SAP CEO Bill McDermott announced he was stepping down last night after a decade at the helm in an announcement that shocked many. It’s always tough to measure the performance of an enterprise leader when he or she leaves. Some people look at stock price over their tenure. Some at culture. Some at the acquisitions made. Whatever the measure, it will be up to the new co-CEOs Jennifer Morgan and Christian Klein to put their own mark on the company.

What form that will take remains to be seen. McDermott’s tenure ended without much warning, but it also happened against a wider backdrop that includes other top executives and board members leaving the company over the last year, an activist investor coming on board and some controversial licensing changes in recent years.

Why now?

The timing certainly felt sudden. McDermott, who was interviewed at TechCrunch Sessions: Enterprise last month sounded more like a man who was fully engaged in the job, not one ready to leave, but a month later he’s gone.

But as McDermott told our own Frederic Lardinois last night, after 10 years, it seemed like the right time to leave. “The consensus was 10 years is about the right amount of time for a CEO because you’ve accomplished a lot of things if you did the job well, but you certainly didn’t stay too long. And if you did really well, you had a fantastic success plan,” he said in the interview.

There is no reason to doubt that, but you should at least look at context and get a sense of what has been going in the company. As the new co-CEOs take over for McDermott, several other executives including SAP SuccessFactors COO Brigette McInnis-Day, Robert Enslin, president of its cloud business and a board member, CTO Björn Goerke and Bernd Leukert, a member of the executive board have all left this year.

Activist investors on board

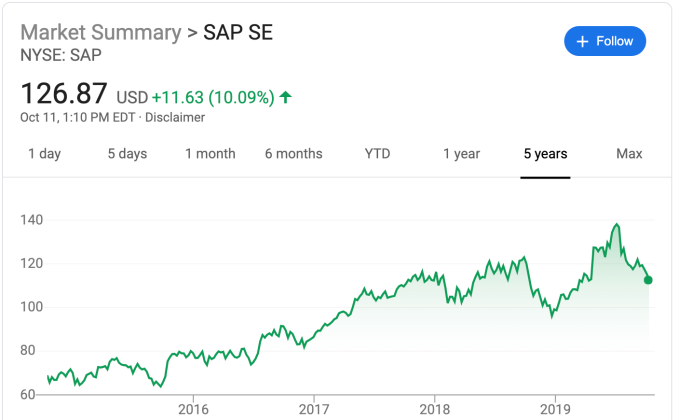

Last April, at around the time that Enslin announced he was leaving, McDermott had to deal with another issue when Reuter’s reported that Elliott Management had bought a $1.35 billion stake in the company. Elliott usually goes after undervalued companies, whose stock has seen better days. It’s worth noting that SAP stock has shown fairly steady growth over the last five years under McDermott’s leadership.

Regardless, Elliott tends to take an activist role, making leading a company significantly more challenging, and while it didn’t want to comment on yesterday’s move, it’s possible that Elliott’s presence was a factor in McDermott’s decision to step away.

It’s worth noting in that in its latest quarterly report announced this week, company revenue was up 13 percent to $7.5 billion for the quarter. The number beat analyst’s expectations of around $7.3 billion, according to reports. The company also predicted a strong revenue outlook for next year.

The licensing issues

Another issue that could have had a factor in McDermott’s decision (and the executive exodus this year) are issues the company has had with its licensing model, known as “Indirect Access, where they moved from a user-driven model to one that bills for indirect digital access or machine-to-machine interactions. The approach has reportedly confused customers, who had a difficult time understanding it, and it sometimes led to usage audits and substantially higher fees.

In one particularly egregious case Diageo, a British alcoholic beverage vendor, was ordered by a court to pay over $68 million in fees to SAP. This was because, as German business publication Handelsblatt reported, “[Diageo] had unwittingly allowed the US firm Salesforce to use data generated by SAP software to help it with marketing. The small print in SAP’s contract spelled out that fees were payable if such data was used by a third party.” The report went onto say the parties settled out of court.

While Forrester analyst Duncan Jones wouldn’t speculate on why McDermott was leaving, he said you have to see his legacy in the context of the licensing issues. “I have a lot of clients with negotiation issues and licensing and stuff like that. I can’t get passed the whole indirect access problem — scandal if you like. Bill wasn’t responsible for that, but he was at the helm while it was happening and didn’t do enough to prevent it. So I think a lot of people will remember that, along with the positive changes that he made,” Jones told TechCrunch

The company has since attempted to shift and clarify the policy, but it created a lot of uncertainty.

New leadership

SAP Co-CEOs Jennifer Morgan and Christian Klein

Jones believes that it was time for a change, and for the organization to shift away from a predominantly sales focus to a more balanced approach between product and sales, which the co-CEO roles bring. “I think it’s a positive move, and one that has balance because one [CEO] is focused on product, one sales; one is German, one American and one is male, one female — which is also something to be praised — and this change is something that existing customers should generally look favorably on,” he said.

Constellation Research founder and principal analyst Ray Wang sees SAP founder Hasso Plattner in a similar role to Oracle founder Larry Ellison. He’s someone who still maintains a strong influence over the business, while putting a pair of capable executives in charge of the day-to-day operations of the company, a strategy that Ellison has employed until recently with co-CEOs Safra Catz and Mark Hurd. (Hurd took a leave of absence recently for health reasons.)

“Both Jen and Christian have proved themselves over the past years that they are ready as insiders for the job. The founders have put operators they trust in sales and operations,” Wang said. He says that while the new executives will be calling the shots on the next-generation vision of the company, Plattner will continue to drive product.

In an interview with TechCrunch’s Frederic Lardinois last night, the two Co-CEOs made their individual leadership emphasis clear. Morgan will be focused on engineering and bringing back an engineering mindset to the company, while combining it with the cloud. “We’re excited about creating a renewed focus on the engineering DNA of SAP, combining the amazing strength and heritage of SAP — and many of the folks who have built the products that so many customers around the world run today — with a new DNA that’s come in from many of the cloud acquisitions that we’ve made,” Morgan told Lardinois.

For Klein, it will be more about revenue and sales, but don’t expect big changes because he sees a strategy that’s working. “I see a huge shift now towards S/4, and the core and business case is there, supporting new business models, driving automation, steering the company in real time. All of these assets are now coming together with our great cloud assets, so for me, the strategy works,” he said in the interview.

As the company shifts to new leadership, McDermott will be stepping away at the end of the year and moving on to whatever comes next. SAP will look to continue to build on the the acquisitions he made including CallidusCloud for $2.4 billion and Qualtrics for $8 billion, and a general attempt to shift the company focus from on-prem to the cloud. Now it’s the turn of the new leadership to put their stamp on the business and take it wherever it’s going next.