Pressed to explain who is using them, and why, 99 percent of cryptocurrencies let out all their air, go flying around the room making a raspberry sound, hit the wall and fall behind the couch forever.

The party is over. A few, however, can present a credible use case. “Tokenized securities” could be one of them: a more open and efficient way to transact shares and notes as well as distribute cash flows.

Proponents of “security token offerings” (STOs) have been telling that story now for a little more than a year. This data report canvases the market, finds few are buying it, interviews market participants for perspective and reveals gaps in the use case at the ground level that explain its failure to thrive.

In October 2017, the market for “initial coin offerings,” or ICOs, reached a peak, with more than 100 capital raises closing through the sale of crypto tokens, according to market data provider Token Data. Proponents thought these tokens were an innovation on par with the joint stock corporation: not a claim on cash flows, but a vessel to participate in and directly capture the value latent in network effects. “Tokenized” networks raising money that month ranged from the prosaic, like a no-fee crypto exchange called Cobinhood ($13.2 million), to the ludicrous, like Dentacoin, “the blockchain solution for the global dental industry” ($1.1 million).

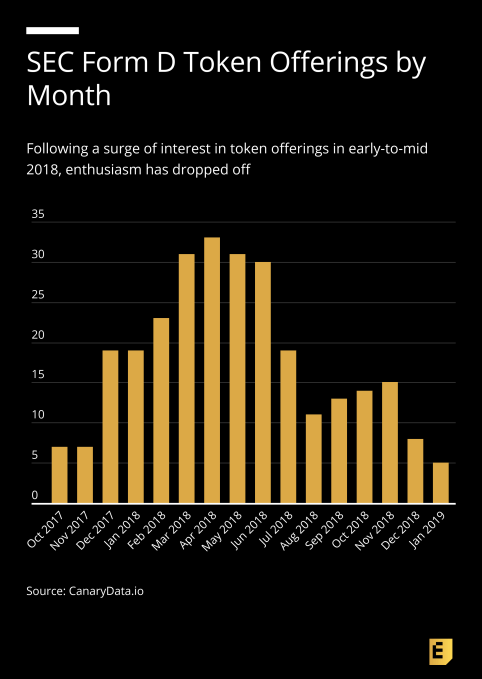

At the time, it was nearly unheard-of for such a project to acknowledge its token might be a security like the mundane stock certificate. In the following months, the US Securities and Exchange Commission (SEC) sent dozens of subpoenas to token issuers, indicating that they disagreed. By the following March, the number of SEC registrations for new token offerings equaled more than half the total ICO deal activity for the month.

As SEC moved in and ICOs cooled, a new enthusiasm for paperwork

The sudden popularity in 2018 of the so-called “security token” was undoubtedly a scramble to paper over cash grabs. However, there is a use case for “tokenized securities” that is worth considering. Bitcoin showed how ownership could be digitally secured and transferred without intermediaries. A tokenized security could do the same for investment contracts. “Smart contracts” are a value proposition that has been discussed in cryptocurrency since long before Bitcoin.

There is reason to be optimistic that this form of programmable ownership can bring efficiency, transparency, liquidity and access to the $1.7 trillion annual US private placement market. The value proposition is that smart contracts will reduce the cost of compliance in primary issuance and secondary trading. Issuers benefit by reduced liquidity premiums and more buyers to compete for their offering. Investors benefit by gaining more access to opportunities for growth-stage investment. This is a compelling story in US capital markets that have, for nearly two decades, starved retail investors of exposure to growth-stage investments.

Decline of the small-cap IPO reduced retail opportunities for risk & return

This value proposition, and a narrative of regulatory chill in the markets, have led some to believe that tokenized securities would bring back a bull market in crypto. The Wall Street hype machine has moved on from crypto; security tokens are one of the few areas in which the avid listener can detect faint echoes of its passing.

Media hype

- “If it works you’re going to see tremors across Wall Street.” -CNBC commentator

- “Apple and Tesla shares on the blockchain could be the next big thing” -CNBC headline

- “2019: The Year Digital Securities Offerings Become the New ICOs” -CoinDesk

- “Why security token offerings are replacing initial coin offerings” -Silicon Valley Business Journal

From 30,000 feet up, the use case for tokenized securities looks compelling. As with many blockchain-based projects, zoom down to the user level and misaligned incentives appear for key market participants.

