Even when Apple telegraphs its hardware strategy, it’s proving to be nearly impossible for startups to beat them.

The company’s executives have been motioning interest in following their runaway success on mobile with hefty investments in augmented reality, something that has led to the rise of dozens of venture-backed startups hoping to beat Apple to the punch by creating their own AR headsets.

In 2019, this vision collapsed for some of the most recognizable AR startups as reality proved less predictable than executives at these startups had imagined. A trio of shutdowns this year painted the root cause — overreach, framed by high burn rates and an overly optimistic attitude toward respective software ecosystems taking off.

My prediction earlier this year of a rough 2019 is exactly what happened.

ODG

At the beginning of the year, I reported on the collapse of Osterhout Design Group. The augmented reality startup was an early pioneer in the AR space that capitalized on industry excitement to raise a $58 million Series A in 2016. Following that raise, the company overreached, expanding its product lines even as it failed to squash manufacturing bugs in its current generation products.

“That’s a little bit the story of ODG and Ralph, in general: everything is a prototype, nothing is finished, and before one thing is 60 percent done, you’re already onto the next one,” a former employee told TechCrunch at the time. “I think the heart of ODG’s downfall was its lack of focus.”

The company laid off employees as acquisition talks with Facebook and Magic Leap fell through, sources told TechCrunch, before it was forced to sell off assets to an undisclosed buyer earlier this year.

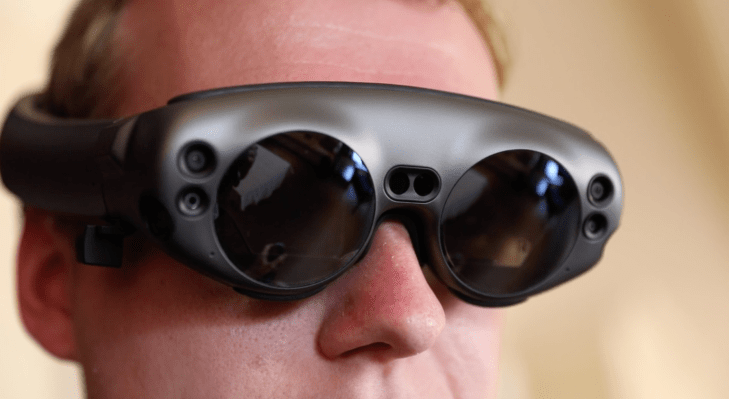

Meta CTO Kari Pulli wearing the company’s latest headset.

Meta

One of the more bizarre stories in the AR headset space was the folding and reincorporated unfolding of Meta, a Y Combinator-backed AR headset company that was also an early entrant which decided to ramp up its spending as Apple and others began to invest in the technology.

Like ODG, Meta’s demise also came as early as it did partially due to a negative trade climate with China, which left the firm scrambling as a Chinese backer who was poised to lead a new round of funding walked away. That stroke of bad luck marked the beginning of the end for Meta, whose CEO Meron Gribetz kept the company alive on fumes just long enough to find a second home for the IP earlier this year, selling assets to Olive Tree Ventures which set up a new venture named Meta View.

Meta raised $73 million.

DAQRI

In September, I reported on the imminent shutdown of Daqri. The enterprise-focused augmented reality startup founded in 2010 had spent years building out its AR business around a helmet-shaped AR hardhat only to be quickly overtaken by Microsoft’s HoloLens and entered 2019 on the verge of collapse.

As of mid-2017, a Wall Street Journal report detailed that Daqri had raised $275 million in funding

In many ways, the hubristic startup collapses of 2019 were just the final chapters of AR companies emboldened by the hype in 2016 and 2017 wrapping their death throes in a time period where even low-quality investment was harder to come by in the space.

In conversations with industry insiders, some apparent signals for this VC slowdown were headlines surrounding Magic Leap’s stumbles in making good on its more ambitious tech promises. As the fast-spending startup failed to miniaturize some of its most impressive technologies, late-stage investors grew cold to the entire sector.

Nevertheless, Magic Leap has continues to raise capital even as news of its product development reached a standstill in 2019. It’s raised at least $2.6 billion to date, including $280M from Japan’s DoCoMo in April. A spokesperson for the company told Variety last month that Magic Leap was in the process of closing a Series E round.

Despite releasing the first version of its augmented reality glasses in 2018 and welcoming developers to its platform, the company has had precious little to say in public about its products. After hosting its first developer conference last summer, a flashy affair in LA with a 3-hour long keynote led by the company’s CEO Rony Abovitz, Magic Leap did not hold a similar event this year.

Notably, the company has not offered up any details on a follow-up to its first headset, which it has been careful to frame as neither a consumer-focused product, enterprise-focused product or developer product. Earlier this month, The Information reported the company had sold just 6,000 units of the headset.

After years of hyping its technology ahead of debuting in 2018, in 2019 the company has grown suspiciously quiet.

Even as Apple reportedly readies multiple AR products for release in the next several years, including a pair of AR glasses for 2023 according to a report from The Information, the landscape for startups looking to compete has never looked quite this grim. There are still plenty of entrants, but the small startups left will likely have a tough time raising capital to expand their niche efforts in 2020.