To become a global fintech player, locate your company in San Francisco and Africa.

That’s the approach of payments company Flutterwave, digital lending startup Mines, and mobile-money venture Chipper Cash—Africa-founded ventures that maintain headquarters in San Francisco and operations in Africa to tap the best of both worlds in VC, developers, clients, and the frontier of digital finance.

This arrangement wasn’t exactly coordinated across the ventures, but TechCrunch coverage picked up the trend and some common motives among these rising fintech firms.

Founded in 2016 by Nigerians Iyinoluwa Aboyeji and Olugbenga Agboola, Flutterwave has positioned itself as a global B2B payments solutions platform for companies in Africa to pay other companies on the continent and abroad.

Clients can tap its APIs and work with Flutterwave developers to customize payments applications. Existing customers include Uber, Booking.com and African e-commerce unicorn Jumia.com.

The Y-Combinator backed company is headquartered in San Francisco, runs its operations center in Nigeria, and plans to add offices in South Africa and Cameroon.

Flutterwave opened an office in Uganda in June and raised a $10 million Series A round in October. The company also plugged into ledger activity in 2018, becoming a payment processing partner to the Ripple and Stellar blockchain networks.

“We set up in San Francisco because of YC and we also wanted to be the African payment partner of choice for global companies…[and] to have outreach close to global clients,” Flutterwave’s founder Agboola (who goes by “GB”), told TechCrunch.

In January, the startup partnered with Visa to launch a new consumer payment product for Africa called GetBarter. The app-based offering is aimed at facilitating personal and small merchant payments within and across African countries.

For the moment, Flutterwave sources all of its engineers from Nigeria, but is looking to tap developers more broadly across Africa, according to GB.

He believes characteristics of Africa’s fintech landscape have forced unique innovation. “African fintech is ahead of its time,” he explained. “Fragmented payment markets have required payment processors like us to become world-class in execution and delivery by developing global solutions that can adapt to local circumstances.”

One of those local realities is a dearth of credit options in Africa for individuals and traders to cover small expenses, emergencies, and working capital needs.

To meet that need, Mines.io—a San Francisco-based, Nigeria-founded technology company— is creating white-label lending solutions for Africa’s largest banks.

Mines has worked to address the reasons large financial institutions in Africa have overlooked consumer lending products in favor of corporate banks.

The startup uses big-data (extracted primarily from mobile users) and proprietary risk algorithms “to enable lending decisions,” CEO Ekechi Nwokah told TechCrunch in 2018.

“We combine a strong AI technology with full…deployment services — disbursement…collections, payments, loan management, and regulatory — wrap it up in a box, give it to our partners and then help them run it,” he said.

Nwokah believes the benefits of African fintech firms locating in major global tech hubs depends on the nature of their business.

“For us data science is so key, we couldn’t be all in Africa and needed to build a team in San Francisco,” he told TechCrunch on a recent call. Mines is tapping its global team and products to expand into new markets, including Asia and South America in 2019.

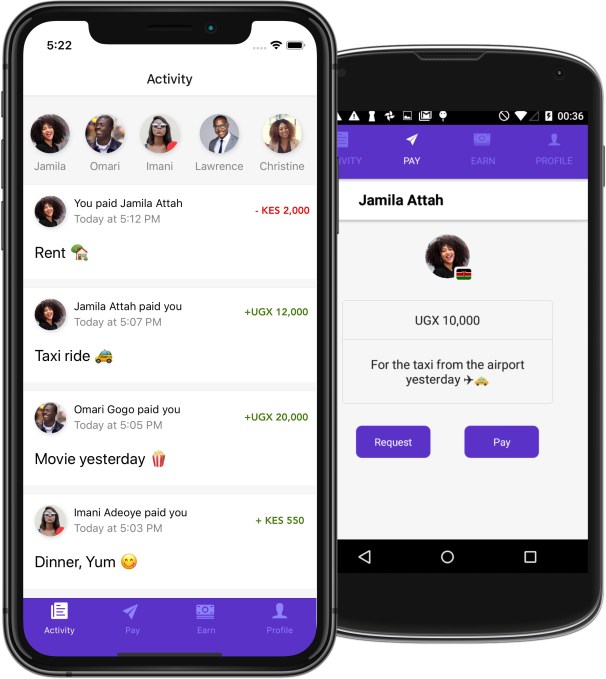

No-fee, cross-border payment startup Chipper Cash is another fintech startup founded by Africans and headquartered in San Francisco with operational focus and presence in Africa.

