When you watch a commercial for one of the major stock exchanges, you are welcomed into a world of fast-moving, slick images full of glistening buildings, lush crops and happy people. They are typically interspersed with shots of intrepid executives veering out over the horizon as if to say, “I’ve got a long-term vision, and the exchange where my stock is listed is a valuable partner in achieving my goals.” It’s all very reassuring and stylish. But there’s another side to the story.

I have been educated about the realities of today’s stock exchange universe through recent visits with Brad Katsuyama, co-founder and CEO of IEX (a.k.a. The Investors Exchange). If Katsuyama’s name rings a bell, and you don’t work on Wall Street, it’s likely because you remember him as the protagonist of Michael Lewis’s 2014 best-seller, Flash Boys: A Wall Street Revolt, which explored high-frequency trading (HFT) and made the case that the stock market was rigged, really badly.

Five years later, some of the worst practices Lewis highlighted are things of the past, and there are several attributes of the American equity markets that are widely admired around the world. In many ways, though, the realities of stock trading have gotten more unseemly, thanks to sophisticated trading technologies (e.g., microwave radio transmissions that can carry information at almost the speed of light), and pitched battles among the exchanges, investors and regulators over issues including the rebates stock exchanges pay to attract investors’ orders and the price of market data charged by the exchanges.

I don’t claim to be an expert on the inner workings of the stock market, but I do know this: Likening the life cycle of a trade to sausage-making is an insult to kielbasa. More than ever, trading is an arcane, highly technical and bewildering part of our broader economic infrastructure, which is just the way many industry participants like it: Nothing to see here, folks.

Meanwhile, Katsuyama, company president Ronan Ryan and the IEX team have turned IEX into the eighth largest stock exchange company, globally, by notional value traded, and have transformed the concept of a “speed bump” into a mainstream exchange feature.

Despite these and other accomplishments, IEX finds itself in the middle of a vicious battle with powerful incumbents that seem increasingly emboldened to use their muscle in Washington, D.C. What’s more, new entrants, such as The Long-Term Stock Exchange and Members Exchange, are gearing up to enter the fray in US equities, while global exchanges such as the Hong Kong Stock Exchange seek to bulk up by making audacious moves like attempting to acquire the venerable London Stock Exchange.

But when you sell such distinct advantages to one group that really can only benefit from that, it leads to the question of why anyone would want to trade on that market. It’s like walking into a playing field where you know that the deck is stacked against you.

As my discussion with Katsuyama reveals, IEX may have taken some punches in carving out a position for itself in this high-stakes war characterized by cutting-edge technology and size. However, the IEX team remains girded for battle and confident that it can continue to make headway in offering a fair and transparent option for market participants over the long term.

Gregg Schoenberg: Given Flash Boys and the attention it generated for you on Main Street, I’d like to establish something upfront. Does IEX exist for the asset manager, the individual, or both?

Brad Katsuyama: We exist primarily for the asset manager, and helping them helps the individual. We’re one step removed from the individual, and part of that is due to regulation. Only brokers can connect to exchanges, and the asset manager connects to the broker.

Schoenberg: To put a finer point on it, you believe in fairness and being the good guy. But you are not Robinhood. You are a capitalist.

Katsuyama: Yes, but we want to make money fairly. Actually, we thought initially about starting the business as a nonprofit, But once we laid out all the people we would need to convince to work for us, we realized it would’ve been hard for us to attract the skill sets needed as a nonprofit.

Schoenberg: Do you believe that the US equity market today primarily serves investors or traders?

Katsuyama: I would say traders, and more specifically, high-speed traders.

Schoenberg: As you know, sometimes people think in black and white terms when it comes to HFTs. Is there any useful role for them?

Katsuyama: Yes. Absolutely. It’s an incorrect statement to say high-speed trading is bad.

Schoenberg: How about as a market stabilizing mechanism during periods when the natural buyers go away? Is there a role there?

Katsuyama: There is, but I’m not sure they play that. You listen to any high-speed trader talking about volatility, they talk about it as a moment of profit. And because the exchanges continue to raise prices on technology and data, the number of market makers has dramatically shrunk.

Schoenberg: Speaking of tech and data, I think you would agree that some of your competitors extract large rents for co-location, connectivity, data, etc. But as you said, you’re a capitalist. They are too. Do you have a problem with these economic rents because they are unfairly characterized, or is it because they increase systemic risk?

