We just closed our $11 million Series A financing, and within 15 minutes of the news hitting the wire, the weirdness began. It turns out that once you announce to the world that you have money, everyone wants a piece. Some want to earn your business, some actually want your business, some want you to move your business, and others just want to straight-up steal your business.

These are the weird things that no one tells you will happen after you close your round that I’m hoping you will find helpful, insightful and maybe spare you a headache or two.

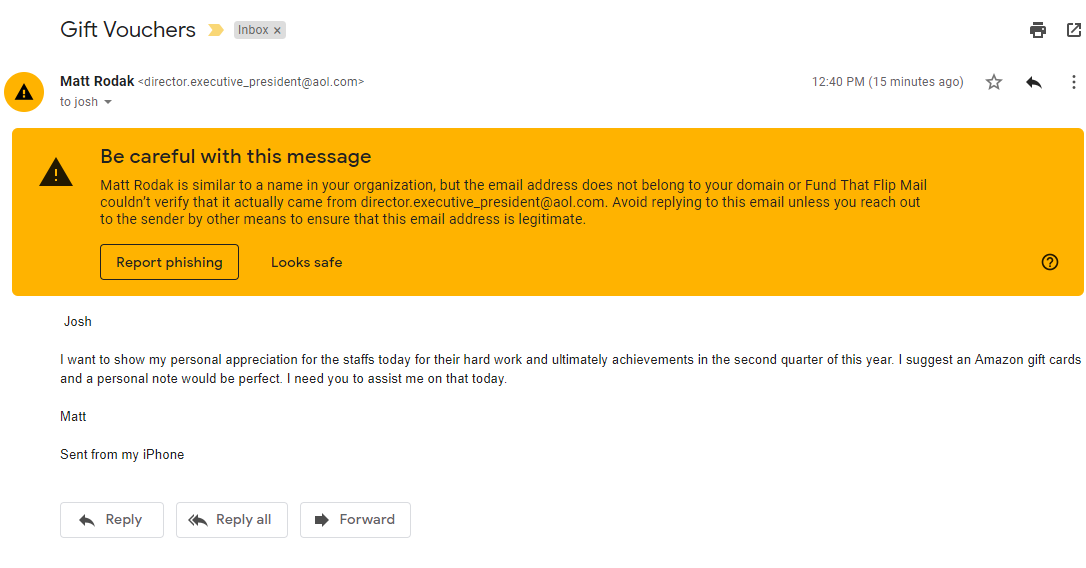

Phishing attacks

We’ll start with the scariest of them all. Just like taxes and death, phishing attacks are pretty much certain after your fundraise, especially if you have a larger team. Within minutes of the news hitting, our team was receiving emails that looked like they were coming from me.

One ask? Help buying everyone gift cards (or “gift vouchers” as this attacker idiosyncratically called them). We didn’t follow this request down the rabbit hole, so who knows where it goes from here, but they’re likely looking for someone to send over credit card information or click a link to create a backdoor into our system.

Lesson: We experienced this after our Seed round when we had a smaller team. Knowing it was likely to happen again, we prepared early and sent an email to our entire team letting them know what to look out for and to report anything that even looked suspicious.

There are often telltale red flags you can have your team look out for: suspicious “from” addresses (note the very official “director.executive_president@aol.com”), dubious sentence structure, and usually some kind of monetary request. Hopefully, you manage to catch all these before they do any damage, and they turn into harmless running jokes on the company Slack.

In addition to giving the team a heads-up on these likely hackers, it’s also a good idea to give them some guidelines on how to handle all of the solicitors that will ensue… more on those below.

You’ll be held ransom

The scum that isn’t trying to get you with phishing attacks may be running “white hat” penetration tests on your website. They’re quick to point out all the “vulnerabilities” of your site and “fix” them if you’re willing to pay up. Not willing to pay up? Then be prepared to be threatened by these wolves in sheeps’ clothing.

Lesson: We experienced this one at our seed round too, so we were prepared this time around. We ran our own trusted penetration test prior to the announcement. This way when we were threatened, we knew immediately that the claims were nothing more than empty threats.

Be prepared internally and run your own tests prior to your announcement. Delete the emails and move on.

Recruiters, recruiters and more recruiters

My first internship was with an executive search firm, so I know a little bit about how hard the headhunter has it. But my GAWD, these guys and gals are hungry. I counted 37 different emails inside of 24 hours from folks that all just happen to have “a great candidate that fits the exact description of your open roles.”