In May 2019, the venture leveraged its Bay Area network to raise a $2.4 million seed round that included 500 Startups and Liquid 2 Ventures, the investment firm of former San Francisco 49er Joe Montana.

Chipper Cash went live in October 2018, joining a growing field of fintech startups aiming to scale digital finance applications across Africa’s billion-plus population.

The startup was co-founded by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, both of whom emigrated to the U.S. to study and work in Silicon Valley. Chipper Cash offers no-fee, P2P, cross-border mobile-money payments in Africa.

Chipper Cash also runs Chipper Checkout: a merchant-focused, fee-based C2B mobile payments product that supports its no-fee mobile money business.

Chipper Cash also runs Chipper Checkout: a merchant-focused, fee-based C2B mobile payments product that supports its no-fee mobile money business.

With Africa offices in Ghana and Nairobi — Chipper Cash has processed 250,000 transactions for more than 70,000 active users, according to Serunjogi.

On locating in San Francisco and Africa, “I think we’re better off for it because we essentially have the best of both worlds,” he said. “If we were just in Nairobi, I think we’d be a lot further behind from where we are today.”

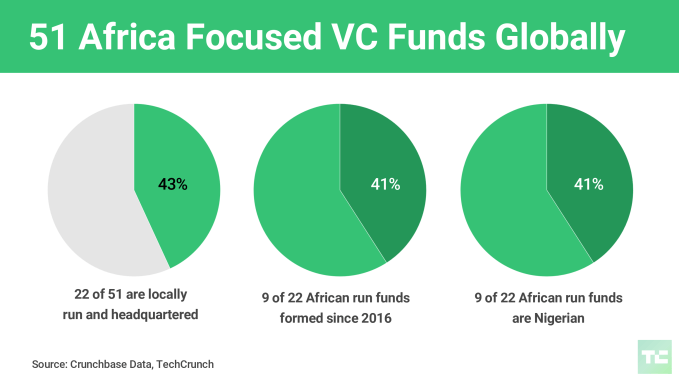

The company raised all of its recent seed round from U.S. and Silicon Valley sources, but received some investment offers from African VCs. Serunjogi sees the possibility to raise in both markets for future rounds. A 2018 study by TechCrunch and Crunchbase tracked a rise in local venture capital formation in Africa.

Chipper Cash has hired developers from both continents and is currently seeking new engineers for its Nairobi office.

On international ambitions, “We’ll be looking to expand globally…as we continue to grow,” Serunjogi told TechCrunch.

Chipper Cash’s CEO shared the sentiment of Mines and Flutterwave founders that being in Africa is becoming more of a necessity for global fintech players.

By a number of estimates, the continent’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population. The unbanked don’t have bank accounts or access to financial institutions. The underbanked include individuals and SMEs who lack a full range of financial services, including credit, working capital, and basic interest earning options.

An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns this scenario into an opportunity for mobile-based financial products.

Hundreds of startups are descending on Africa’s fintech space, looking to offer scalable solutions for the continent’s financial needs. By stats offered by Briter Bridges and a 2018 WeeTracker survey, fintech now receives the bulk of VC capital and deal-flow to African startups.

In its latest Africa funding report, Partech classified financial inclusion as a sector attracting 50 percent of $1.1 billion in VC to African startups in 2018.

![]() As a sector, African fintech has grown leaps and bounds since Kenya’s mobile money product M-Pesa became a global success story for the potential of digital finance applications to scale to millions. Fintech startups, such as Paga in Nigeria and Yoco in South Africa, are generating revenue offering payment services to individuals and SMEs.

As a sector, African fintech has grown leaps and bounds since Kenya’s mobile money product M-Pesa became a global success story for the potential of digital finance applications to scale to millions. Fintech startups, such as Paga in Nigeria and Yoco in South Africa, are generating revenue offering payment services to individuals and SMEs.

African fintech products and solutions have also found traction internationally. Safaricom (M-Pesa), Paga, Flutterwave, Mines, and Chipper Cash are among companies who offer or plan to offer their products in regions such as Asia, Europe, and Latin America.

Big global payments players, such as Visa and Mastercard, are also expanding in Africa. In March, Visa partnered with San Francisco based micro-lender Branch International on a $170 million VC raise and launch of a virtual debit card product in Africa.

As more African founded fintech startups look to expand on and off the continent, location in and partnerships with actors in the Bay Area could become more common. The progress of Flutterwave, Mines, and Chipper Cash will certainly serve as a marker.