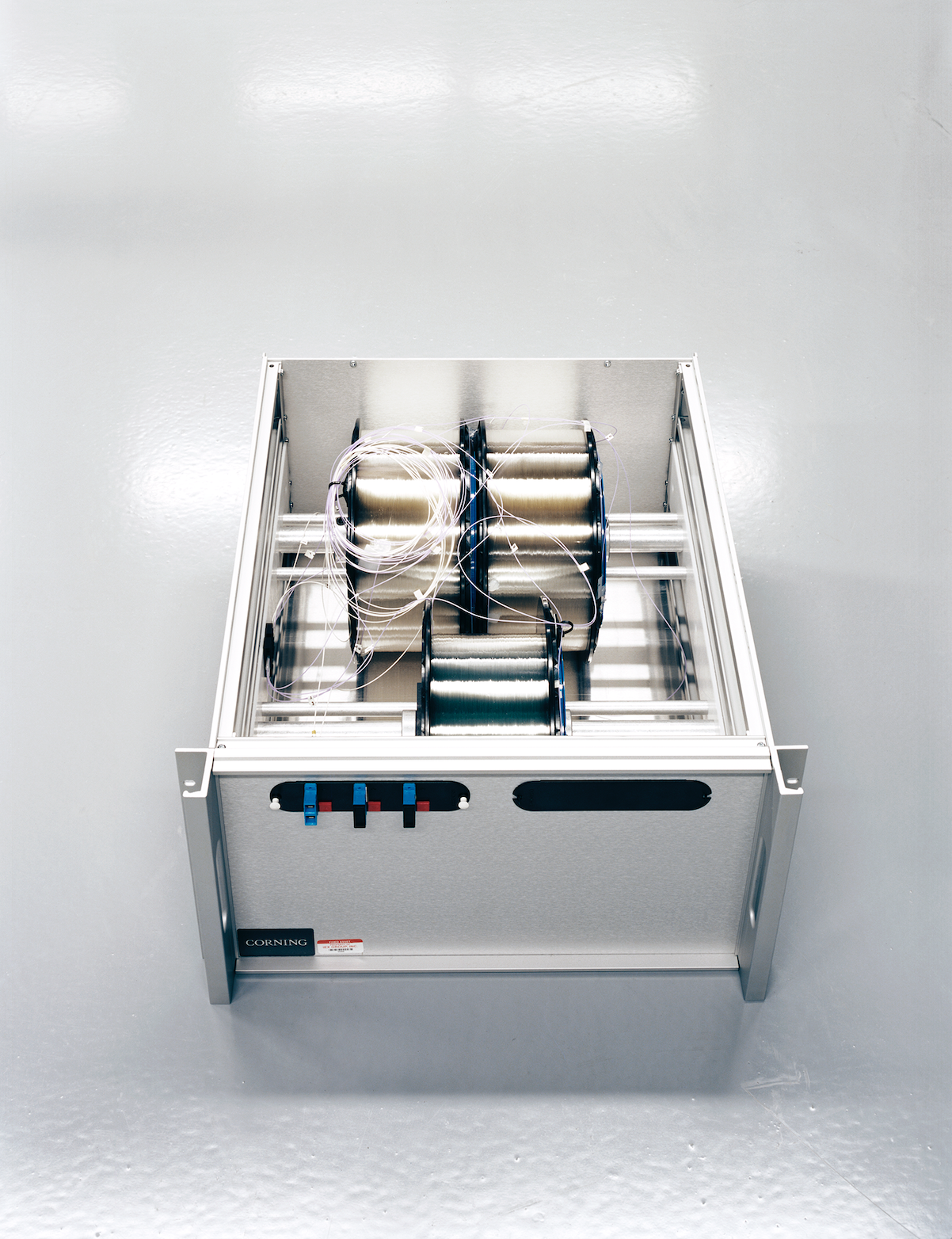

Katsuyama: Let’s talk about it in terms of priorities. When the exchange operators made the decision to prioritize speed, and basically sell things like co-location, high-speed market data, microwaves—

Schoenberg: —Which IEX does not do.

Basically, they abuse their market and regulatory position by selling market data connectivity for huge markups.

