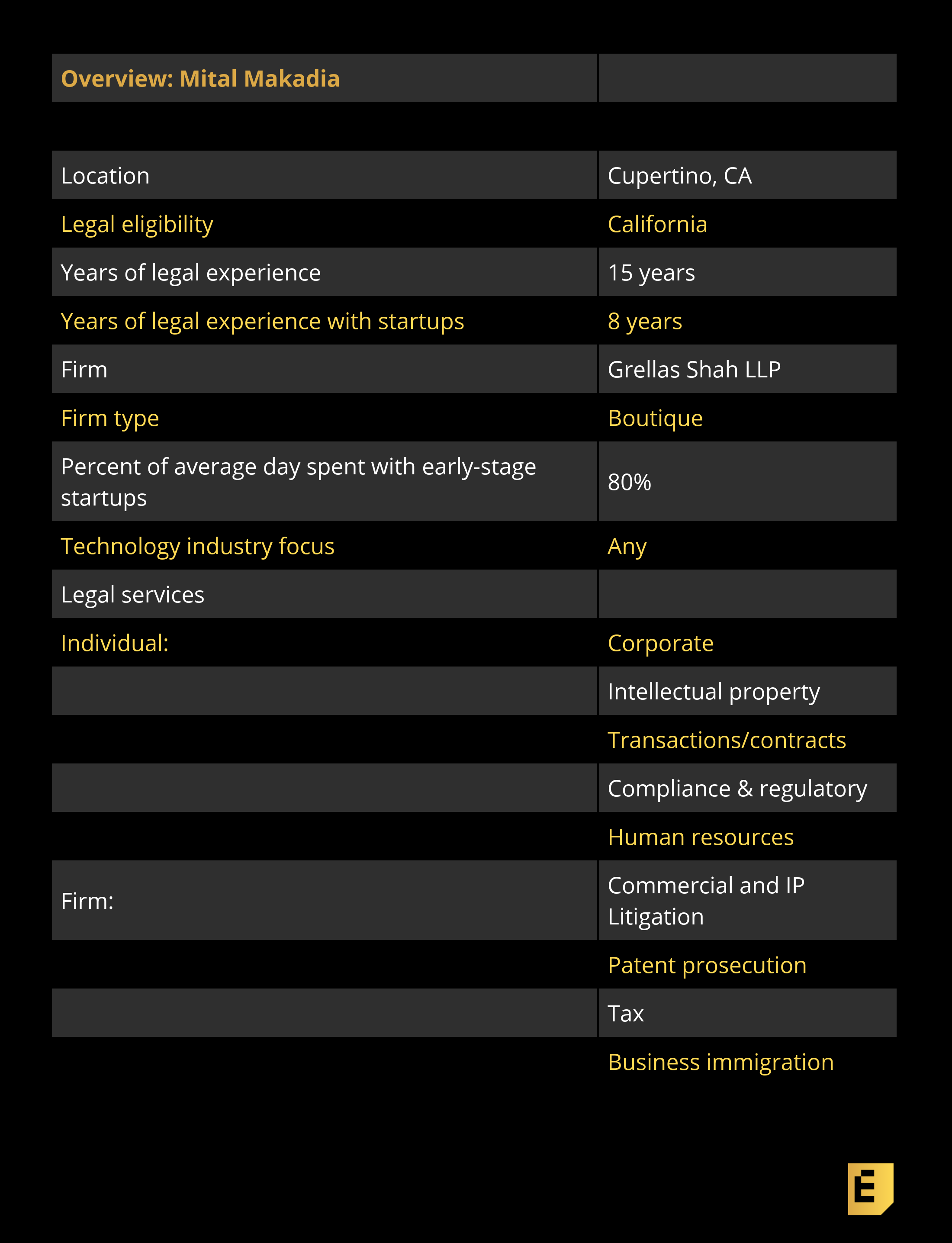

Mital Makadia’s legal career began on the East Coast, with Big Law firms, but she moved into early-stage startup work with long-time Silicon Valley boutique Grellas Shah nearly a decade ago. She’ll work with companies on a range of usual startup issues, but she and the firm also focus on individual founder representation (when it comes to that).

As part of the interview below, we got into a conversation about contentious terms in term sheets — and she ended up writing a guest post for us about the biggest gotchas that she sees in Series A docs. Read up on her here, then go check out What To Watch For In A VC Term Sheet.

