Slack has filed its S-1 registration statement with the SEC in preparation for its direct listing. One interesting data set that usually comes out of these S-1s is the company’s actual fundraising history. Slack has raised eight main rounds (series A-H), and 15 rounds total when including individual tranches, since it incorporated on February 25, 2009, according to Delaware records.

Now that we have data, we can ask: How did the tech press do in covering the company?

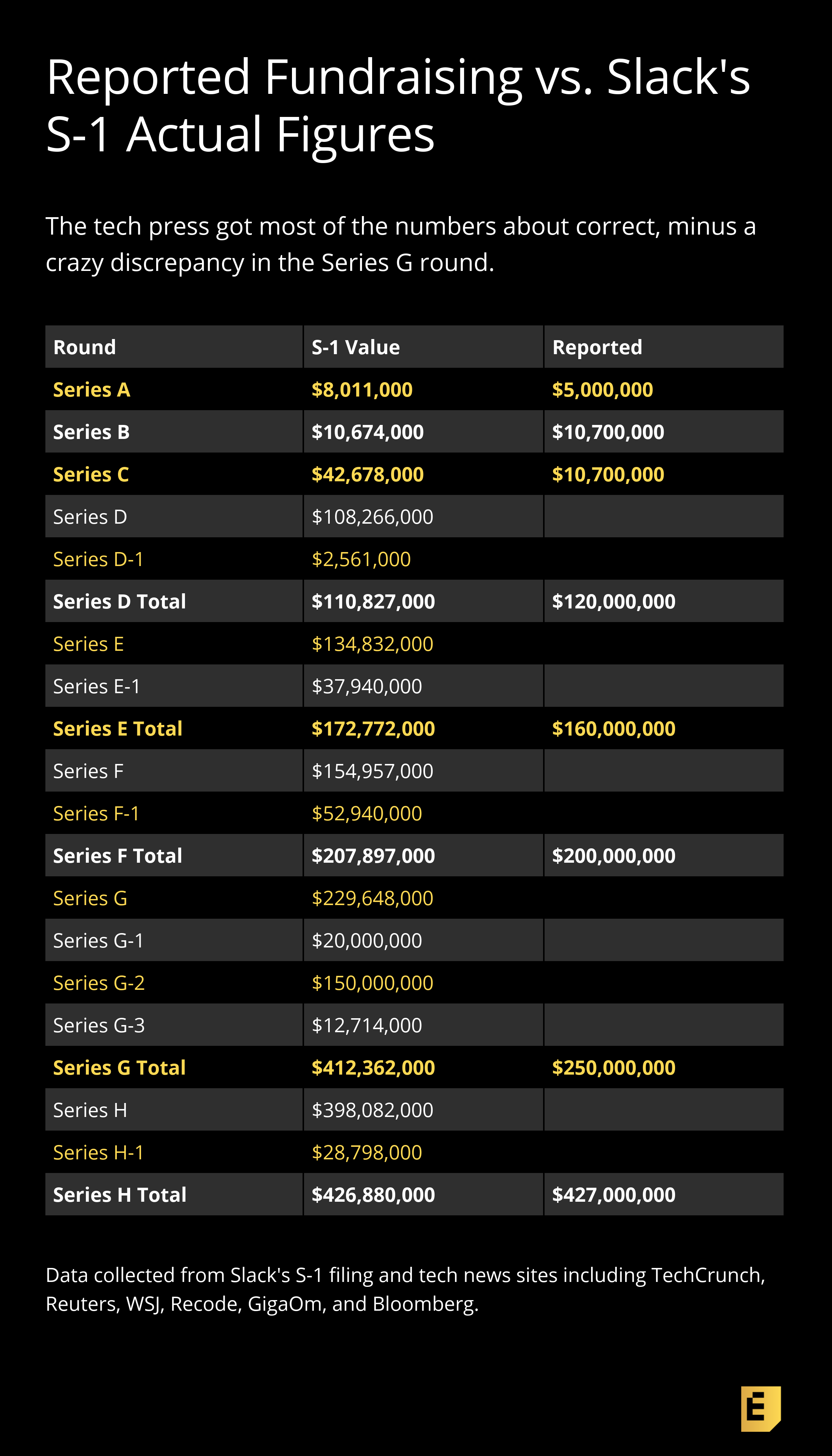

Arman and I investigated by looking at coverage of Slack’s individual rounds of capital on startup news sites and comparing those reported numbers to the data now offered in the S-1. For the most part, the tech press did decently well, except for one curious, $162 million gap.

