Two months ago, we reported that Carbon was set to raise up to $300 million, bringing the 3D printing company’s valuation up to a lofty $2.5 billion. The real numbers released this week by the company aren’t quite so lofty, but are impressive nonetheless. The Series E fetched $260 million, putting its valuation at closer to $2.4 billion.

The latest round follows a $200 million Series D that arrived in late-2017, bringing the company’s total raise to $680 million. What exactly is the bay area-based startup planning to do with that massive sum, in the wake of high profile manufacturing partnerships with companies like Adidas and Riddell?

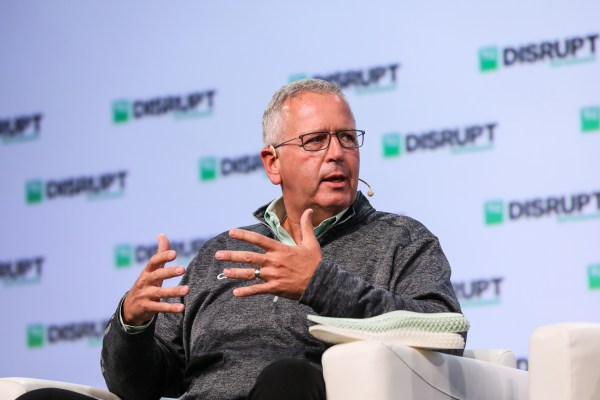

CEO/co-founder Joseph M. DeSimone and recent addition CMO Dara Treseder (most recently of GE Ventures) stopped by our offices to discuss what the latest round means for the Bay Area-based company.

Asked for a timeline around when Carbon might exit, DeSimon offered a non-committal answer. “As we grow our business, we haven’t made announcements for our IPO or anything like that yet,” he told TechCrunch. But the revenue business is growing nicely. So we’re in pretty good shape.”

It’s hard to say precisely what goals the company is hoping to attain before going public, but at the very least, Carbon presents a good indicator that the 3D printing industry is back on the uptick — in some circles, at least.

The previous 3D printing hype bubble led by companies like MakerBot promised a manufacturing revolution on a smaller, more localized scale. In the past several years, much of the thinking shifted to the notion of addictive manufacturing less as a completely democratized means of production propelled by the hobbyist to a more direct analog for existing (but ancient) technologies like injection molding.

Carbon’s certainly at the forefront of that push, and it’s been proving itself piece by piece, primarily through high profile partnerships. Adidas is the most prominent and longest lasting of the bunch.

According to DeSimon, Adidas has printed some 100,000 pairs of the $300 shoes and is set for 10 times that many by the end of 2019. This year, Ford and NFL helmet manufacturer Ridell have announced plans to use Carbon’s technology to create customized consumer offering.

Ford will be using parts printed on Carbon machines for its Ford GT Mustang and F150 truck. As for helmets, the company intends to expand well beyond football, to other sports like hockey and baseball, offering players customized fits not previously available with more traditional foam inserts. From there, it’s so-called “single-impact” helmets designed for activities like bike riding.

The company currently has an install base of around 1,000 printers in the world (though it won’t specify the market share breakdown between the high volume L line and smaller M line). Currently, Carbon offers the machines primarily as a multi-year lease.

The bulk of the machines are leased by the companies doing the printing, though some third-party manufacturing facilities have begun to adopt the technology, offering access to smaller companies that can’t afford to run warehouses full of dozens or hundreds of machines.

It’s not quite the desktop industrial revolution we were promised, but it’s a step closer to broader access for 3D printing technology beyond the prototyping stage.

“One of the biggest opportunities for us is injection molding shops,” says DeSimone. “There’s 4,000 injection molders in North America. Great businesses — some of them are global, some of them are regional, some of them focus on different things from medical products to packaging.”

Dental is becoming a booming business for smaller companies. In October 2017, Invisalign had 40 patents expire, and the company has continued to lose exclusivity on dozens of patents since, created an opening for the competition. Carbon was waiting in the wings with a technology that could bring 3D dental molds into the world more efficiently than ever before.

It’s been a perfect storm for the company’s growth and clearly convinced VCs to continue to invest. This latest round, led by Madrone Capital Partners and Baillie Gifford will largely go toward international growth, as Carbon targets Europe and Asia, along with additional infrastructural costs having to do with supplies and other components.

The investment will also be used to create Carbon’s Advanced Development Facility. While the company largely expects its technologies to be house in external warehouses, it is also developing a warehouse for its own technologies that will serve as a kind of large scale R&D center/factory.

“Part of this investment that we have today is for building out something we call the advanced development facility. It’s a facility in Santa Clara, in partnership with third parties to develop a full manufacturing line. That is not just a printer, but it’s everything end to end for a product, including Carbon’s manufacturing cloud, and our manufacturing execution system, all the software, all the metrology, all the quality systems. And so we talked about carbon crafted parts we’re talking about, you know, we can go to the FDA and say, ‘look, we know every photon, we know which lot of resin. This was all made to specifications. We can say the same thing to Ford and Adidas.”