founders and funders in Latin America over the past two decades, says that “any team with men and women together will have a better chance of profitability.” She continues, “Women tend to return money to investors faster than men, and at the same time they obtain higher returns. Women are in charge of 64% of all global purchasing decisions on products and services, so having women in C-level positions increases the chance that a startup be highly attractive to a massive market and become a unicorn.”

Many studies now bear this out. Ann Williams is COO of Brazilian powerhouse Creditas, which is nearing its own unicorn status. She is also one of the female angels invested in Theia. “In an environment that shows diversity you can be yourself, and when you can be yourself you do a better job,” she says.

Herrera, the Cowboy VC investor, adds that diverse teams “are able to see areas of opportunities that more homogenous teams might miss. I think the next generation of investors are more likely to question conventional wisdom, forms of pattern recognition that may lead to bias, and other structural barriers that have historically left out promising entrepreneurs.”

Camila Farani is a well-known investor in Brazil. In her role as founder of G2 Capital, former president of Gavea Angels and a personality on Brazil’s Shark Tank, she says “having diverse points of view at the table makes the decision clearer and more certain.” She adds, “People who think differently than you and have other visions of the market sometimes can show you what you can’t see by yourself.”

Take ALLVP, one of the leading VC firms in Latin America. It just hired their first female partner, Antonia Rojas Eing, who is also the youngest female partner in Latin America. As ALLVP founder Fernando Lelo de Larrea says, “To make the best decisions, you need diversity. We’re looking for EDGE and having women on our team lets us do that.”

Laura Huang, the Harvard University professor who wrote “Edge: Turning Adversity into Advantage,” is in agreement. “There have been dozens of empirical studies showing that diversity is valuable and provides a unique advantage. We have known this intuitively for a long time, or at least some have, and now we have the rigorous research to back it up. Diversity in thought, personal history, and demographics — including gender — is beneficial to both entrepreneurial and investor teams. It leads to creativity, richer perspectives, and more thorough analyses. Ultimately, diversity gives you an edge.”

And this matters on both sides of the table. Eric Perez-Grovas, co-founder and managing partner of Jaguar Ventures, which has more than 33% of its portfolio invested in female co-founders, says there are still male investors in Mexico who are worried a female founder will “get married and pregnant and abandon the ship.” Lelo de Larrea, whose own portfolio has invested 22% of its funds in female co-founders, says his fund is often perceived as female-led, and adds that being in the “business of trust” means that ALLVP doesn’t want female founders to come in on the defensive, worried they are going to have to face an inappropriate question. “That’s why having diverse founding teams and diverse investors is essential,” he says.

Like Perez-Grovas and Lelo de Larrea, Juan Manuel Giner identifies as another “male ally” who is passionate about diversity. “Diversity is important ALWAYS. Not only in gender, but also in background and experience,” said Giner, who is also executive director of ARCAP, the Argentine Association of Venture Capital and Private Equity. “In the world of investors and entrepreneurs, I believe more than ever diversity ensures that a team is more than the sum of its parts.”

Only 11.6% of Argentinian startups founded in 2019 had at least one woman on the founding team, but “this is changing, and I believe in Latin America it can happen in a more accelerated way,” Giner said. “It’s a question of time, but we need to make these issues visible to speed up the process. Research, publications and events can all help to put the issue on the table.”

The importance of investor-market fit

Sutian Dong, venture partner at Female Founders Fund, said she thought female investors are “better positioned” when it comes to finding opportunities in certain consumer products. Lara Lemann, who co-founded Brazilian VC firm MAYA Capital with Monica Saggioro Leal, agrees, and has invested 33% of their portfolio in female co-founders like Theia. “We have the advantage of understanding female-centric models like Theia in a way that maybe an all-male investment team does not.”

Nathan Lustig is the founder and managing partner of Magma Partners, a Latin American VC firm whose own investments into female co-founders beat the regional fund averages. There are several women in junior investing roles on his team. As he explains, “the first three people who look at our potential investments are women from three different countries. Their diversity of experience has helped us identify things that an all-male team might have overlooked.”

I call this Investor <> Market fit and argue that it is a far cry from the discriminatory nature of typical pattern matching that legendary VC John Doerr and his quest to match for a “white, male, nerds” co-founder produced in the larger industry.6 Instead, it speaks to a variation on the concept of Founder <> Market fit that Homebrew’s Hunter Walk swears by.

Take Sousmile, a dental beauty startup that retails in locations throughout São Paulo and which recently raised a $6 million Series A led by Kaszek Ventures, the leading fund in Latin America, and another fund that beats the averages for investing in female co-founders. Co-founder Ornella Moraes is one of Sousmile’s four female co-founders, alongside two male co-founders. “Our brand is a woman,” she says. “More dentists in the world are women than men, so it’s been critical for our team to have more female founders.” If Founder <> Market fit makes sense, I argue that so does Investor <> Market Fit.

