As someone who covers Africa’s tech scene, I’m frequently asked about Andela. That’s not surprising, given the venture gets more global press (arguably) than any startup in Africa.

I’ve found many Silicon Valley investors have heard of Andela but aren’t exactly sure what it does.

In a bite, Andela is Series D stage startup―backed by $180 million in VC―that trains and connects African software developers to global companies for a fee.

The revenue-focused venture is often misread as a charity. In 2017, Andela CEO Jeremy Johnson described the organization as “a mission-driven for-profit company” ― a model for the concept “that you can actually build businesses that create real impact.”

I asked Johnson recently to clarify the objective behind Andela’s drive. “It’s the exact same mission as when we started, based around our founding principle… that brilliance and talent are distributed equally around the world, but opportunity is not,” he said.

“We’re about breaking down the walls that prevent brilliance and opportunity from connecting to each other.”

A major barrier for Africa’s software engineers, according to Johnson, is simply the fact that the continent has been totally off the network that companies look to for developer talent.

So to be clear, Andela doesn’t view itself as a company that trains up disadvantaged Africans to become software engineers. Rather, it aims to select and pair up the continent’s elite developers to global jobs for which they should have always been in the running.

Toward this end, Johnson co-founded Andela in 2014 with Nigerian tech entrepreneur Iyinoluwa Aboyeji (Aka “E”), Canadian Ian Carnivale, and American Christina Saas.

Johnson is still at the helm, while Carnivale departed to do VC, E left to found fintech startup Flutterwave, and Christina recently stepped down, but continues as chair of Andela’s advisory board.

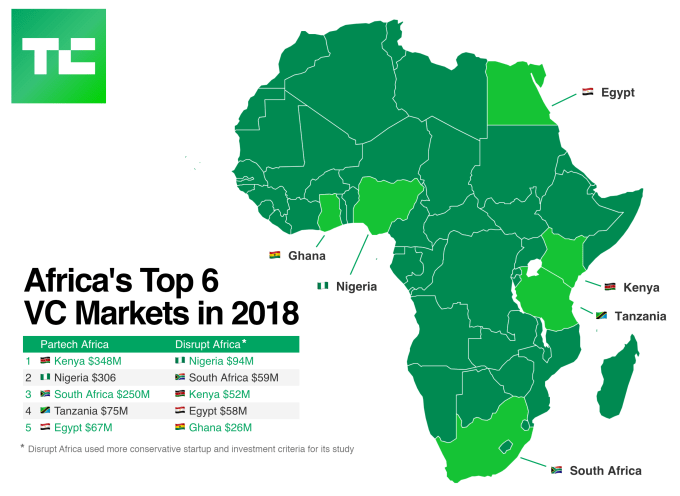

Today Andela has offices in New York and five African countries: Nigeria, Kenya, Rwanda, Uganda, and Egypt―which largely align with the continent’s top tech VC markets.

Across this network and the internet―which Johnson dubs Andela’s official HQ―the company recruits software developers, builds software engineers, and deploys teams of software engineers.

Selection is rigorous. “We accept a very very small portion of applicants overall. It’s about 1 percent over the past 5 years,” said Johnson.

Andela has brought in around 1700 developers into the company since 2014, currently employs 1575 and will hire 1000 this year. Johnson offers some nuance around how the company preps new hires.

“We accept engineers at all levels…some are junior…some are experienced…training is very important and Andela often gets confused as a training company, but we’re not a training company,” he said.

“We generate zero dollars in revenue from training. We’re actually an engineering as a service company with hundreds of customers.”

Those customers include companies including Github, Cloudfare, and Kenya’s largest telecom, Safaricom. Andela engineers have created agtech solutions, digital consumer data apps, and mobile money products.

Once in Andela, developers have an open-ended tenure working with the company. Johnson likens the employee experience to the structure at global management consulting firms, such as McKinsey, where associates do several year stints working on various high-level projects, some stay, some go on to senior positions elsewhere, some form their own companies.

