When analyzing the cloud market, there are many ways to look at the numbers; revenue, year-over-year or quarter-over-quarter growth — or lack of it — or market share. Each of these numbers tells a story, but in the cloud market, where aggregate growth remains high and Azure’s healthy expansions continues, it’s still struggling to gain meaningful ground on AWS’s lead.

This has to be frustrating to Microsoft CEO Satya Nadella, who has managed to take his company from cloud wannabe to a strong second place in the IaaS/PaaS market, yet still finds his company miles behind the cloud leader. He’s done everything right to get his company to this point, but sometimes the math just isn’t in your favor.

Numbers don’t lie

John Dinsdale, chief analyst at Synergy Research, says Microsoft’s growth rate is higher overall than Amazon’s, but AWS still has a big lead in market share. “In absolute dollar terms, it usually has larger increments in revenue numbers and that makes Amazon hard to catch,” he says, adding “what I can say is that this is a very tough gap to close and mathematically it could not happen any time soon, whatever the quarterly performance of Microsoft and AWS.”

The thing to remember with the cloud market is that it’s not even close to being a fixed pie. In fact, it’s growing rapidly and there’s still plenty of market share left to win. As of today, before Amazon has reported, it has a substantial lead, no matter how you choose to measure it.

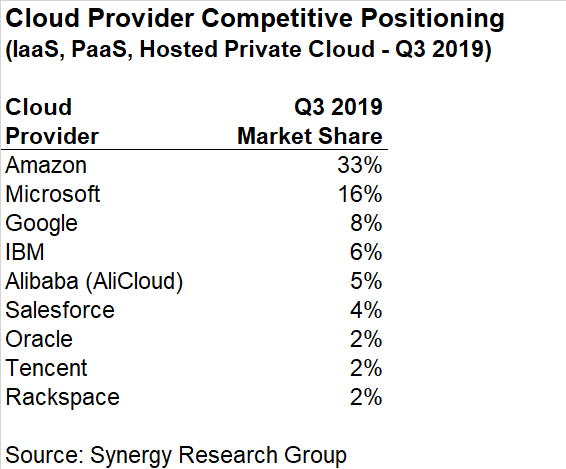

If you look at pure cloud infrastructure and platform services, Synergy shows Amazon with 39% and Microsoft with 19% in most recent analysis at the end of last October.

But Synergy tends to combine several categories, which takes down these numbers a bit. “In most of our market numbers we show total cloud services, so we also include revenues from Hosted/Managed Private Cloud services. This has the effect of bumping up market shares for firms like IBM and Rackspace and nudging down market shares for Amazon / Microsoft / Google / Alibaba,” said Dinsdale.

Microsoft keeps on keeping on

Why is Microsoft doing so well, yet remains stuck well behind Amazon? The power of first-mover market status is huge. Even with the tremendous success that Microsoft has experienced in its cloud numbers in the last several years, it’s extremely challenging to make up ground given the amount of time it took Microsoft to become competitive.

Don’t forget, AWS started in 2006, and while Azure has existed since 2009, it’s only taken off under Nadella’s leadership. He laid the groundwork as VP of servers and tools from 2011-2013 and led the growth of the cloud after he took over as CEO in 2014. Still, taking that long to get going gave AWS a huge advantage, and it’s hard to fix that, even with a huge addressable market still out there for the taking.

One thing is clear, there is plenty of business left to haggle over. AWS CEO Andy Jassy certainly made that clear at the company’s customer conference, re:Invent, last year, pushing the idea that the pace of change has been slow and that while companies struggle to transform, they need to find ways to fight through that and make the move to the cloud.

Playing to its strengths

Microsoft has some strengths it can exploit. One big opportunity we hear a lot centers around retail, as businesses that have lost ground to Amazon’s e-commerce business are reluctant to give their hosting business to AWS. Examples abound, including deals with Walmart, Kroger and Walgreens. That’s an area where in theory, Microsoft (and to some extent Google) could really take advantage.

Another area where it could develop customers is at the developer level, taking advantage of the $6.5 billion 2018 GitHub acquisition and other tools in its arsenal. RedMonk analyst Stephen O’Grady recently suggested in a blog post that Microsoft can capitalize on this community. “Whatever its product limitations, Microsoft — like Amazon — is a company that has always focused on the needs of developers. Unlike Amazon, Microsoft’s history with developer tools is excellent,” he wrote.

He added, “For the developer experience to be improved and fragmentation mitigated, it has to extend from project inception all the way through to deployment and operation. AWS has unparalleled reach post-deployment; its pre-deployment footprint is much more limited. Microsoft, by contrast, owns GitHub, which has in recent years itself dramatically expanded its reach via products such as Actions and acquisitions such as Semmle.”

He’s not wrong. Microsoft knows it has these strengths too, which is why it has used its resources to boost them through acquisitions, as O’Grady pointed out. Satya Nadella noted that strength in his earnings call with analysts this week:

From Azure DevOps to Visual Studio to GitHub, we offer the most complete developer tool chain, independent of language, framework or cloud. New capabilities make it easier for any developer to go from idea to code and from code to cloud. Developers can collaborate on the go with the new GitHub mobile app and GitHub Security Lab addresses the important need to keep open-source software secure.

Nobody is questioning that Microsoft has created a strong cloud product set with a nice developer entry point at the top of the funnel or its ability to deliver big numbers, as its earnings report yesterday clearly showed. Even with all the market left to conquer, it’s unclear who will grab the lion’s share — and that’s what’s going to be interesting to watch in the coming years.

For the time being, Amazon remains king of the mountain, reporting $9.95 billion in pure AWS revenue yesterday. That puts it on a run rate of close to $40 billion just for its cloud business. It has the engineering and financial resources to react to changes in the marketplace should its dominance be threatened by Microsoft or anyone else, making Microsoft’s mission all the more challenging.