Katsuyama: Right. But when you sell such distinct advantages to one group that really can only benefit from that, it leads to the question of why anyone would want to trade on that market. It’s like walking into a playing field where you know that the deck is stacked against you.

Schoenberg: That leads to the topic of paying for order flow, which is also something you don’t do.

Katsuyama: Correct. And ask yourself this: If I’m selling such a distinct advantage, why would anyone else want to come?

Schoenberg: What you’re saying is that in order for some HFTs to be in a position to make money off of their edge, there needs to be a patsy.

Katsuyama: They have to trade against someone. There’s a great quote from a high-speed trader who once said something like, “If you put all high-speed trading firms on the same exchange, there would be no volume.”

Schoenberg: Turning to the topic of market data, why do have such an issue with how much other exchange operators charge for it? Isn’t it good for you if they charge a ton?

Katsuyama: Basically, they abuse their market and regulatory position by selling market data connectivity for huge markups. We’re talking about a 2,000 to 4,000% markup on some of these products. And these prices just continue to go up.

Schoenberg: A few of your critics basically called you Lucifer in fleece for supposedly cherry-picking the data to make that case via the white paper you published.

Katsuyama: The exchanges only, I think.

Schoenberg: But I would imagine it plays in your favor.

Katsuyama: Yes. Essentially, it reinforces our approach and emphasizes we prioritize order protection.

Schoenberg: Can you translate that?

Katsuyama: We don’t want to give people an advantage to pick you off.

Schoenberg: And by “you,” you mean?

Katsuyama: It ultimately means the investors, and some brokers, who are our big clients. We make money trading, and we charge a flat fee to do it.

Schoenberg: But you have moved into the data business, too. How does your model differ from the other exchanges?

Katsuyama: It’s a very simple model. Our bills from the exchanges are many lines, 10 to 12 pages long, with all of the different charges just racking up.

Schoenberg: To be clear, you’re paying other exchanges for market data, so you get bills yourself?

Katsuyama: Yes. However, the bill that Goldman Sachs gets from IEX is very simple: Here’s how much volume; here’s the fee. It’s totally transparent.

Schoenberg: The founding story behind why IEX came to exist is because, when you were a trader, you noticed the HFTs getting in the way of your trades. But now, you seem to be suggesting that the bogeyman isn’t the HFTs anymore, it’s the exchanges that have the HFTs by the throat.

Katsuyama: We’ve always viewed the exchanges as being the primary issue in the market. They created the playing field that allowed the HFTs to profit. I think a lot of HFTs would make money without the advantages the exchanges are handing them, just because of the way that trading has been automated. But the exchanges are essentially creating arbitrage.

Schoenberg: How does that arbitrage take money out of the investor’s pocket?

Katsuyama: The best analogy is a horse race, where you’ve seen the horse cross the finish line, but you know that some people still think the race is happening. You’re going to run back into the off-track betting parlor and look to take the other side of anyone who thinks the wrong horse is going to win. Those high-speed traders are paying to see the future while everyone else is looking at, essentially, a delayed version of the future.

Schoenberg: A riskless trade?

Katsuyama: Yes. You’re in the parlor: “Oh, you want the wrong horse to win? Sold to you.” It’s a riskless trade. The whole point of the speed bump was essentially to combat this.

Schoenberg: My understanding is that your speed bump itself wasn’t enough to thwart high-speed traders, right?

Katsuyama: That’s correct.

That’s right. In that five-second window, where all this activity is happening, we are trying to protect people. And the other exchanges are auctioning off who gets to pick people off.

Schoenberg: So you created something called the IEX Signal to neutralize the ability of HFTs, right? Catchy name, by the way.

Katsuyama: Ha, thanks. Basically, we use machine learning to look at market data in each individual stock, and to make predictions on which way the market is going to shift in every stock in the US. We make thousands of predictions per stock for the next two milliseconds.

Schoenberg: Can you explain why this is a so-called crumbling quote signal?

Katsuyama: Theoretically, let’s say you have an order book for TripAdvisor where the bids are $39.99 and the offers are $40.01. For the market to actually go lower than that, all of these bids have to get knocked out. What we look for in the signal is the quote crumbling. Sometimes, you’ll see that one exchange will drop, then the next exchange will drop, etc… The bids are evaporating over two milliseconds, but the midpoint at $40 remains until the last exchange drops.