On the founder focus:

“We approach the practice with a view to protecting the founders. So we’re not looking to please the VCs. And if that means reviewing the transaction a little bit differently then what the investors are used to, that’s fine by us. That’s pretty much our philosophy.”

“Mital has an amazing ability to analyze complex issues and, not only explain them clearly, but also give us spot-on recommendations on what to do next to keep the company moving.” Bryant Lee, San Francisco, cofounder and CEO, Cognition IP

On the different perspective:

“For me, I have been through enough financing rounds to know what VCs tend to push for and what’s ‘market’ at a given point in time. But just because a provision might be one my client will likely have to give on, depending on negotiating leverage, I make sure my client understands how it impacts the company and its founders. I don’t simply gloss it over as “market.” And sometimes in those conversations, I suss out legitimate concerns from clients that we can creatively address. But that requires you to have a founder hat — not a VC hat – on when you are reviewing a term sheet.”

On second looks:

“Now, we have a lot of clients who come to us, whether they’re going through an M&A or whether they’re incorporating or whether they are going through a financing round term sheet who may have a lawyer representing the company, but who wants our advice in protecting the founders.”

Below, you’ll find founder recommendations, the full interview, and more details like their pricing and fee structures.

This article is part of our ongoing series covering the early-stage startup lawyers who founders love to work with, based on this survey and our own research. The survey is open indefinitely so please fill it out if you haven’t already. If you’re trying to navigate the early-stage legal landmines, be sure to check out our growing set of in-depth articles, like this checklist of what you need to get done on the corporate side in your first years as a company.

Full Interview:

Eric Eldon: I would love to hear about how you got into working with startups, given your very different focus earlier in your career.

Mital Makadia: Actually, I didn’t start my legal career working with startups. After law school, I did general corporate work at large firms in New York and DC. That feels like a lifetime ago.

Mital Makadia: Actually, I didn’t start my legal career working with startups. After law school, I did general corporate work at large firms in New York and DC. That feels like a lifetime ago.

I eventually moved out to the West Coast when I got married and came across Grellas Shah when I started looking for a job here. I can’t say my goal was necessarily to work with startups at that point. But I loved this practice from day one.

Of course, I immediately loved working with entrepreneurs. The brilliant new ideas, enthusiasm, optimism, work ethic, and ambition is infectious.

But a huge part of what I have loved about this practice is working with and learning from our firm’s founder, George Grellas. George has been working in Silicon Valley since 1983 and has really seen the ups and downs in the tech industry. Largely due to his reputation as a sharp yet practical startup attorney, our firm has built an enviable client base, which has been an ideal platform for me to launch my own career in the startup world.

What I like about our practice is that it’s a little bit different from the standard Silicon Valley fare. What distinguishes us from the traditional startup practices at the larger firms is our founder focus. We don’t, as a general matter, represent the investor class. We don’t represent VCs. We see it as a bit of a conflict of interest because even when they start out with a startup, their ultimate repeat client is the VC that comes in at the Series A. Here at Grellas Shah, we stay with the founders.

We approach the practice with a view to protecting the founders. So we’re not looking to please the VCs. And if that means reviewing the transaction a little bit differently then what the investors are used to, that’s fine by us. That’s pretty much our philosophy.

Eldon: Can you tell me more about the kind of clients you work with? How focused are you on just sort of Silicon Valley companies versus founders in other parts of the country or the world?

Makadia: We are a full-service law firm with a separate corporate and litigation practice. About 80% of our work is focused on the technology startup. And that’s based largely on word of mouth and referrals. A lot of our clients are founders here in the Valley. But many are from other parts of the country and all over the world. We do the range of things that a startup would need — from incorporation to M&A work. In between, we handle their financing rounds, their commercial contract work and their IP work, including licensing work and trademark registration. We have specialty tax counsel, specialty patent counsel, employment counsel, and business immigration counsel, if necessary.

Eldon: Can you tell me more about how you work with your clients?

Makadia: It’s really what the individual clients desire. We have some clients that come to us for their incorporation, come to us for their initial employee set up and commercial contracts and then can disappear. They’re very comfortable using our forms. They’re very comfortable handling things on their own. And they just come to us occasionally. We won’t hear from them until there’s an M&A transaction or there’s a financing round term sheet. Sometimes this works perfectly. Other times it does mean a lot of last minute cleanup work. And then, there are other clients who want us to play more of a general counsel role. For these clients, we take an active role in helping them manage all of their legal needs, including managing their cap table, onboarding their employees, and negotiating their commercial contracts with their customers.