Lustig says that as VC dollars grow in Latin America, so will this trend. “Investor-Market fit is something that many founders, especially in emerging markets, haven’t had the luxury of having: they’ve had to take money from the small number of funds that had the capital. That’s changing as more people from more backgrounds, especially entrepreneurs, are joining VCs or starting their own. It’s one of the biggest pieces of advice that we stress to our portfolio companies when they’re going out to raise follow on funding.”

The positive cycle of building an ecosystem

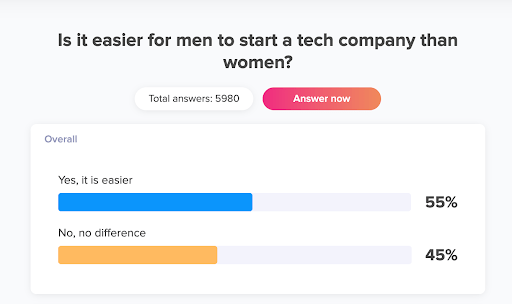

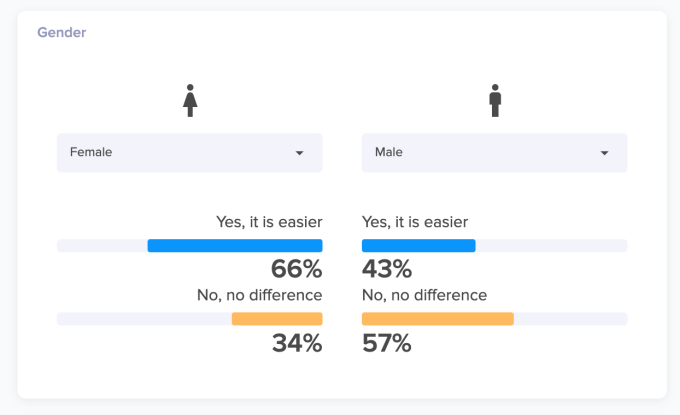

“Saying you are gender-blind doesn’t change the gap,” says Lelo de Larrea of ALLVP, the Mexican VC firm that just hired its first female investing partner. That’s why peers, mentors, allies and champions are all essential. And those come when you build an ecosystem. They make you more likely to get the meeting. They make you better prepared for the boardroom. They give you confidence inside. And they make you more likely to close the deal. This is critical, given that the public agrees that building a tech company is simply harder for women. In my study with TruePublic, we found that 55% of the nearly 6,000 respondents agreed it was easier for men to start a tech company. Of the 45% who disagreed, 57% were men and only 34% were women.7

The importance of an ecosystem is “key” says Robles. Alongside Marta Cruz, co-founder of NXTP Labs, another Latin American fund over-indexing into female co-founders, Robles and Cruz have been credited for leading the charge to build an ecosystem of female founders and investors in Latin America. They have done so through programs like WeXchange, a platform that connects women entrepreneurs from Latin America and the Caribbean with mentors and investors; WISE, an organization for STEM entrepreneurs; and LAC, a community for female investors and entrepreneurs. Ultimately, Robles said it is “sheer need that pushes you to collaborate,” and that an ecosystem like Silicon Valley simply doesn’t have the same need to bring people together. “In 10 years, we will have created a much more collaborative market than the developed markets,” which she says are traditionally more “cutthroat.”

The importance of an ecosystem is “key” says Robles. Alongside Marta Cruz, co-founder of NXTP Labs, another Latin American fund over-indexing into female co-founders, Robles and Cruz have been credited for leading the charge to build an ecosystem of female founders and investors in Latin America. They have done so through programs like WeXchange, a platform that connects women entrepreneurs from Latin America and the Caribbean with mentors and investors; WISE, an organization for STEM entrepreneurs; and LAC, a community for female investors and entrepreneurs. Ultimately, Robles said it is “sheer need that pushes you to collaborate,” and that an ecosystem like Silicon Valley simply doesn’t have the same need to bring people together. “In 10 years, we will have created a much more collaborative market than the developed markets,” which she says are traditionally more “cutthroat.”

MAYA Capital also believes in the power of collaboration. Lemann says, “At the end of the day, we want to create an ecosystem that supports and celebrates women in entrepreneurship.” And she sees that it’s working. “At MAYA I think we see more women for three primary reasons. 1. Women seek us out; 2. We have the advantage of understanding female-centric models (like Theia) in a way that maybe an all-male investment team does not; 3. Since we see so few women, when we do, we make an extra effort to help them in any way we can.” She explains that this creates a positive cycle. “Since we give women more attention, they seek us out more, etc.”

Juliane Butty, startup head at Platzi and former regional manager of Seedstars, one of the leading accelerators and investors fostering female entrepreneurship in emerging markets, agrees that in order to increase the capital allocated to women, we need first to increase the effort into capacity building, working on the quantity and quality of venture-backed businesses by female co-founders.

