When Microsoft reported its FY19, Q4 earnings last week, the numbers were mostly positive, but as we pointed out, Azure earnings growth has stalled. Productivity and business, which includes Office 365, has also mostly flattened out. But slowing growth is not always as bad as it may seem. In fact, it’s an inevitability that once you start to reach Microsoft’s market maturity, it gets harder to maintain large growth numbers.

That said, AWS launched the first cloud infrastructure service, Amazon Elastic Compute Cloud in August, 2006. Microsoft came much later to the cloud, launching Azure in February, 2010, but so were other established companies in Microsoft’s market share rearview. What did it do differently to achieve this success that the companies chasing it — Google, IBM and Oracle — failed to do? It’s a key question.

Let’s look at some numbers

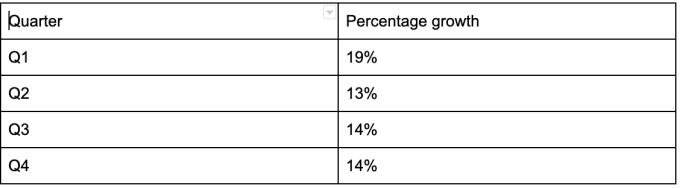

For starters, let’s look at the most numbers for Productivity & Business Processes this year. This category includes all of its commercial and consumer SaaS products including Office 365 commercial and consumer, Dynamics 365, LinkedIn and others. The percentage growth started FY19 at 19% but ended at 14%

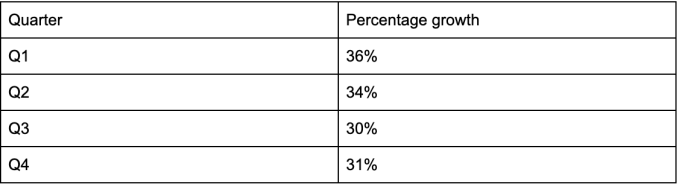

When you look at just Office365 commercial earnings growth, it started at 36% and dropped down to 31% by Q4.

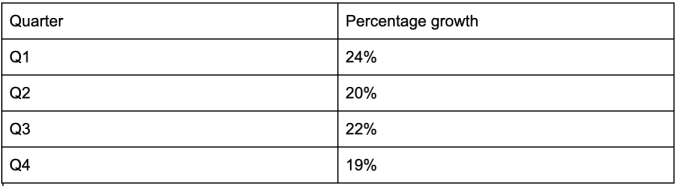

Intelligent Cloud where Azure lives started at 24% growth and ended FY19 at 19%.

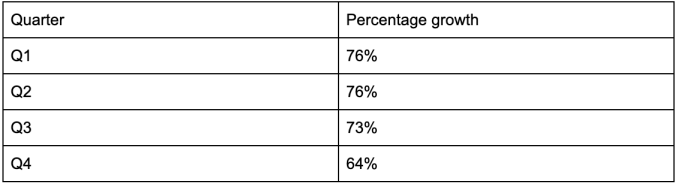

Finally, focusing just on Azure, it started at 76% and ended the fiscal year with Q4 growth of 64%.

SaaS market share leader

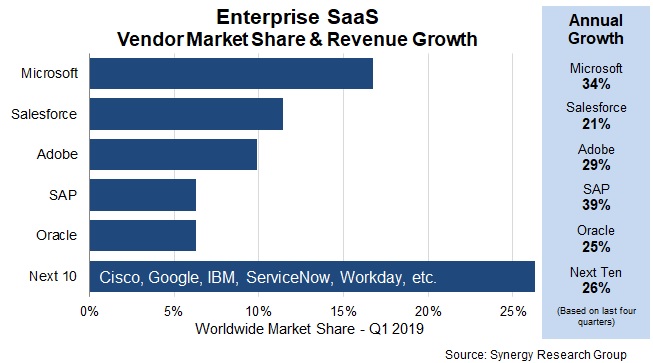

In spite of the downward growth trend, Microsoft still rules the roost when it comes to SaaS market share, well ahead of rivals Salesforce and Adobe, according to numbers from Synergy Research, a firm that tracks market share in the cloud.

“Microsoft is a very clear market leader in the SaaS market and its growth rate is above the overall market growth rate. The SaaS market is more fragmented than cloud infrastructure services, but Microsoft still has a 17% share of the worldwide market.

Its market share continues to increase by around a percentage point per year. It remains well ahead of Salesforce, Adobe, SAP and Oracle,” Synergy’s John Dinsdale wrote in a commentary shared with journalists by email.

