A little over a year after sparking a legal firestorm for musing that he would take Tesla private for $420, Elon Musk is likely glad he didn’t.

Tesla’s stock just hit a record high yesterday, brushing close to $400 per share and putting the company within striking distance of that $420 figure that cost Musk $20 million in fines with the Securities and Exchange Commission.

Since Tesla announced a surprise profit in the third quarter of the year the stock has been on a tear, recovering from its year-long tumble wrought by Musk’s Twitter tirades and extracurricular shenanigans.

The company’s core business is looking very strong, thanks in part to a weak performance by rival automakers electric vehicle offerings and the seemingly successful ramp up of manufacturing and sales in China.

There’s also another tailwind at the back of Tesla’s business and that’s in its far smaller (for now) energy business.

Lost in the hubbub over the decisions to slash costs of its Chinese manufactured vehicles by 20%; the success of the new gigafactory in the country; and the beginnings of a new gigafactory in Berlin was the news that the company had sold its first Megapack — a massive lithium ion battery installation — to a utility in Alaska.

The Megapack is the latest iteration of Tesla’s energy storage ambitions, building on the success of the company’s Powerwall for home installations and Powerpack for businesses and utilities.

In Alaska, Tesla’s 93 Megawatt hour capacity Megapack is going to be installed by the Homer Electric Association, an electric cooperative in the state. The power can be delivered at a rate of 46.5 megawatts per hour, which is enough to power roughly 30,000 homes (based on distribution estimates from the Idaho utility, which has a somewhat similar climate to Alaska).

“The BESS will allow [Homer Electric Association] to meet its reliability requirements without having to burn additional fuel. This will result in greater system efficiencies, lower greenhouse gas production, and reduced power outages,” the energy coop said in a statement.

As prices for renewable energy fall across the country — bringing solar and wind energy into cost-parity with natural gas in some states and making the energy far cheaper than coal, new energy storage projects will need to come online to ensure the stability of the energy grid.

That’s going to create more demand for energy storage technologies like Tesla’s.

Lots of battery manufacturers are seeing more demand come from utilities and venture capital dollars are flowing back into the once-maligned battery industry.

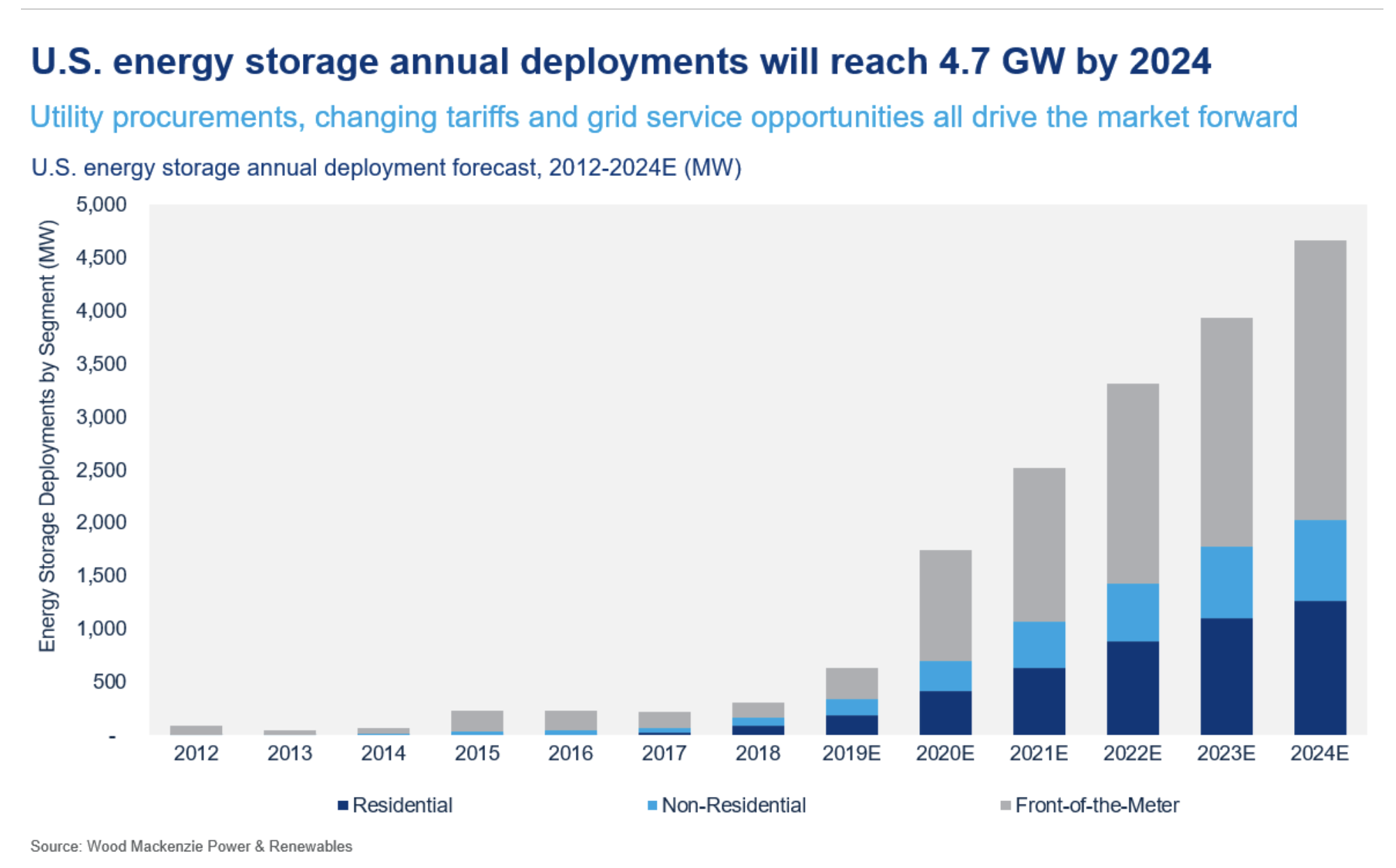

Estimates from the Energy Storage Association and the analyst firm Wood Mckenzie indicate that there’s going to be a huge surge in energy storage projects over the next four years. By 2024, energy storage projects will hit 4.7 gigawatts by 2024 and be worth roughly $5.3 billion, according to Wood McKenzie Energy & Research.

Tesla is uniquely positioned to capture a large portion of this spending. The company already operates the second largest battery-based energy storage project in the world through its battery installation in Australia (Hyundai took the top spot with a 150 megawatt lithium ion battery project in Korea).

While Elon Musk is known for bombastic statements, he’s not wrong about the opportunities that lie ahead for Tesla’s energy business. Indeed in the third quarter the energy business raked in $402 million with gross margins of around 23%.

“It could be bigger, but it will certainly be of a similar magnitude,” Musk said during the third quarter earnings call.