AWS is already the clear market leader in the cloud infrastructure market, but it’s never been an organization that rests on its past successes. Whether it’s a flurry of new product announcements and enhancements every year, or making strategic acquisitions.

When it bought Israeli storage startup E8 yesterday, it might have felt like a minor move on its face, but AWS was looking, as it always does, to find an edge and reduce the costs of operations in its data centers. It was also very likely looking forward to the next phase of cloud computing. Reports have pegged the deal at between $50 and $60 million.

What E8 gives AWS for relatively cheap money is highly advanced storage capabilities, says Steve McDowell, senior storage analyst at Moor Research and Strategy. “E8 built a system that delivers extremely high-performance/low-latency flash (and Optane) in a shared-storage environment,” McDowell told TechCrunch.

While Amazon is always looking to enhance its service offerings, it’s also looking for an edge when it comes to running its data centers more efficiently. “This is less about new features that will be delivered as AWS offerings, and much more about optimizing AWS itself. E8 technology will be integrated into Amazon’s rack-level architecture,” McDowell explained.

Ray Wang, founder and principal analyst at Constellation Research, says that this acquisition gives AWS a big storage performance lift. “There’s a battle to drive storage costs down and make IO more efficient. Shared [SSD] storage is a great way to do it and E8 is the market leader in the low latency workloads that require this type of performance. Their benchmarks are 50 to 60% cheaper than what Amazon could do before the acquisition,” Wang said.

In fact, it’s such an advantage that Wang was surprised that AWS didn’t have more competition in the deal from its competitors. “It’s a strategic bet. I would have expected Google or even Oracle to have acquired them,” he said.

McDowell points out that when you look at the deal in combination with the acquisition of TSO Logic earlier this year, it shows that Amazon is looking to optimize its data centers. “Coupled with Amazon’s other recent acquisition of TSO Logic, who provides IP for managing datacenter workload efficiency, it’s clear that they’re beefing up their backend,” he said.

The acquisition is also about gaining the kind of talent and skills AWS will need as it moves to build the next generation of cloud computing architecture. “They are in the midst of a modernization and refresh right now, and they need to acquire new skill sets and talent. So the acquisition is not only about the tech, but also about the talent from E8,” Wang said.

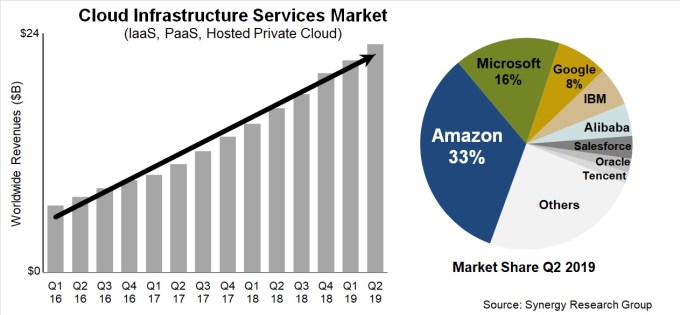

While AWS growth slowed a bit in its most recent earnings report last month, the company still remains well in front in the cloud infrastructure market with 33% market share, according to data from Synergy Research. Its closest rival, Microsoft, is well back with 16%.

Amazon understands that to stay on top of the market, it can’t simply sit still. It needs to modernize its data centers and learn to run as efficiently as technology will allow. Sometimes that means building these tools, as they often have in the past, but sometimes, as with yesterday’s acquisition, it’s better to use your market advantage and simply buy it.