As Microsoft CEO Satya Nadella pointed out yesterday in the earnings call for analysts, it’s not just Office 365 that’s driving growth in SaaS, although it is a big part of it. “We are redefining business processes with Dynamics 365 and Power Platform with modern, modular, extensible, and AI-driven applications. Dynamics 365 uniquely enables any organization to create digital feedback loops and take data from one system and use it to optimize the outcomes of another, enabling any business to become an AI-first business,” Nadella told analysts.

Strong second in infrastructure

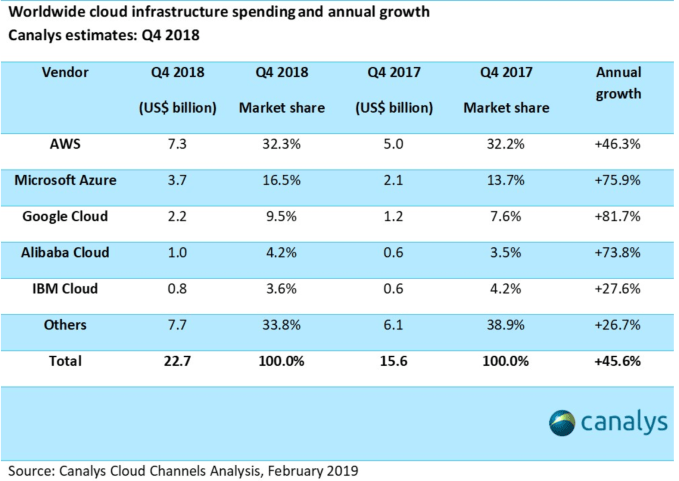

On the infrastructure side, the company is a strong number 2 behind AWS, which is the clear infrastructure market leader. Still, Microsoft continues to grow steadily in terms of market share, and is in fact the only other cloud company with double-digit share, coming in at over 16 percent, according to the most recent numbers from research firm Canalys.

Microsoft’s moves

Microsoft did not get here by accident. There was a concerted effort that began long before Nadella took over in 2014 to begin a shift to the cloud that included strategic and cultural changes like building more data centers around the world, becoming more developer-friendly (including buying GitHub for $7.5 billion), using an acquisition strategy to enhance its SaaS catalogue and taking advantage of its Office market leadership. The company also took advantage of its strong position in the enterprise, but that’s something that rivals behind it (other than Google) could also have done, but failed to do.

One way it was able to achieve that was by understanding that a cloud sale was different from a traditional sale, where you sold licenses and maintenance agreements. It required more of a partnership, and Microsoft seems to have comprehended that much better than its lesser rivals, especially after Nadella took over.

Ray Wang, founder and principal analyst at Constellation Research, says the company also intelligently combined SaaS and infrastructure deals to maximize sales (as it did with the $2 billion AT&T deal announced last week). “Microsoft is succeeding because it bundles its overall enterprise agreements into the deals. The one-stop shopping model is working for them,” Wang told TechCrunch.

Ways to grow the market

Yet Wang says, the company could do better if it built up its offerings in areas where its rivals excel. “Azure is seen as a safe choice and a hedge against Amazon as buyers are afraid of Amazon lock-in. To step up the game, Microsoft needs to build coalitions and data-driven digital networks to combat Amazon, and needs to up its game in AI and ML to catch up to GCP,” Wang explained.

Even as the cloud growth numbers begin to fall, Microsoft came in with a strong earnings report last week with overall revenue up 12%, operating income up 20% and net income up 49%, numbers analyst Patrick Moorhead from Moor Research and Strategy saw as mostly positive.

“Microsoft is firing on all cylinders now, growing big in growing markets, and even managing growth in mature markets like PCs. In the cloud, Microsoft is cementing its spot as the #2 provider in IaaS, PaaS, and SaaS services,” Moorhead told TechCrunch.

Even as its cloud growth begins to decline, Microsoft has clearly staked out a strong place for itself in the market. If it improves in some key areas, it could do even better, but of course, its rivals are not sitting still.

Google brought in long-time Oracle executive Thomas Kurian at the end of last year to help give it a push in the enterprise. Meanwhile, IBM recently closed the $34 billion Red Hat deal, one it hopes will give it a big boost in the hybrid cloud market, and Oracle is working to change its image with innovation hubs. Microsoft cannot afford to be complacent, but for now at least, its market position is secure.