- Investors: Digital tokens carry technological risk, regulatory risk and market risk. Without a liquid market ready and waiting, private placement investors have little incentive to layer risk on top of the risk-return they already understand.

- Brokers: Effective bankers and broker-dealers charge a premium for primary issuance; the more effective they are, the less incentive they have to adopt, especially given their investors are not clamoring for this product.

- Issuers: With markets awash in private capital, there are very few quality issuers that cannot raise funds. The better the investment opportunity, the likelier its access to funds and investment banks in the top quartile, where investment decisions have kingmaker effects in the market. Interest in innovation that disrupts these relationships is therefore inversely related to suitability for capital, a repeat of the pattern in US issuers accessing new equity crowdfunding options under the JOBS Act of 2012.

If you build it, will they come?

To determine whether new tokenized security issuance is finding a fit in the market, Canary Data, an open crypto research initiative, undertook an exhaustive search of news wires and the SEC’s EDGAR database, beginning in 2017 and ending mid-January, looking for public statements and filings related to security token offerings. It’s an imperfect method; our database of offerings is constantly evolving as new information becomes available. But in an emerging segment of the financial markets it reflects the level of credible, mainstream activity.

We filtered out tokens that are in the mold of the ICO “utility token,” offering a financial instrument as a form of access to a valuable network effect. Many of these have registered as securities, but it is the value proposition of a tokenized tradtional security — a claim on cash flow, represented as a token — that we are interested in.

This value proposition may sound good, but the market isn’t buying it. Enthusiasm for so-called STOs is nearly non-existent, absent market FOMO for crypto assets in general. This put security token issuers at increasing distance from reality, as 2018 progressed and the number of projects announcing security token offerings has increased while the price of blue-chip crypto assets like Bitcoin and Ethereum slid further into a crater. Much of that momentum in would-be fundraisers has been driven by the timing of technology and advisory services coming online to support those offerings. Amid many launches, very few projects have successfully raised funds.

Our database of security token offerings currently has 84 STO hopefuls announcing sales of tokenized securities over a period beginning in March 2017 and continuing through Jan. 15, 2019. Of those, 14 reported raising any funds at all. Only two of the 14 reached a stated fundraising goal. In total, these projects targeted $3.44 billion in fundraise goals. So far, $220.69 million has been raised, a drop in the bucket of private placements. Of that total, $134 million flowed to one project, tZERO, a regulated secondary market for crypto assets. Into this tiny pool of issuers and investors, more than 75 service providers, including tZERO, are competing to offer technology and advisory offerings.

Tokenized securities were far more successful against the backdrop of ICO mania and a run-up in crypto prices. Of the seven offerings that took place during the crypto bull market that ended in Q4 2017, three actually reported raising funds (although two of the three were undersubscribed). Since the crypto bear market began in 2018 through Jan. 15 this year, 78 projects have attempted to raise capital through STO, and only eight have raised any capital at all.

“I don’t think 2019 is the year. I’m kind of skeptical 2020 is the year,” said Andy Bromberg, co-founder and president of CoinList, in an interview. An AngelList spin-off, CoinList handled some of the earliest ICOs to register their offerings as securities. However, CoinList has avoided, for the most part, tokenized securities, instead focusing on compliant offerings of “utility tokens,” designed with open networks in mind.

Rather than a chicken-and-egg problem, Bromberg said the tokenized security has a neither-here-nor-there problem. “The crypto investors aren’t interested because they want something that’s going to go to the moon and this isn’t going to go to the moon,” he said. “The traditional investors are like, ‘I’m going to go find a deal that involves a piece of paper instead of a token.’”

How many investors are responding? The three largest raises were conducted on the Ethereum blockchain, making it easy to look deeper into their transaction and ownership records. Looking on Feb. 1 at the top three from my database, ownership tends to be concentrated among a handful of holders.

- In tZERO, a security token trading system that went operational in January 2019, after it reported raising $134 million in January 2018, the top five addresses hold 58.7 percent of its token. There are 728 holders in total.

- In Aspencoin, which reported raising $18 million tokenizing shares of the Aspen St. Regis hotel in Colorado in October 2018, the top five hold 85.2 percent, with one address holding just over 50 percent of the offering and no transactions since its initial distribution to just 22 holders.