Would I like to see their resume? No, I would not. We actually had one headhunter stop by the office, uninvited, trying to set a meeting. I forgave them because they at least brought a bottle of wine.

Lesson: Recruiters can and certainly do provide a lot of value to an organization that needs to hire and grow quickly. We’ve had much more success with recruiting firms that were referred to us from trusted sources. Nail down your recruiting plan in advance, select recruiters you know and trust and then just blow the rest of them off.

Getting courted by economic development groups

What do London (yes, that London) and St. Petersburg, Florida have in common? Someone on their team tracks headlines and seeks to attract recently funded businesses to their cities. That’s correct, a delegation from both St. Pete’s and London will soon be in NYC and would like to sit down to discuss economic incentives available to companies like ours.

Lesson: There’s actually a great takeaway here. While we’re HQ’d in NYC, our larger operation is in Cleveland, OH. Having a second office in a market that has great talent and a lower cost of living has been a huge advantage for us.

If you’re in a high-cost city and have jobs that can be done anywhere, it may be worth exploring what other states or cities can offer. The state of Ohio has also provided us with some great job creation tax credits. I’m a huge fan of Cleveland and more generally, Ohio, and more than happy to connect anyone to the fantastic folks in their economic development groups.

(If we didn’t already have this set up, I might be inclined to listen to the St. Petersburg pitch… the weather is certainly better.)

The bankers are coming

Commercial bankers, investment bankers and M&A advisors will all want to take you to lunch. As the saying goes, “there’s no such thing as a free lunch,” so you’ll want to have a plan to deal with these solicitations. Our business is super capital intensive, and we leverage a lot of other banking services, so we’re taking a close look at our needs and what others have to offer.

Lesson: Have a perspective on what your banking needs are going into the round. Many of us early-stage founders are taught all about VC funding but rarely explore debt financing.

There are a lot of banks that will lean into an equity raise and offer additional financial products that can help you manage cash as things scale up. If nothing else, it may be wise to start a spreadsheet to track all these folks and follow-up at a later date.

…And also the real estate brokers

I guess this one makes the most sense. You just raised money. You’ll be hiring people. You’ll need a place to put these wide-eyed new hires.

In our case, the thing that these clever prospectors neglected to investigate was the fact that most of our current and future people are in Cleveland, OH. Our NYC office space will be just fine for some time, thank you very much.

Lesson: A good broker that can help you navigate the market and find a space that works for your growth plans is great to have. As with headhunters, we’ve had the best luck by working with someone that was referred in-network. If you’re going to need more space, I would say that you should start looking 6-8 months in advance of when you plan to close, and perhaps even further out if you’ll be building out your own space.

Wealth advisors. Because – money!

This is my personal favorite. Everyone thinks you must be personally wealthy after your raise. And they’re quick to tell you how important life insurance or setting up a trust for your descendants must be.

Don’t get me wrong, I’m all about healthy personal finances… it’s just that I’m very unlikely to take a meeting with a stranger that solicited me over email or LinkedIn and even less likely to open up my personal financials to them.

Lesson: If things go well, you will have an absolutely massive fortune to manage. Don’t wait until that time to find someone you can trust with your personal finances. Since most people don’t like sharing this information with a “friend” who might be in the business, check with your accountant, attorney or other trusted advisor to get some introductions.

A good wealth advisor will invest in the relationship with you as you grow. A bad advisor will try to sell you a life insurance policy on the first date.

Finally, to all the solicitors:

If you’re going to reach out cold to a company immediately after a fundraise, realize that you are not alone in this endeavor. This means that even if you craft the perfect email, it’s likely going into a black hole. Don’t be discouraged — it’s not because we’re jerks or because we don’t value your product or service.

It’s that there is A LOT of noise after a fundraise. There are congratulatory emails, press releases, TV hits, internal communications, new investors/board members, new strategic initiatives… the list is endless.

Not to mention that for the last 6-8 months, the founders have been running the business while simultaneously raising capital, both of which are full-time jobs. In the few days after the raise, and when we have to get back to growing the business at breakneck speed, the last thing we want to do is hear a pitch.

So be strategic: have some empathy, send over a bottle of wine with a handwritten note and call me in 30 days. I promise we’ll still be hiring, looking for that new office space or exploring bank relationships. And in 30 days when that noise has died down, at least slightly, we’ll be in a much better place to understand that value your company brings.