Back in 2013, Dropbox was scaling fast.

The company had grown quickly by taking advantage of cloud infrastructure from Amazon Web Services (AWS), but when you grow rapidly, infrastructure costs can skyrocket, especially when approaching the scale Dropbox was at the time. The company decided to build its own storage system and network — a move that turned out to be a wise decision.

In a time when going from on-prem to cloud and closing private data centers was typical, Dropbox took a big chance by going the other way. The company still uses AWS for certain services, regional requirements and bursting workloads, but ultimately when it came to the company’s core storage business, it wanted to control its own destiny.

Storage is at the heart of Dropbox’s service, leaving it with scale issues like few other companies, even in an age of massive data storage. With 600 million users and 400,000 teams currently storing more than 3 exabytes of data (and growing) if it hadn’t taken this step, the company might have been squeezed by its growing cloud bills.

Controlling infrastructure helped control costs, which improved the company’s key business metrics. A look at historical performance data tells a story about the impact that taking control of storage costs had on Dropbox.

The numbers

In March of 2016, Dropbox announced that it was “storing and serving” more than 90% of user data on its own infrastructure for the first time, completing a 3-year journey to get to this point. To understand what impact the decision had on the company’s financial performance, you have to examine the numbers from 2016 forward.

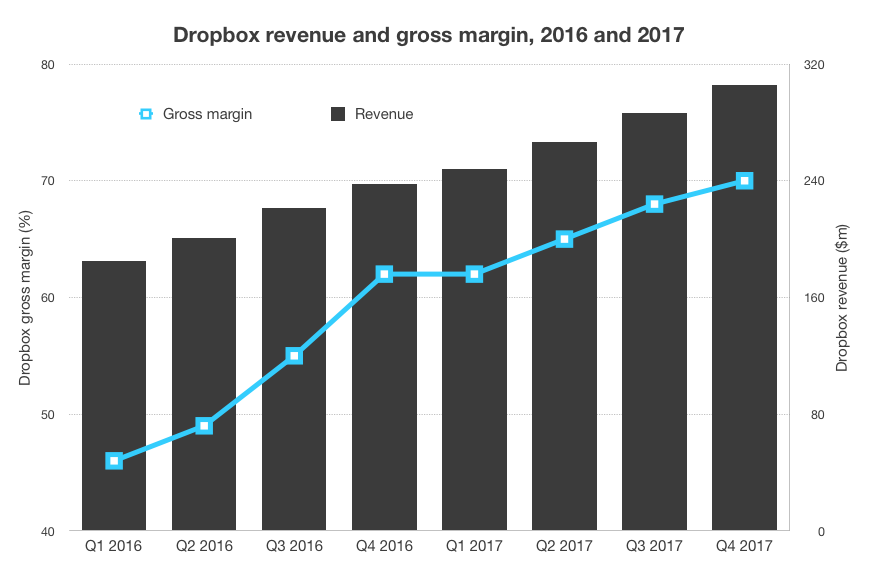

There is good financial data from Dropbox going back to the first quarter of 2016 thanks to its IPO filing, but not before. So, the view into the impact of bringing storage in-house begins after the project was initially mostly completed. By examining the company’s 2016 and 2017 financial results, it’s clear that Dropbox’s revenue quality increased dramatically. Even better for the company, its revenue quality improved as its aggregate revenue grew.

Dropbox’s gross margins during 2016 and 2017 quickly improved as its revenue continued to grow. Chart: Alex Wilhelm

Dropbox’s revenue grew from $185.0 million in the first quarter of 2016 to $305.5 million in the final quarter of 2017. Over the same period, the company expanded its gross margins from 46% in the quarter when it announced its nearly-complete self-storage project to 70% in the final quarter of 2017.

In more human terms, after bringing storage in-house, Dropbox’s revenue quality steadily improved; many factors were certainly at play, but the sharp improvements were likely due to moving data off of AWS and bringing storage costs under control. It’s worth noting that Dropbox’s gross margins have continued to improve in the ensuing years, reaching 75.5% in its most recent quarter. But the bulk of the improvement trend appears to have happened right after the completion of the in-house storage project in 2016 and 2017.

Moving to its own infrastructure allowed Dropbox to keep more of its revenue to help cover operating costs, improving profitability and cash flow at the same time, resulting in a more valuable business. If the company had failed to improve its margins past the ~50% range, it would be worth a fraction of what it is today.

That translates to billions of dollars in saved value. Moving to its own storage was worth every penny for the San Francisco-based company.

Still taking a hybrid approach

In spite of the obvious financial advantages of going its own way in 2016, Andrew Fong, Dropbox’s head of infrastructure, says his company still sees hybrid as a viable strategy and partners with Amazon on a number of fronts, especially when the tech falls outside their primary skill set as a company. “There’s a set of things that we believe Amazon will always be a very good partner for and offer a much better technology stack than we could build internally,” he said, citing analytics as an example.

“When you look at the investment Amazon has made in the ecosystem around analytics, it’s always going to be there faster and be able to get out the door with better technology than we will because our core competencies are very much around storage,” he said.

He adds that another area Amazon can help Dropbox is around international expansion, and he says that the company deliberately designed the back-end they call Magic Pocket to be flexible enough to accommodate internal and external options.

“Amazon also has enabled us to be a little bit more agile around international expansion. So one of the things we’ve done in this past year alone is that, we launched Tokyo and Australia data centers as storage locations, and both of those are actually S3-backed,” he said.

The company also uses Amazon for desktop client distribution and for bursting workloads when capacity outstrips their ability to keep up in house.

Best of both worlds

While most companies move from a privately-run data center to the cloud, Dropbox chose to buck conventional wisdom and bring its storage component in-house. As it grew, the company’s cloud storage bills were cutting into its gross margins in a way that was not sustainable long-term. They were able to solve that by building instead of buying.

Yet in spite of the success of that move, it has not rigidly adhered to either an in-house or cloud strategy. Instead, it has taken a hybrid approach, continuing to partner with AWS when it makes sense, and getting the best of both worlds.