Eldon: Can you tell me how you’ve helped clients navigate through a tricky situation?

Makadia: We had a client who we did work for occasionally that used a large law firm for the bulk of their legal work. They had a Series A term sheet come in and they worked with a well-known partner at the larger firm to mark it up. They decided to send it to me for a second look. I called the CEO that night and gave them some of my comments. They were really shocked and surprised that the large firm partner didn’t see the term sheet in the way I saw it.

It’s understandable, though. At a large firm, your repeat business is usually from VCs. Startups don’t have the resources to rack up enough bills to mean much to a large firm. Even unconsciously, that’s going to impact the way you look at a VC term sheet. As a firm that represents startups and VCs, you almost certainly aren’t going to forget the VCs interests when reviewing any term sheet. And keep in mind, if your lawyer introduced you to a VC, there’s a fair chance their law firm represents that VC.

For me, I have been through enough financing rounds to know what VCs tend to push for and what’s “market” at a given point in time. But just because a provision might be one my client will likely have to give on, depending on negotiating leverage, I make sure my client understands how it impacts the company and its founders. I don’t simply gloss it over as “market.” And sometimes in those conversations, I suss out legitimate concerns from clients that we can creatively address. But that requires you to have a founder hat — not a VC hat – on when you are reviewing a term sheet.

I guess, that kind of word of mouth gets out and I’ve done quite a few second looks on transaction documents. We often have clients that come to us saying, ‘I’m really not happy with how my lawyers seem to be representing the VCs more than my interest and the company’s interest. So can you look at this?’

Now, we have a lot of clients who come to us, whether they’re going through an M&A or whether they’re incorporating or whether they are going through a financing round term sheet who may have a lawyer representing the company, but who wants our advice in protecting the founders.

Eldon: How do you do billing and what’s your sort of operating process? Do you do flat rate fees, do you do subscriptions, do you do deferrals?

Makadia: Most of our work is billed hourly, though we consider alternative and more creative arrangements on occasion. For example, we have done work for clients on a subscription model. We offer a fixed-fee package for incorporations. We also do deferred fees on a case-by–case basis. This allows a client to delay paying our fees, up to some cap, for some period of time (usually six months) in exchange for the firm receiving a small share issuance from the company. I don’t think it usually makes sense to do deferred fees, just because the initial legal cost that the startup will incur in the first six months these days are fairly contained. And so it might not necessarily make sense for clients to defer that in exchange for losing precious equity. For founders who have more involved legal needs at the outset, like patent filings, a deferred fee arrangement can be the right move.

Founder reviews:

“Mital has been our legal counsel since inception. She has guided us on all corporate matters and, most recently, helped put together the right structure and documents for our seed round.” — Ashok Ramaswami, SF Bay Area, Founder and CEO of Seqnc Inc.

“Mital and the Grellas team have been a great partner and sounding board for BWK during a critical inflection point in our timeline. As a law firm, Grellas gets startups on a deeper level than anyone else I have worked with. And Mital has been fantastic to work with.” — Ben Kellogg, New York City, founder, BWK

“Efficient, effective Series A process. Fast ongoing advice on customer issues.” — A startup founder and CEO in San Francisco

“Excellent representation on legal matters pertaining to HR issue. I have been using them for the last 5+ years!” — A startup founder in Cupertino, CA

“High-quality answers provided efficiently. Great at explaining complex concepts quickly. Mital has an amazing ability to analyze complex issues and, not only explain them clearly, but also give us spot-on recommendations on what to do next to keep the company moving.” — Bryant Lee, San Francisco, cofounder and CEO, Cognition IP

“Grellas Shah is an outstanding legal boutique firm that is very founder friendly and has expertise in all areas of corporate law. They worked with us from the very beginning all the way through our acquisition and their help was instrumental to the company’s success.” — Ilya Semin, San Diego, founder and CEO, Datanyze

“Grellas Shah, LLP are the best high tech startup lawyers in Silicon Valley (helped us in the formation of our company, financing rounds, etc. and on all our legal matters). I highly recommend them to anyone!” — A cofounder and president of a startup in Monterey, CA

“As a startup founder, I appreciate working with partners who are nimble and creative. Mital at Grellas Shah helped guide me through legal issues in a collaborative and accessible manner. I found working with her to be a pleasure.” — Joel Andren, CEO, PressFriendly