Schoenberg: You’re trying to neutralize the ability of the HFTs to take advantage of the fact that they see the orders crumbling.

Katsuyama: Yes. They see TripAdvisor is going to tick down, and they say, “I want to sell it.” We use the same signal to protect a buyer in TripAdvisor from paying what we believe is going to be the wrong price in two milliseconds. It’s using technology to fight technology.

Schoenberg: I take it these are pretty substantial predictions.

Katsuyama: Yes, and here’s the craziest stat: If you take every two-millisecond prediction we make on a per-stock basis, it adds up to five seconds per day.

Schoenberg: In our example, then, if you add up all those two-millisecond windows, it’s like five seconds per day where you’re making high-impact predictions.

Katsuyama: Yes. There are 23,400 seconds in a trading day, from 9:30am to 4:00pm. All of these little predictions we make are cumulative. And when we first launched the first version of the signal, we got 34% of all marketable orders sent to IEX in that five-second cumulative window. That’s fucking bananas.

Schoenberg: 34% of all the orders received at IEX, a market dedicated to deterring high-speed trading, came flooding in during this five-second period?

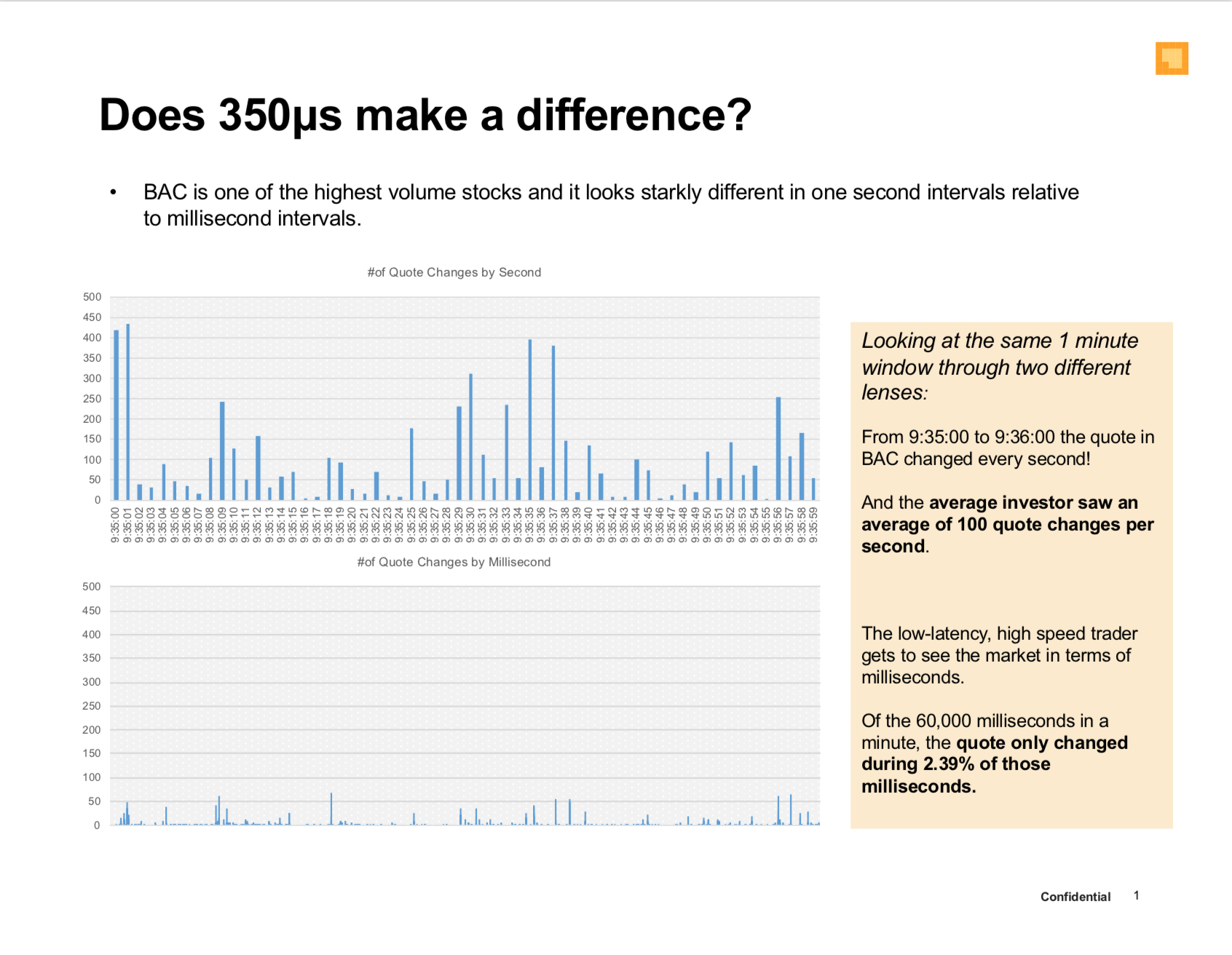

Katsuyama: Yes. In fact, we once analyzed Bank of America’s stock by breaking up the trading day into one-second buckets. For each one-second bucket, we looked for some kind of activity, whether it was the price changing, or a quote changing, etc. In about 99% of the one-second buckets, you see some kind of change. But then we looked at the activity over one-millisecond buckets.

Schoenberg: I bet things looked much different over that interval.

Katsuyama: Totally. You see mostly nothing, then a mass burst of activity, and then nothing again, because ultimately, if you took the entire day and broke it into one-millisecond buckets, only 1.8% of millisecond buckets had any activity at all.

Schoenberg: This further reinforces the idea that the sophisticated players in the market see a market that is very different than the one portrayed on the screens.

Katsuyama: While everyone else sees a market that looks frenetic, high-speed traders view the market in slow motion. But IEX is watching the market in slow motion too, and moving orders and adjusting the prices.

Schoenberg: With the intent of protecting your members?

Katsuyama: That’s right. In that five-second window, where all this activity is happening, we are trying to protect people. And the other exchanges are auctioning off who gets to pick people off. I mean, that’s ultimately why you put a microwave tower on a roof.