The missing Form D

First, though, a note about Form Ds.

As regular readers of Extra Crunch know, I talk incessantly about how Form Ds are no longer filed with the SEC after the close of a venture round. Slack is a case in point on this front. While it has raised eight series of capital and 15 including tranches, there is nary a Form D in sight about the company on the SEC’s EDGAR information search service.

Going through all the coverage of Slack’s rounds over the years, we found that company confirmations were the source of nearly all of the news. TechCrunch scooped its series C by a day, and TechCrunch and The Information got word of its Series D a bit in advance as well. We also seemed to beat the market a bit for its Series E and its Series H.

Nonetheless, the vast majority of the reported fundraising coverage and capital raised figures are derived from the company’s official press statements. That shouldn’t be much of a surprise — without any sort of filing data, there was literally nothing to build upon when it came to understanding the amount the company fundraised or who bought its shares.

What did the tech press get wrong?

Given that most of the stories covering Slack derived from the company’s own announcements, you would expect that those stories and the data in the S-1 would match.

In short: they do, somewhat.

For instance, the Series B and Series C rounds posted by TechCrunch basically match the S-1, as does the company’s most recent round, its Series H.

Other rounds, though, showed discrepancies. Some differences are technical. For instance, the reported value of the Series A shares for Slack was $8 million according to the S-1, while the tech media (in this case, GigaOm) reported a value of $5 million. That difference appears to be the value of the company’s seed rounds converting to equity, which would have been triggered assuming they were convertible notes.

In three cases, the media was off a bit. The Series D was reported to be $120 million, but the actual round size according to the S-1 was only $111 million. The discrepancies went the other way in the Series E and F rounds, where the media under-reported the numbers by $12 million and $8 million respectively. One possible explanation is that other investors came into the round after it closed.

The curious case of the Series G

The big mother of gaps in coverage, though, concerns the Series G. TechCrunch, Reuters and Bloomberg reported that the company raised $250 million from SoftBank with Accel as a co-lead, with participation from other investors. That’s the value of the company’s reported Series G and Series G-1 rounds put together.

But then, the company seems to have raised another $162 million on top of that in Series G-2 and G-3 rounds exclusively led by SoftBank just weeks later, which was never reported from what we can tell from searching.

As TechCrunch wrote at the time:

The $250 million financing amount was reported by Bloomberg. Axios first had the names of the lead investors. Recode originally reported on a $500 million round last month, but we’re hearing that was likely in reference to the same round and the amount just wound up being $250 million.

Well, it didn’t just wind up being $250 million. Instead, it ended up being about $412 million, with Vision Fund putting in $280 million total, Accel $66.75 million and Social Cap putting in $3 million. The remaining $62.25 million or so comes from unlisted investors. Whoever or whatever that fund is, Slack doesn’t have to disclose them because they don’t meet the 5% major shareholder threshold.

In short, the media got most of the details right, but got one round, very, very wrong.

Lessons on news integrity

Covering the startup beat is hard and getting harder. Without filing data from the SEC, reporters have to rely on company insiders for information, insiders who have a direct financial stake in presenting their companies in the best possible light.

If Slack is any indication, the good news is that when companies announce their rounds, they tend to be honest and forthright with the details. The challenge is that a company can announce a round earlier than when it officially finishes receiving cash from investors. As the Series G point makes clear: sometimes companies get an announcement out early, and never bother to update the total with another round of press.

Ultimately, there don’t appear to be any consequences for this lack of transparency, much as how startups failing to file Form Ds don’t appear to be suffering any punishment either. The tech press gets most of our details right, but mostly because we rely on the companies themselves to offer that information to us. We need to be always vigilant about what they might choose to withhold.

Appendix: Astro Technologies

Last September, Slack acquired AI email bot startup Astro Technologies, which we covered on TechCrunch. Terms of that deal were not disclosed at the time, but we now know the structure.

Slack paid $43.3 million in cash for the company as part of the transaction. In addition, it offered $10.7 million in cash for the startup’s employees, to be paid out on their original vesting schedule. PitchBook indicates that Redpoint invested $10 million into the company at a roughly $20 million pre ($30 million post), and so clearly they didn’t come out all that well in the final analysis. However, with limited numbers of employees, that $10 million continued employment incentive may be reasonably lucrative, all things considered.