Prosus Ventures last week filed a hostile offer for British food delivery startup Just Eat, an attempt to defeat a unanimous rejection from its board and simultaneously fend off a bid from rival Takeaway.

The giant Naspers spinoff said it was willing to pay as much as $6.3 billion in cash to lure Just Eat, one of Europe’s largest foodtech players.

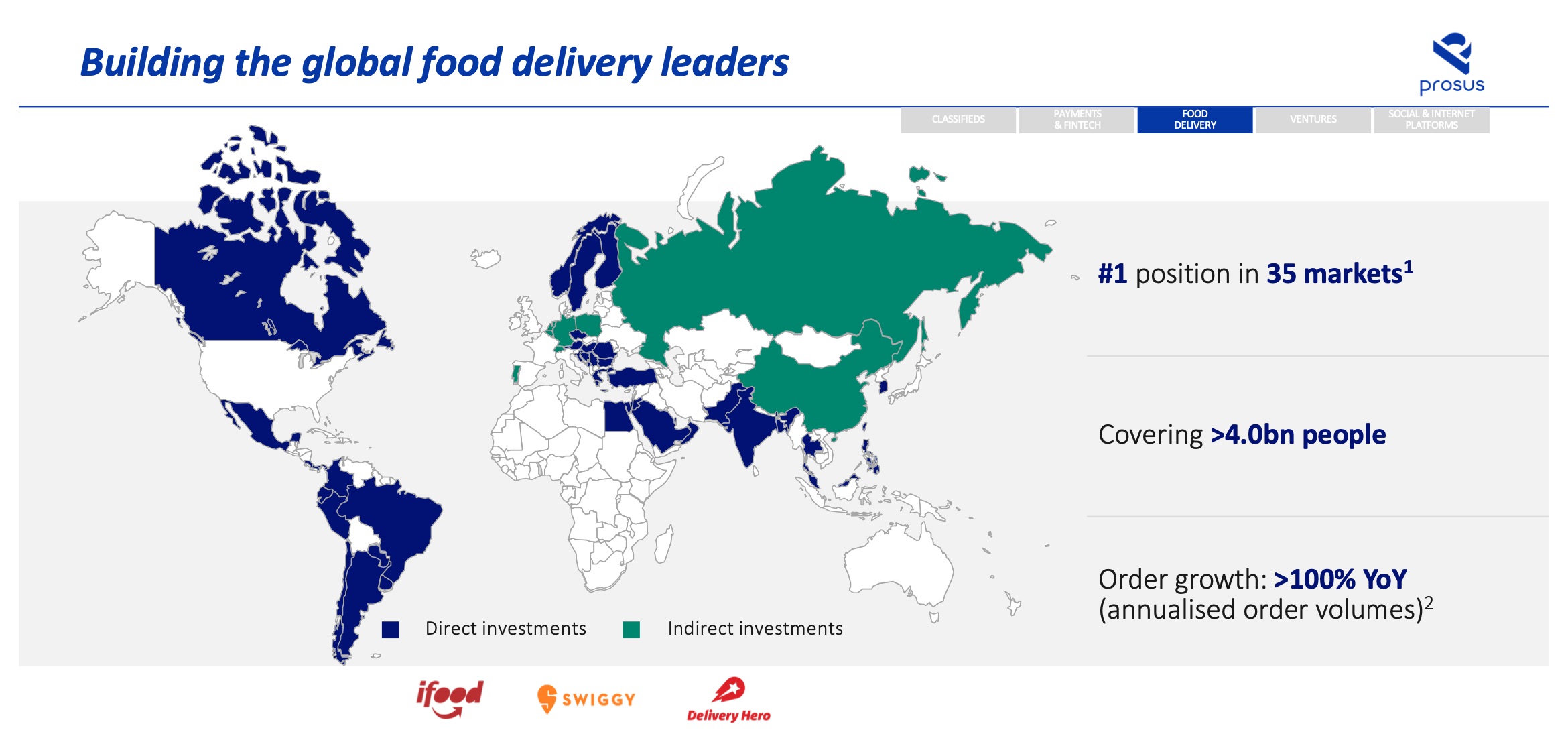

Prosus’ major bet on online food startups shouldn’t come as a surprise; the recently-listed subsidiary, whose parent firm has invested in companies in more than 90 nations, has shown a great appetite for food delivery startups globally.

How deeply Prosus believes in foodtech is perhaps on display in emerging markets such as India, one of the most buzziest nations for the investment firm, where the unit economics doesn’t work yet for almost any internet startup and probably won’t for another few years.

Prosus Ventures’ investments in food delivery startups globally

Last year, South Africa-based Naspers led a $1 billion financing round for Indian food delivery startup Swiggy. The investment firm contributed $716 million to the round, just shy of the roughly $750 million that Swiggy’s chief rival, Zomato, has raised in its 11 years of existence.

TechCrunch spoke with Larry Illg, CEO of Prosus Ventures and Food, and Ashutosh Sharma, head of investments for India at the venture firm, to understand how significant foodtech is for the investment firm and the bets it is making in India.

Swiggy

“We had a thesis on food delivery globally,” said Illg, describing the company’s first search for a food delivery company in India. “We knew that at least one big player will be there in India in the future. We went around the town and spoke to a lot of startups.”