- In The Art Token, which reported raising $15.3 million of a targeted $16 million, the top five addresses hold 63.35 percent of the tokens. There are 1,957 holders in total.

Private placements such as these are typically restricted to accredited investors. “That is not a big marketplace,” said Howard Marks, co-founder and CEO of StartEngine, an equity crowdfunding marketplace, in an interview. “Wealthy people are not all day long on their computer trading crypto. They have limited partnerships they have holdings in oil and gas. They have real estate. They have people managing wealth. They don’t really create liquidity.”

Marks is skeptical of the notion that tokenization can create a liquid market in crypto assets. Instead, he offers a vision of more incremental innovation: a blockchain to track the transfer of privately-held securities, a layer atop the existing system of transfer agents and administrators — not replacing them with an impersonal, digitalized marketplace.

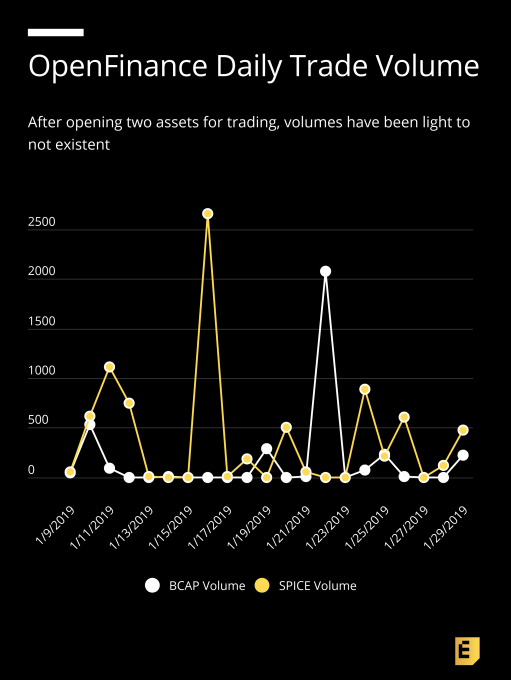

At the beginning of Q1 2019, there is no market of any size or depth for assets issued digitally on a blockchain. In December, OpenFinance, an alternative trading system, opened trading in two assets, becoming the first to facilitate a secondary market for tokenized securities in the US. Its two listings, Blockchain Capital and Spice VC, were among the earliest tokenized securities issued in the US, both likened to limited partner participation in tokenized venture capital funds.

A review of transaction data published on OpenFinance’s trading dashboard over a three-week period in January found volumes in these two assets less than thin. On their most robust trading days, the two assets never crossed $3,000 in 24-hour volume. On 10 out of the 21 days we tracked, there were no trades in Blockchain Capital (BCAP) at all. Both BCAP and Spice VC (SPICE) saw several days on which no trading occurred at all, remarkable in a 24/7 market.

“For us, it’s regulatory unclarity: lack of clarity from governing bodies on a clear path forward. That’s one of the things that has been hurting the industry and the growth potential,” said OpenFinance CEO Juan Hernandez, in an interview. He specifically mentioned clarity over how money managers can properly custody crypto assets. “In the face of uncertainty people will tend to sit on the sidelines. Especially when you think about institutional players.”

Jumping ahead of the market

Launching a tokenized security or a tokenized security platform in 2018 or 2019 is like being five years ahead of the market. There is significant risk of being too early, i.e., wrong. However, as the ICO wave has crashed and spilled over into issuance, early entrants’ greenfield advantages are muted. The noise is receding, and there are two or three platforms that have raised enough capital and demonstrated momentum such that they might outlast this condition. However, there is also room for new entrants.

There’s a trough of disillusionment coming in tokenized securities and it could be a long one. Entrepreneurs are planting seeds that aren’t likely to bear fruit for years. It’s good to be farsighted, but usually it means you start out having the field to yourself. Instead, it’s crowded. Early movers in tokenized securities are mired in a wash of noise left by the ICO wave that crested, crashed and spilled into a new fad for regulatory compliance.

In the long term, the market for private placements will be digitalized and a more liquid, transparent and impersonal structure will emerge. This will take at least three years, if not five or more. Until then, proponents of tokenized securities face a chicken-and-egg problem, compounded by an unusual combination of early-adopter risk plus market noise washing over from the crashing of the ICO wave. Early operators should be looking at overcoming these headwinds in a niche where other incentives, besides private equity returns, are at work.