A lot of companies said, ‘We want to see someone go first.’ And so, we got someone to go first (Interactive Brokers), which has gone well. We would have thought that this example would have de-risked it, but a lot of companies are now coming back saying, ‘We need to see five companies now.’

Schoenberg: Last year, you said, “There was a naivete about me in thinking there was going to be a fight, but not fully appreciating how big of a fight it would be.” What were you underprepared for?

Katsuyama: How dirty the exchanges would be in fighting back. I think there was a certain level of company-to-company battle that I expected, but never to the extent of what we’ve seen behind the scenes. And just look at the way that they’re interacting through their aggressive lobbying in DC.

Schoenberg: Are you saying that you don’t have the money to throw around in Washington like they do?

Katsuyama: It’s partly the money, and partly the aggressiveness with which they were attacking the SEC. I mean, the idea that the exchanges would sue the SEC—

Schoenberg: —Why do you think they did it?

Katsuyama: Because rebates are critical to their business model. But it continues to shock me at the levels they’re willing to go.

Schoenberg: You got your exchange license in Q3, 2016. Did you think your volumes were going to be higher than roughly three percent by now?

Katsuyama: Yes.

Schoenberg: I take it you didn’t appreciate the full power of the rebates to keep exchange volume going to where it’s always gone.

Katsuyama: Yes. I thought that once we became an exchange, and our data became public, more people would seek a route for execution quality, and not cling to the rebate.

Schoenberg: But that’s really on the brokers for having made that decision, for having opted to stick with getting paid for their order flow.

Katsuyama: There are some brokers who do not prioritize rebates, but in other instances, it does surprise me.

Schoenberg: With respect to your effort to convince companies to select IEX for their primary listing, it’s proven to be quite a challenge. You have Interactive Brokers, and I had heard the rumors about WYNN prior to the issues they had. What’s the core challenge?

Katsuyama: It’s a good question. A lot of companies said, “We want to see someone go first.” And so, we got someone to go first (Interactive Brokers), which has gone well. We would have thought that this example would have de-risked it, but a lot of companies are now coming back saying, “We need to see five companies now.” At the same time, oddly, it’s one of the few decisions that requires board approval.

Schoenberg: Which works against you.

