The African no-fee, cross-border payment startup Chipper Cash has expanded to Nigeria.

The San Francisco-based startup, with offices in Ghana and Kenya, will offer its P2P payment service and app in Africa’s most populous nation in partnership with Paystack — the payment gateway company. Paystack CEO Shola Akinlade confirmed the collaboration.

Chipper Cash will establish a company presence in Lagos and has hired a country manager, Abiodun Animashaun, co-founder of Lagos-based ride-hail startup Gokada.

Animashaun is one of two senior figures departing African tech ventures to join Chipper Cash. Alicia Levine will leave Nairobi-based internet hardware and service startup BRCK to become Chipper Cash’s chief operating officer, according to Chipper Cash CEO Ham Serunjogi.

The startup went live in October 2018, joining a field of fintech startups aiming to scale digital finance applications across Africa’s billion-plus population.

Chipper Cash was co-founded by Serunjogi (from Uganda) and Ghanaian Maijid Moujaled, both of whom emigrated to the U.S. to study and work in Silicon Valley.

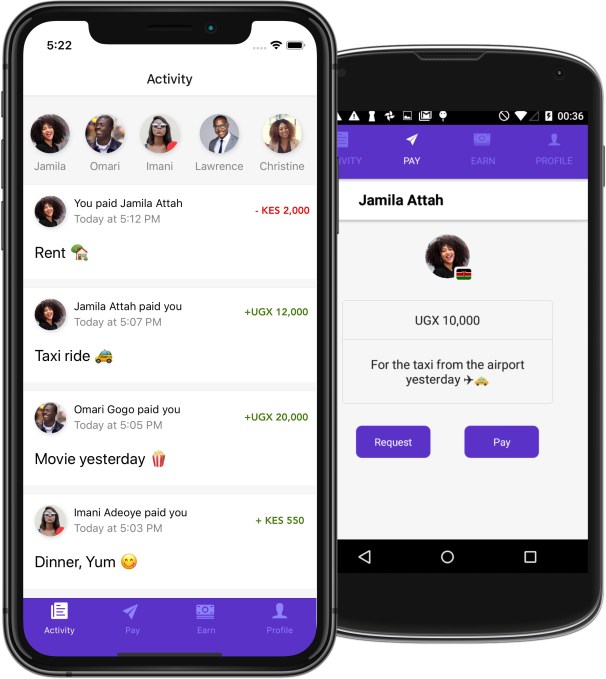

The fintech company now has more than 70,000 active users and has processed 250,000 active transitions on its no-fee, P2P, cross-border mobile-money payments product.

The startup also runs Chipper Checkout: a merchant-focused, fee-based C2B mobile payments product that supports its no-fee mobile-money business.

Chipper Checkout will make its debut in Nigeria several months after Chipper Cash’s mobile-payments launch, according to Serunjogi.

The imperative to move to Nigeria was pretty straightforward. “Nigeria is the largest economy and most populous country in Africa. Its fintech industry is one of the most advanced in Africa, up there with Kenya and South Africa,” he said.

“I think for any company doing fintech across borders, that is looking to be successful in Africa, it’s imperative that you have a presence in Nigeria.”

For some fintech startups, such as Chipper Cash, locating in Nigeria is not just strategic for expanding in Africa, but also to serve international ambitions.

Chipper Cash was recently profiled in an Extra Crunch feature as one of three African fintech startups — with goals to scale globally — that has co-located in San Francisco with operations in Africa. The play is to tap the best of both worlds in VC, developers and the frontier of digital finance.

Toward that end, Chipper Cash raised a $2.4 million seed round led by Deciens Capital this May.

The payments company also persuaded 500 Startups and Liquid 2 Ventures — co-founded by American football legend Joe Montana — to join the round.

Per stats offered by Briter Bridges and a 2018 WeeTracker survey, fintech now receives the bulk of VC capital and deal-flow to African startups.

A number of estimates show the continent’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population.

In addition to creating greater financial inclusion on the continent, African fintech products and solutions have also found traction internationally. Safaricom (M-Pesa), Flutterwave, Paystack, Paga, Mines and Chipper Cash are among companies that offer or plan to offer their products in regions such as Asia, Europe and Latin America.