On revenue structure for developers, there is no set fee scale given variability in projects. “The way it works is companies pay us for an amount of resources consumed, based on the combination of number of engineers, stack, and level of seniority, so it varies,” said Johnson.

A typical Andela client prospect, according to Johnson, is a company that runs into challenges with local hiring or off-shoring options for developers.

“They don’t find the data to be able to match effectively and don’t provide the right kind of oversight to do agile software development. We do that and our developers are the kind of people, that when they work with them, they think ‘if this person lived down the street, I’d hire them tomorrow,” Johnson said.

At the most junior entry point, Andela’s developers make a minimum two-year commitment to the company. Beyond that “I would think of it like joining a McKinsey, it’s no longer a time defined commitment,” Johnson said of the company’s engineers.

At the most junior entry point, Andela’s developers make a minimum two-year commitment to the company. Beyond that “I would think of it like joining a McKinsey, it’s no longer a time defined commitment,” Johnson said of the company’s engineers.

Andela’s software engineers receivef a salary are encouraged to continue working and living in their home markets in Africa.

Both pay and locale are infused in the debate that occurs around Andela in African tech across articles, the Twitter-sphere, and informal conversation.

The company has been criticized for taking a disproportionate share of VC in Africa’s startup space and for creating a second brain-drain, when software developers leave Andela and Africa, to take positions with global companies.

I’ve also heard plenty of critique that Andela soaks up talent and drives up developer prices in Africa’s big tech markets, such as Nigeria and Kenya, where rapid startup development over the last decade is starting to outpace software engineering skills.

To the talent-exit discussion, Johnson offered some example and data. “This year Andela is going to hire approximately 1000 engineers and of our total developer staff of 1575, approximately 120 engineers will leave Andela because we either don’t have a role for them or they choose to pursue other opportunities,” he said.

Of those who leave, about 10 per quarter move outside their countries and the others take jobs in the local ecosystem, according to Johnson.

“The more interesting number, though I have no way of tracking it, is how many engineers stay in their home country because of Andela,” he added.

That raises one of the limitations in the debates around Andela: there isn’t much quantitative data or empirical research out there on Africa’s developer markets to inform it.

There are definitely additional trends to track vis-a-vis the company’s position in African and global tech.

One is the rise of competition in other tech-talent type accelerators in Africa. There are other players in these markets―such as Ethiopian founded Gebeya and South Africa WeThinkCode―that could find a way to train and match Africa’s developers for less, with less VC.

One is the rise of competition in other tech-talent type accelerators in Africa. There are other players in these markets―such as Ethiopian founded Gebeya and South Africa WeThinkCode―that could find a way to train and match Africa’s developers for less, with less VC.

Andela is also growing into an incubator for spinoff entrepreneurs and startups. This trend began at the top, when co-founder E departed to found Flutterwave, and has continued former Andela hires forming startups, such as proptech company Fibre.

This also connects to Andela’s impact mission, by building tech capacity in these markets, and across Africa’s tech-disapora―whether its alums are still working for the company or not.

The most significant development to watch around Andela, is if the mission-driven for-profit can actually get into the black.

On the question, “We’re definitely not profitable, hence our recent raise,” Johnson admits upfront. “But but at the same time revenues are growing, as you would expect for a top-tier venture-backed company.”

With its $180 million in VC from backers that include the Chan Zuckerberg Initiative and Generation Investment Management (co-founded by former Vice President Al Gore), Andela is inching up toward a unicorn company valuation.

Johnson plays down achieving billion-dollar status or any IPO ambitions. “It’s not something we spend a lot of time thinking about. Ultimately it comes down to are we able to create real opportunity for developers and for companies that are looking for talent,” he said.

Profitability is a goal but not an end-all, according to Johnson. “We’re probably a couple years out… but we’re absolutely focused on getting to sustainability on our own and not continuously raising venture capital,” he said. “But we’re not focused on maximizing profitability, because there’s so much work to be done.”