Katsuyama: Well, there are only four days a year when a decision can be made. Now, couple that with the fact that if you’re listed for one day on another exchange, you pay an entire year’s worth of a fee. So now, we’re down to two board meetings a year, and I think we underestimated the indifference people had regarding where they were listed.

Schoenberg: Let’s talk about what’s new. The speed bump was an amazing innovation, but—

Katsuyama: —Now, everyone wants a speed bump. It’s table stakes, a recognition that an exchange needs some kind of headstart in figuring out what the best price is.

Schoenberg: Right. And there are other big issues out there. For example, my understanding is that when corporations buy back stock, they’re getting picked off all the time, because that order is very detectable by the HFTs. It’s a hanging curveball right over the center of the plate.

Katsuyama: That’s a creative way of expressing it. In fact, we petitioned the SEC to modernize the rules associated with buybacks because of the price-gaming and exploitation that we believe is taking place.

Schoenberg: To translate that, currently, buyback orders are easy to spot because they are subject to certain restrictions in how they can repurchase their shares?

Katsuyama: You’re referring to the zero plus tick rule.

Schoenberg: Yes, so you’ve got corporate buybacks being restricted to this zero plus tick rule combined with the fact that they are now a huge part of the market.

Katsuyama: Correct.

Schoenberg: If you add those two factors together, it says to me that the whole bloody market is way more gameable than it used to be.

Katsuyama: I really like your passion on this topic.

Schoenberg: Turning back to IEX, regarding IEX Cloud and IEX Astral, which are two other offerings you have rolled out, don’t they run the same risk of ultimately getting in the way of the core function of an exchange being to match trades?

Katsuyama: It’s a good question. For us, these initiatives are a natural outgrowth of the exchange. Take IEX Astral, for example. Astral was led by the institutional investment managers who trade with dozens of different brokers and have their data stored locally at the broker.

In trying to stitch a very complicated market back together, they were spending so much time and effort normalizing it, they had very little resources left over to analyze the data. As we realized that a bunch of our clients had the same challenge, IEX became a place to help them gather this data in a single place and normalize it for them.

Schoenberg: As you know, passive index strategies continue to take up a bigger share of equity volume, arguably at the expense of price discovery. Meanwhile, there’s an ETF price wardriving expense ratios closer to zero, and then you’ve got the Robinhoods, who are offering so-called commission-free trading. Would you agree that these trends are bad news for many of your asset manager clients?

Katsuyama: We have a bunch of passive clients as well, but I would say that everyone pays a tax to a market structure that’s not as efficient as it could be. I would also say that the highest proportion of that tax, on a relative basis, is being paid by active managers, because they trade in large size.

Schoenberg: If Robinhood is selling order flow to HFTs who are thinking, “Thank you for selling us this delightful, one-off retail catnip,” doesn’t that ultimately serve to disadvantage mainstream asset manager clients?

Katsuyama: It siphons away order flow that other people would want to interact with.

Schoenberg: It fragments the order flow.

Katsuyama: Yes.

Schoenberg: I know selling order flow has been around a long time, and that many brokers rely on this revenue stream. But it burns me up because I think, fundamentally, it’s another example of a case where you, the consumer, are the product, and we’ve all seen how that model has worked out for people. But to end on a positive note, I want to revisit Flash Boys. The last time we met, you told me that the success of Flash Boys made your fundraising job much easier. Right?

Katsuyama: Yes.

Schoenberg: Do you ever sometimes wish, though, that you weren’t lionized in a Michael Lewis bestseller, because that elevated expectations on how quickly you could make headway against the incumbents?

Katsuyama: I’ve never regretted it. But I never lean too hard into it. I made a conscious point to not let it affect how I live my life. Now, I’m happier that the spotlight is dimmer. But the book created an awareness that otherwise never could have been created.

Schoenberg: I know that Netflix has bought the rights to turn Flash Boys into a movie.

Katsuyama: Yes.

Schoenberg: Have you guys talked about what happens if the movie is made and becomes a big hit like The Big Short, Moneyball and The Blind Side?

Katsuyama: We’ve talked about it a little bit. I just don’t want any kind of public attention to take away from the substance of what we built, because we’ve built a better market, regardless of whether there’s a movie about us or not.

Schoenberg: On that note, Brad, thanks for your time, and I look forward to seeing who plays you in the movie.

Katsuyama: Ha thanks, Gregg. It’s always good to talk to you.