And then they found Swiggy. But, Illg said, it was a very different Swiggy from the one that currently dominates the Indian market. “So here was a food delivery startup that was already profitable. The only challenge was that it was operational in just six cities in India.”

And thus began Naspers’ journey to convince Swiggy to expand its service nationwide. Now operational in more than 500 cities around the country, Swiggy today competes with Zomato, UberEats, and Ola-owned FoodPanda (now known as Ola Foods).

Prosus Ventures’ Sharma, who heads India business, cautioned that it is early for food startups in India. “I want to say we are on day one, but it might as well be day zero. The number of smartphone users in India who are ordering food online is still less than 2%,” he said.

But even this nascent category has attracted some tough competitors. While UberEats and Ola’s Foods are struggling to make a significant dent, Swiggy and Ant Financial-backed Zomato are locked in an intense battle.

Both companies, according to industry reports, are losing more than $20 million each month. Zomato was burning about $45 million each month a year ago, Info Edge, a publicly-listed investor in the startup revealed in its recent earnings call with analysts.

Illg is not really bothered with the frenzy cash burn in India’s food delivery market, and said Prosus has no shortage of cash, either.

That cash might come in handy very soon. A source at Zomato told TechCrunch that the company is in talks to raise as much as $550 million in a round led by Ant Financial.

TechCrunch reported earlier this year that Zomato is quietly setting up its own supply chain to control the raw material its restaurant partners use. Two sources familiar with Zomato say the food delivery startup is thinking of expanding beyond delivering food items.

Earlier this year, Swiggy announced that its delivery fleet can now move just about anything from one part of the city to another. The service, called Swiggy Go, is currently limited to select cities. Zomato plans to replicate this, sources say. Neither of these developments have been previously reported.

Additionally, cloud kitchens are current area of focus for Swiggy. This week, the company announced it has established more than 1,000 cloud kitchens in the country, more so than any of its rivals.

Illg said cloud kitchens are crucial for a country like India, which has a low density of restaurants. “We have the visibility of all the market dynamics,” he said. “We can look at a location, comb through the data and know what kind of restaurants and food supplies would work there.”

For restaurateurs, cloud kitchens reduce risk when they look for expansion. “You have figured out the menu, and you know the operations. But you still have to take a big real estate risk when picking the location. Kitchens allow them to de-risk all these factors,” he said.

On a sober note, Illg added that “coupons and discounts” that food delivery startups are bandying out in India are there to “encourage some behaviours,” such as trying out a new restaurant. But over time, “it would fade away.”

But that doesn’t mean the core prices of food purchase would increase. “People ask me, ‘when are you going to raise the prices?’ The answer is never. Our whole bet is that by using technology, setting up cloud kitchens and scaling up operations, the company will attain a stage where it can afford to keep the prices stable, if not lower them further.”

This reveals part of the strategy that separates Prosus Ventures from other firms. Prosus expects its portfolio startups to take time to establish dominance in the market and in becoming profitable, Illg said, who added that he doesn’t mind if a company takes as long as “20 years to get there.”

One of the most fascinating things we learned talking to Illg is how he sees India. At a time when a growing number of startups and companies are beginning to realize that they have really tapped the addressable market, Illg says the actual market is much bigger. “Swiggy can leverage its scale and operations expertise to take the price out of the market. That will expand the market,” he said.

Other bets in India

You can’t really talk about Swiggy without mentioning Sharma; he joined Naspers in 2016, and Swiggy was the first deal he struck.

We recently met at a cafe at Indira Nagar in Bangalore, a startup hub city. As I entered the cafe, Sharma was just about to finish a meeting with Sandeep Deshmukh, co-founder and chief executive of ElasticRun, a startup that aims to solve India’s logistics nightmare.

Earlier this month, three-a-half-year-old ElasticRun announced that Prosus Ventures had led its $40 million Series C financing round.

Some of Prosus Ventures’ biggest investments in India

Prosus Ventures, which began investing in India 11 years ago, has invested about $4.5 billion to date in the country, Sharma said in the interview. In the past, Prosus Ventures invested in startups like e-commerce giant Flipkart, which was sold to Walmart last year for a sweet $18 billion; PayU (which it owns), and online travel ticketing platform MakeMyTrip.

This year, it has invested in carpooling service Quick Ride and led a $125 million round in social commerce startup Meesho. The company is also a big stakeholder in edtech startup Byju’s, which was valued at $5.75 billion earlier this year.

But the investment firm is just getting started, Sharma said. “The proliferation of smartphones and plummeting of mobile data prices in recent years have dramatically turned India into an even bigger market,” he said.

What’s more fascinating is that the new batch of startups like Meesho and ElasticRun are solving problems that are not faced in the west. “Since we are not a venture capital fund and have no particular mandates, our check size can vary from a million to hundreds of millions of dollars,” he said.

In light of the considerable bets Naspers has made in India, it’s surprising that it only has two people in the country. “We are a global company. Whenever I need advice, Larry and others quickly take a flight and get here,” Sharma explained.

This global approach has perhaps become the biggest strength of the investment firm. “When we have someone investing in a food delivery or edtech platform in Brazil, I offer a helping hand. That’s how we work.”

For startups Prosus Ventures has invested in, this also means that it is always thinking about ways to explore ways to take its startups in other markets. “If Swiggy’s model works in India, and we think there are similar opportunities in other markets,” said Sharma, “you can bet that it’s a path we all seriously consider taking.”