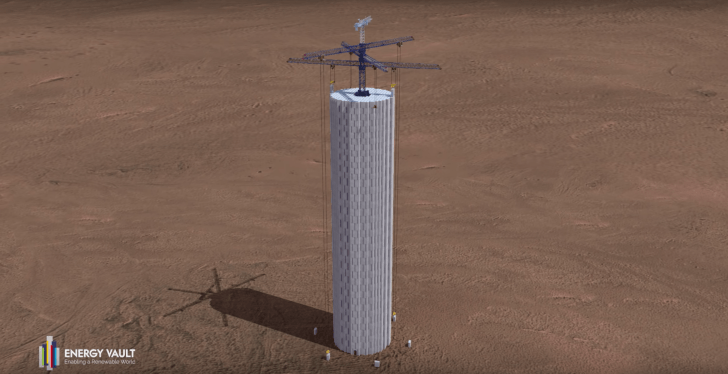

Imagine a moving tower made of huge cement bricks weighing 35 metric tons. The movement of these massive blocks is powered by wind or solar power plants and is a way to store the energy those plants generate. Software controls the movement of the blocks automatically, responding to changes in power availability across an electric grid to charge and discharge the power that’s being generated.

The development of this technology is the culmination of years of work at Idealab, the Pasadena, Calif.-based startup incubator, and Energy Vault, the company it spun out to commercialize the technology, has just raised $110 million from SoftBank Vision Fund to take its next steps in the world.

Energy storage remains one of the largest obstacles to the large-scale rollout of renewable energy technologies on utility grids, but utilities, development agencies and private companies are investing billions to bring new energy storage capabilities to market as the technology to store energy improves.

The investment in Energy Vault is just one indicator of the massive market that investors see coming as power companies spend billions on renewables and storage. As The Wall Street Journal reported over the weekend, ScottishPower, the U.K.-based utility, is committing to spending $7.2 billion on renewable energy, grid upgrades and storage technologies between 2018 and 2022.

Meanwhile, out in the wilds of Utah, the American subsidiary of Japan’s Mitsubishi Hitachi Power Systems is working on a joint venture that would create the world’s largest clean energy storage facility. That 1 gigawatt storage would go a long way toward providing renewable power to the Western U.S. power grid and is going to be based on compressed air energy storage, large flow batteries, solid oxide fuel cells and renewable hydrogen storage.

“For 20 years, we’ve been reducing carbon emissions of the U.S. power grid using natural gas in combination with renewable power to replace retiring coal-fired power generation. In California and other states in the western United States, which will soon have retired all of their coal-fired power generation, we need the next step in decarbonization. Mixing natural gas and storage, and eventually using 100% renewable storage, is that next step,” said Paul Browning, president and CEO of MHPS Americas.

Energy Vault’s technology could also be used in these kinds of remote locations, according to chief executive Robert Piconi.

Energy Vault’s storage technology certainly isn’t going to be ubiquitous in highly populated areas, but the company’s towers of blocks can work well in remote locations and have a lower cost than chemical storage options, Piconi said.

“What you’re seeing there on some of the battery side is the need in the market for a mobile solution that isn’t tied to topography,” Piconi said. “We obviously aren’t putting these systems in urban areas or the middle of cities.”

For areas that need larger-scale storage that’s a bit more flexible there are storage solutions like Tesla’s new Megapack.

The Megapack comes fully assembled — including battery modules, bi-directional inverters, a thermal management system, an AC breaker and controls — and can store up to 3 megawatt-hours of energy with a 1.5 megawatt inverter capacity.

The Energy Vault storage system is made for much, much larger storage capacity. Each tower can store between 20 and 80 megawatt hours at a cost of 6 cents per kilowatt hour (on a levelized cost basis), according to Piconi.

The first facility that Energy Vault is developing is a 35 megawatt-hour system in Northern Italy, and there are other undisclosed contracts with an undisclosed number of customers on four continents, according to the company.

One place where Piconi sees particular applicability for Energy Vault’s technology is around desalination plants in places like sub-Saharan Africa or desert areas.

Backing Energy Vault’s new storage technology are a clutch of investors, including Neotribe Ventures, Cemex Ventures, Idealab and SoftBank.