When Visa bought Plaid this week for $5.3 billion, a figure that was twice its private valuation, it was a clear signal that traditional financial services companies are looking for ways to modernize their approach to business.

With Plaid, Visa picks up a modern set of developer APIs that work behind the scenes to facilitate the movement of money. Those APIs should help Visa create more streamlined experiences (both at home and inside other companies’ offerings), build on its existing strengths and allow it to do more than it could have before, alone.

But don’t take our word for it. To get under the hood of the Visa-Plaid deal and understand it from a number of perspectives, TechCrunch got in touch with analysts focused on the space and investors who had put money into the erstwhile startup.

The analysts’ take

Ray Wang, founder and principal analyst at Constellation Research, says that the deal will help both Plaid and Visa. “[Plaid represents] the most important bridge from old-school banks to fintech,” he said, adding that the startup’s “connections to [fintech companies] gives Visa access to massive customer sets.

Turning it around, Wang said the deal will help “take Plaid global, while giving it a dominant position to link customer accounts and sell more payment services.” So, the acquisition is a win for Plaid, and a win for Visa in his view.

CB Insights, a firm that keeps an eye on startup activity, noted in a recent report that Plaid’s penetration of various verticals is in the single digits, so there’s room for growth for both companies if things go well.

Dayna Ford, senior director and analyst at Gartner, says the acquisition should help Visa simplify electronic payments in whatever form that takes. “Plaid supplies data that supports money movement between bank accounts. It does not move money. Visa moves money and would like to keep it that way,” she said.

Ford added that Visa very much wants to influence the new processes of how money moves across the globe. “Buying Plaid gives Visa a more consistent seat at the table and view into fintech’s [startups’] innovations and puts them in a position to influence how the money actually moves,” Ford explained.

So analysts seem bullish on the deal. Of course, it’s not their shareholder equity that was spent buying the startup for a steep implied revenue multiple. But at least the business chattering class gives the deal a thumbs up.

Is fintech consolidating?

It remains to be seen whether Plaid’s acquisition has broader implications for the fintech startup ecosystem. If it does, we could see more deals, leading to a shake-out in various fintech verticals that sport multiple players.

Ford points out that Mastercard recently made some acquisitions of its own, including buying the payments platform owned by Nets for $3.19 billion last summer, so there is clearly some movement among the large credit card vendors.

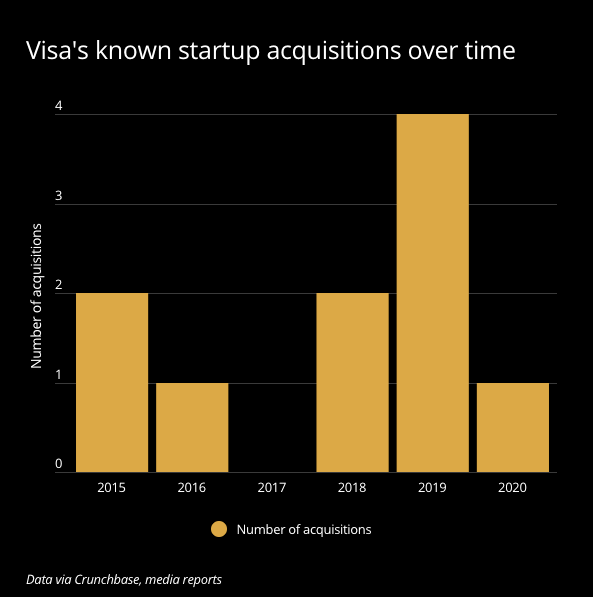

Visa made four acquisitions last year alone before announcing the Plaid deal this week; the giant was quieter in preceding years, however, with just two known purchases in 2018 and zero in 2017, according to Crunchbase data.

Ford says the company is signaling that’s it not done buying smaller companies. “Visa comments include references to becoming the ‘network of networks’ and it makes sense that traditional card networks will continue to expand into the bank-based, account-to-account network space,” she said.

He adds, “That has meant making money moving money has been difficult, so finding partners that can take the technology and integrate it into other services has led to consolidation.” In Wester’s view, the trend is “likely to continue as legacy financial technology companies look to improve their existing technology by acquiring companies with better technology and merge those acquisitions into larger product portfolios that can generate revenue.”

All of this should add up to low-cost money transfers for regular folks, and, hopefully, slicker fintech experiences overall with more vertical integration.

The impact on Plaid

With Plaid becoming part of a larger organization, it’s fair to ask if it will continue to innovate on the platform under Visa’s ownership or get sucked into the vortex of the large corporation.

Wester thinks the outcome will likely be positive. “For Plaid’s existing customers, its acquisition by Visa won’t likely have an immediate effect. […] Over time, they will be able to access additional services from Visa, so it will expand what they get out of the relationship. That should be a good thing,” he said.

Wang adds that success or failure comes down to a common factor. “They need to make sure the innovation spirit is there. Most acquisitions like this fail because of culture, not the technology itself,” he said.

NEA investor and Plaid board member Rick Yang has been with Plaid since its early-stage days as a seed and Series A investor in the company. Something that was quickly apparent during our chat was his emphasis on the “alignment” between Plaid and Visa. Without that, in Yang’s view, the founders wouldn’t have agreed to the deal.

That makes pretty good sense, as the founders likely had the ability to either raise more money and stay independent or select a different acquiring partner. (Yang also briefly extolled Plaid’s operations and capital efficiency. Doing some quick math, Plaid’s return on investment capital [ROIC] is more than 18x. That’s as much of a fact check as we can do, but it seems good enough.)

Any deal like this one, however, brings to mind an interview at TechCrunch Disrupt in 2014 with Pure Storage CEO Scott Dietzen, where the executive made plain his view on selling a company: “Acquisitions always suck, and suck worse than you think that they are going to suck.” Visa is surely going to do everything in its power to buck that trend after spending $5.3 billion to get Plaid.