Although she says stories of great female founders like Cristina Junqueira of Nubank and Vera Makarov of Apli are inspiring and give confidence to others, the path is still long. “We should not take this progress for granted. The gap remains important. Just look at the U.S.,” she says. “In 2019, companies founded exclusively by women raised less than 3% of venture capital funds. So when talking about investment allocated to female entrepreneurs, the whole world is an ‘emerging market.’ ” Butty believes that in order for Latin America to keep leading in terms of investment dollars and deals into women, “we need to triple our efforts!”

It won’t be easy, and it will require more female investors. Cowboy VC’s Herrera, who recently put together a list of Latina VCs in the U.S., says she faces triple challenges as a young Latina VC. “Most events I go to, I tend to be the only female, and I’m usually the only person of color. Sometimes I’m the youngest person in the room, too. But I will say that, in the past year, a lot has changed. We’re starting to see the rise of groups like All Raise working to bring together female investors in the same room and help build community.”8

Shelby Porges is the co-founder of both The Billion Dollar Fund for Women and Beyond the Billion, which have mobilized a global consortium of 80+ venture funds that have pledged to invest over a billion dollars into women-founded companies. She explains, “It’s clear what we need to do to increase funding for female-founded firms: first, get venture funds to ensure that they have women in their deal flow; second, make sure there are women among the decision-makers and third, connect the dots so that female founders seeking capital know which are the funds with a welcome mat out for women.”

Back in Latin America, that’s exactly what MAYA Capital is doing. “Our motivation to speak to and help more women stems from a need to find more success cases of female entrepreneurs in LatAm, to make some great investments and then to let these success cases inspire more generations of entrepreneurs. We need to work together to create successful examples, much like Theia, to demonstrate to other women that entrepreneurship is a valid career option and that they are allowed to dream bigger.”

Anna Raptis, founder of Mexico’s Amplifica Capital, which is on a mission to encourage more women to angel invest, agrees. “You can’t be what you can’t see.”

The path forward

Ultimately, data and knowledge sharing is a big part of making that change we want to see.

As Julie Ruvolo, managing director of venture capital for The Association for Private Capital Investment in Latin America (LAVCA), which has published the definitive lists of women in investing roles in Latin American tech over the past few years, says, “There’s a raw numbers issue, and there is also a visibility issue. Our goal was to address the visibility issue and make it easier for investors and entrepreneurs to identify female decision makers investing in Latin American startups.”

LAVCA’s lists have seen meaningful increases since they started tracking this cohort in 2016. Specifically, The Top Women Investing in Latin America (which includes partner-level investors at VC firms active in the region, as well as angels who have invested at least $50,000 USD in the region in recent years) increased by 7% since 2018. The Emerging Women Investors list (which includes junior and mid-level investment professionals at VC firms active in the region) increased by a whopping 89% year over year. Ruvolo explains that part of this is due to LAVCA’s increasing access and growing community, but more importantly, the number of firms investing in Latin American startups is rising as VC investment has been doubling year over year for the past three years, casting a wider net. “We still have a significant way to go to reach gender equity among tech investors and tech entrepreneurs in the region. And that’s only talking about gender diversity; there is an equally important conversation to be had about racial diversity in this sector globally.”

That’s exactly why the LAVCA data, Herrera’s list of Latina VCs in the U.S. and the new data and lists revealed in this article are so important.

Ultimately, we can’t only look at founders and investors. The number of women in the C-suite matter. The number of women on directory and advisory boards matter. And so do the overall cap tables. The current gender imbalance on cap tables, coined “The Gap Table” by #Angels, a women’s investing collective in Silicon Valley, has so far looked at the differences between founder equity and employee equity in U.S. companies. As April Underwood, founding partner of #Angels and former chief product officer at Slack, explains, #Angels sees this study as just the beginning. “Carta’s data set and partnership have helped us understand the gender equity gap in broad strokes, and it’s worse than we thought. But we need to go further, with Carta and other parties with data which can help us understand how the equity gap looks across other dimensions including ethnicity, age, and other drivers of economic inequity in all geographies.”

It is these kinds of studies that will help the female founders like Flavia Deutsch to better convince women to invest in high-growth companies like Theia. As Deutsch says, the data will only help to “walk the talk.”

Because we now know that female-co-founded teams perform better than all-male teams, we can see that the fact that Latin America’s VC dollars over-index for female co-founders may be a huge reason for the region’s success. Which suggests that should Latin America put more women in check-writing positions at VC firms, there would be no stopping Latin America.

“We know as an industry we can’t continue,” says Lelo de Larrea, of the need for more female investors. “Es una question de tiempo.” In English, Ann Williams of Creditas echoes his words. “It’s a matter of time.”

That time, in Latin America and throughout the world, is now.

- If you have information on a change or update to the data set, please email claire@clairediazortiz.com.

- 2“Do Female Investors Support Female Entrepreneurs? An Empirical Analysis of Angel Investor Behavior,” Seth C. Oranburg, Duquesne University School of Law, Pittsburgh PA, Mark Geiger, Duquesne University School of Business, Pittsburgh, PA ↩